Gold specificities make it a controversial or at least a misunderstood asset class. As a relatively niche investment, its characteristics and market price drivers are poorly understood by the market at large. Other questions investors need to answer are: Does Gold have a diversifying potential, what are the correlations with other assets? What does it add to the sharpe ratio of investors’ portfolios?

To help investors building more efficient portfolio, we detailed below the role of Gold in portfolio construction based on the following articles based on academic research and major gold Asset Managers market insights (Invesco, WisdomTree).

A diversification potential?

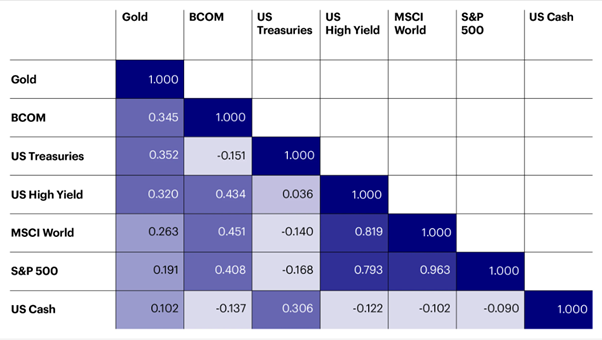

Which brings us to the most interesting aspect of the precious metal, why adding it to asset allocation. The first aspect to consider is its diversification effect. As shown in the correlation matrix, the gold price tends to move more in line with other defensive assets, particularly US Treasuries, but the low correlation with risk assets make it more useful to include in portfolios with significant equity exposure (access Invesco full study). For example the correlation with the S&P 500 over the past 6 years is below 20%.

6 year correlation between Gold and other financial assets

Gold also enhances portfolio’s risk-return?

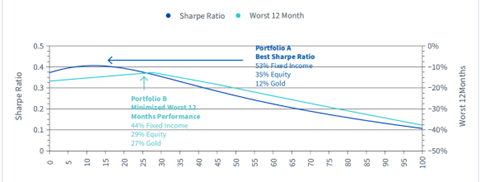

In order to highlight the advantages and drawbacks of a strategic asset allocation to gold, the impact on the portfolio’s risk-return should be analysed. A WisdomTree study considered in the table below, a hypothetical 60/40 fixed income/equity portfolio (“the 60/40 Portfolio”). The objective is to monitor the change in Sharpe Ratio, i.e. the average return earned in excess of the risk-free rate per unit of volatility, as well as the change in the worst 12 months performance, i.e. the performance of the portfolio over the worst 12 month period (access WisdomTree full study). Adding a 12 % of Gold to a portfolio allow to maximise risk, return profile of the portfolio i.e. to increase the sharpe ratio by more than 10%.

What was the optimal allocation to gold from 1973 to 2022 (a WisdomTree study)

based on monthly returns in USD. The portfolio is rebalanced semi-annually. Equities are proxied

by the MSCI World Gross Total Return Index and Fixed Income is proxied by the Bloomberg Barclays US Treasury Total Return Index. Past performance is not indicative of future results.

Marlene Hassine Konqui & Ahmed Khelifa, CFA