Many people, including some professional investors, still think that all cryptoassets are currencies. To capture the breadth, depth, and evolution of equity market sectors, MSCI and S&P Dow Jones Indices developed the Global Industry Classification Standard (GICS). This classification into sectors and industries is based on the observation that the equity universe is heterogeneous and sectors and industries react differently to market and economic changes. Thus it was important to build a classification grouping together industries that behave in a similar way into the same sector. This allows us to analyze sector and industry contributions to portfolio performance and construct consistently defined global or regional sector-based and sector rotation strategies suited for the economic climate. Digital asset markets have yet to coalesce around a GICS equivalent.

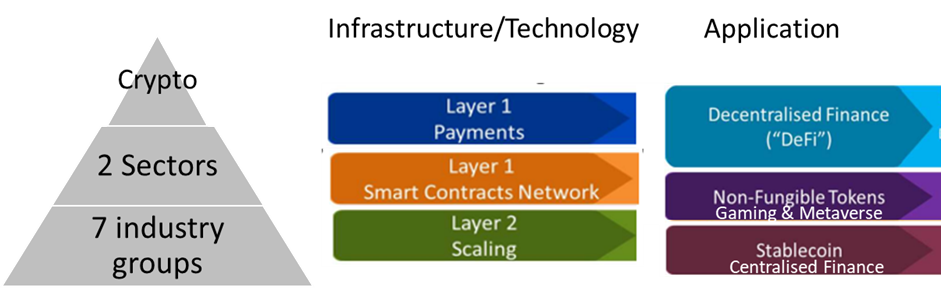

Below, we assess the diversity of the crypto universe, and perform a deep dive into crypto taxonomy to understand how to differentiate those assets in order to build a classification, similar to GICS, with its own sectors and industries. Based on WisdomTree taxonomy (access the full WisdomTree white paper), we identified two sectors, infrastructure and applications that are split into 7 different industry groups (see graph below).

Crypto taxonomy

1. Technology/infrastructure :

The first criteria that allows us to differentiate crypto assets may be their technology. Cryptoassets are based on a new disruptive technology called blockchain.

- Currency: Payment blockchain protocols

The first blockchain technology was Bitcoin which allows for the simple transfer of value between two entities without a third party intervention and in a safe manner. These value transfer capabilities gave currency specificities to Bitcoin. However , as it stands, bitcoin doesn’t allow for large scale payments and needs improvements in its scalability to become a currency.

There are also some centralized blockchains (Ripple and Stellar), controlled by a firm, in opposition to decentralized blockchains such as Bitcoin, that appeared in order to increase transaction speed.

- Protocols: Smart Contracts/Programmable Money

The next technology, Ethereum, allows participants to transact with each other without a trusted central authority, dependent on certain created conditions. This is implemented via a smart contract. Smart contract-enabled blockchains are the underlying infrastructure which allows other cryptos to be adapted.

Competitors to Ethereum, such as Solana and Cardano, were launched with the stated aims of increasing transaction speed and facilitating scalability..

The protocols above are known as Layer 1 blockchains.

- Layer two Infrastructure

Layer 2 infrastructure networks are separate blockchains, built on top of Layer 1 technology. Their aim is to provide increased speed, or scalability. For example, protocols such as Polygon help increase the speed of the layer 1 protocol, Ethereum. There is also the hope that one day a layer two protocol enhances bitcoin scalability and speed allowing it to be used as a payment method at a large scale.

2. Purpose-Application:

The second criteria that allows to differentiate cryptoassets is the purpose or the use case for which the crypto was conceived.

- Decentralized Finance : DeFi

Layer 1 blockchains, in particular smart contract blockchains, have paved the way for a new crypto generation seeking to replicate traditional financial services such as lending, borrowing and even exchanges and swapping. This is how decentralized finance (Defi) appeared.

- Gaming, Metaverse and NFT’s:

Applications are built on smart contract platforms that are disrupting the entertainment sector, including gaming, metaverse, social networking, and fan-related applications.

- Stablecoins

Have values pegged to other assets, most commonly the US dollar and treasuries. Some stablecoins called algorithmic stablecoins are however pegged to a crypto basket. Stablecoins, other than algorithmic ones, are the bridge between cryptoassets and traditional finance and as such need to be better regulated in order to prevent systemic risks and contagion effects to traditional asset classes. Stablecoins are mainly built on smart contract blockchains but are not considered as DeFi because they are generally centralized. However, some decentralized stablecoins exists.

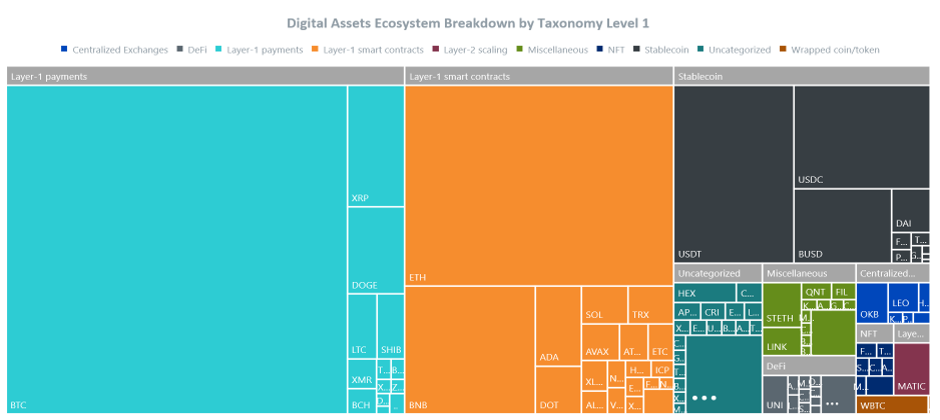

As per the end of January 2023, cryptoassets ecosystem market Cap was around $1 Trillion split as following:

Now that we’ve classified cryptoassets into infrastructure and application cryptoassets, we should observe how each of them is correlated, both with the equity market, and with each other.

Do infrastructure and application cryptoassets behave the same to market condition changes? Does it make sense to treat each separately in portfolio construction?

Ahmed Khelifa, CFA & Marlene Hassine Konqui