ESG investing has grown rapidly in the last decade and has now a place of choice in investors portfolios.This arises new challenges in order to build efficient portfolios:

- Is there a fundamental economic and market rational for this keen interest to persist in the future?

- Can we talk about ESG as a risk factor with a related premium, based on past returns analysis.

- Finally, Is there a solution to address the challenges of traditional benchmarking in ESG based Asset Allocation?

Where money will go: The rationale behind ESG investing craze persistence in the future

Massive planned government investment plans are about to impact most developed countries economies’ as well as emerging ones. These investments are mostly linked to energy transition. The United States is deploying procurement contracts to double its solar power capacity in 10 years,9 plus generous subsidies to build green factories that create jobs with better wages.

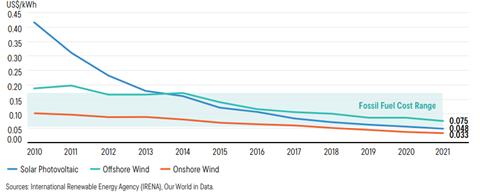

In the past, this allowed for renewable electricity to became more profitable than energy from fossil fuels (read Franklin Templeton full article). These green profits didn’t happen by chance, however. Government incentives—both carrots, such as subsidies, and sticks, like carbon prices—helped redirect capital to make this happen. In total, China’s industrial carrots helped scale up solar PV production 500 times between 2000–2016.

Look at the seismic shift in competitiveness of renewable electricity over fossil fuel options. From 2010 to 2021, the costs of solar PV electricity dropped 88%, which is now below the costs of fossil fuel electricity, as indicated in Exhibit 1.5 At these prices, solar PV is more profitable for power plants than coal or gas-fired electricity. It’s with an eye toward green profits that India’s largest power company is now committed to building 60 gigawatts of solar PV electricity by 2032.

The United States is deploying procurement contracts to double its solar power capacity in 10 years, plus generous subsidies to build green factories that create jobs with better wages.

This strong commitment towards energy transition could have an impact on future ESG investment performances, but what about past ESG investment performances vs more traditional ones?

Can we talk about ESG as a risk factor with a related premium, based on past returns analysis.

How ESG investments performed in the past: Ambivalent and heterogeneous results:

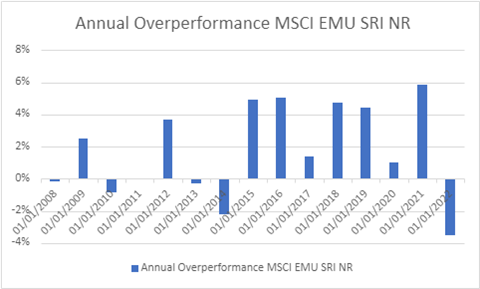

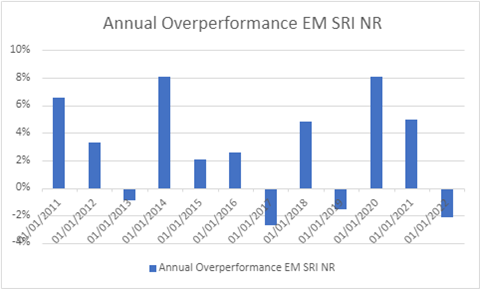

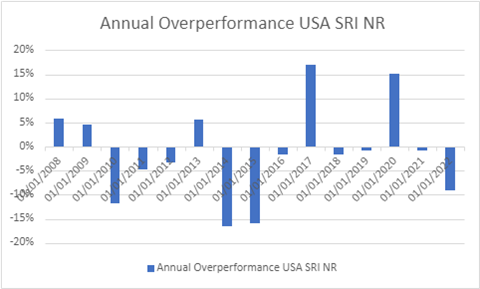

To answer this question, we looked at equity returns in the three main different regions, U.S, Europe and Emerging Markets. For comparability reasons, we choose to look at the over/underperformance of MSCI SRI indices over their traditional MSCI equivalents.

If we look at each of these three regions separately, will find different results.

Europe equity markets

When looking at the 10 Developed equity Markets countries in the EMU (European Economic and Monetary Union), using MSCI EMU NR LCL and MSCI EMU SRI NR LCL, will find that there’s a significant overperformance –over 2%- of SRI investments over non SRI ones in average over the last ten years (2013 to 2022). This led to a difference of 32% over the same period.

Emerging equity markets

The same observation applies (for a Eurozone investor) to Emerging Markets equities’ when comparing MSCI EM SRI NR EUR performance to MSCI EM NR EUR with an average annual overperformance of 2,3% per year over the last 10 years and a total over performance of 38%.

US Equity markets

Thus, the story is not the same for U.S equities, the MSCI USA SRI NR LCL significantly underperforms the MSCI USA NR USD over the last 10 years mainly due to poor returns consecutively in 2014 and 2015. This may be explained by the fact that ISR indices are built on exclusion and may have had less important exposure to sectors that overperformed during 2014 and 2015 but also to lesser ESG interest by institutional investors in the region compared to their European pairs as explained by Leila Bennani and al in “How ESG Investing Has Impacted the Asset Pricing in the Equity Market”. According to the Global Sustainable Investment Alliance (2017), Europe is the first ESG market and represents more than half of global assets that are managed using ESG strategies. Marlène Hassine Konqui flows analysis (access full article) highlights the gap between the weight of ESG investments in European institutional investors’ portfolios and the weight of ESG investments in those of U.S investors.

ESG is the new factor:

Our findings are also consistent with the conclusions of the same paper that shows that in the past ESG become a major risk factor in the Eurozone and less in the U.S “ESG helps to enhance the diversification of multi-factor portfolios in the Eurozone. In North America, the results are ambivalent”. However, in a forward-looking approach, ESG may be one of the major risk factors in both regions: “The integration of ESG in a factor investing framework is more puzzling. Backward looking, ESG seems not to be a new risk factor in North America whereas ESG could improve the diversification of multi-factor portfolios in the Eurozone. Forward looking, ESG appears to be a very serious candidate to join the very exclusive club of risk factors that explain the cross-section of stock returns.”

Finally, Is there a solution to address the challenges of traditional benchmarking in ESG based Asset Allocation

A large number of institutional investors prefer to implement ESG investing using optimized benchmarking portfolios in order to fit their strategic asset allocation (SAA) policy. For instance, they generally define a SAA portfolio based on market-capitalization indices, and monitor their investments by computing the tracking error between the invested portfolio and the strategic portfolio. Leila Bennani and al in “How ESG Investing Has Impacted the Asset Pricing in the Equity Market” show that, in the case of the MSCI World Index, improving the ESG score by 0.5 implies accepting an important tracking error of 32 bps on average. Being an ESG investor requires taking on an important tracking error risk. This result highlights the need to develop ESG-based SAA policy and ESG-based equity indices as the only way to avoid being constrained by the traditional cap-weighted benchmarking framework. MSCI developed an interesting parallel benchmarking approach to address this issue, especially regarding climate objectives (access MSCI full article here).

Ahmed Khelifa, CFA