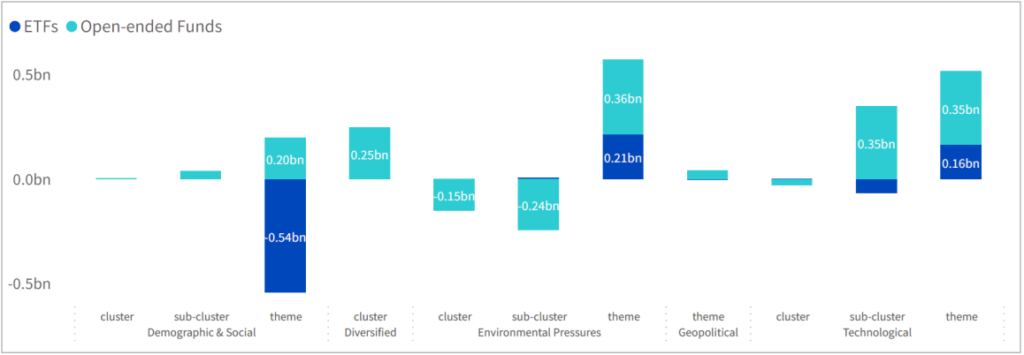

In a complete reversal from last year trends, Open-ended funds and ETFs have gathered the most flows in the “Technological Shifts” cluster, in line with markets’ expectations of a pivot (access the full report Future-proofing your tech exposure A fresh take on the technology megatrends in 2023). Within both wrappers, most of the year-to-date flows went into both the theme-focused strategies and more diversified wrappers within the sub-cluster “Disruptive Technologies”. Whereas in 2022, flows were directed into green themes as investors were looking for defensive exposures. In the “Environmental Pressures” clusters, we observe that open-ended funds suffered outflows in multi-thematic strategies focused on climate change or energy transition. At the same time, in strategies focused on single themes, ‘Sustainable Energy Production’ and ‘Sustainable Food’ suffered outflows in ETFs. More about thematic flows, AuM and WisdomTree classification, in WisdomTree latest quarterly update.

This can mean that investors are rotating between thematics as they used to rotate between growth and value or cyclical and defensive stocks.

YTD flows in Europe by wrapper in cluster, sub-cluster and focused themes

We can then assert that flows to thematics can be considered as a good indicator of market sentiment. Thus, a comparison of flows going into green and tech themes can add additional colour to the sentiment on equity markets and potential shifts in it.

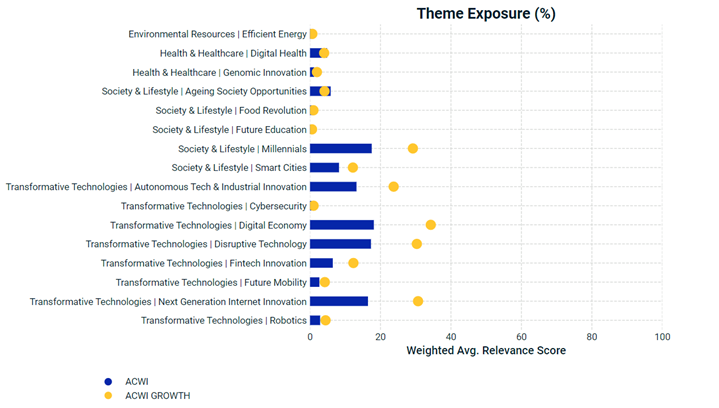

This overlay between Growth and Disruptive technology may be true currently, as shown in the following MSCI article (no-country-for-old-firms).

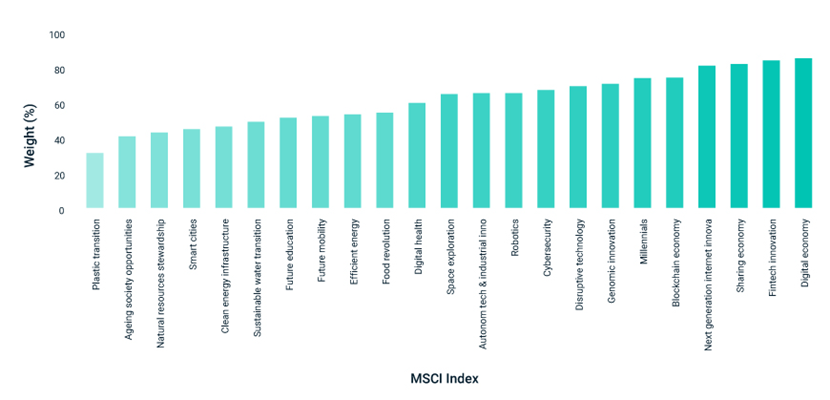

Weight in growth firms varied across thematic indexes

However, investors should be aware of two major points. The first one is that growth presented by traditional growth indices is different from growth captured by thematic investing as shown in the following MSCI study (click on download report button following this link)

Traditional growth allocation is different from the ‘growth exposure captured by thematic investing

The second one is that some thematics seen as a defensive play can encapsulate a large amount of growth factor. Some Environmental Pressure indices are a good example as shown by this food revolution index aiming at reducing gas emissions in protein production (Food Revolution).

High returns volatility and performance dispersion: the need of a new approach to construct thematic portfolios

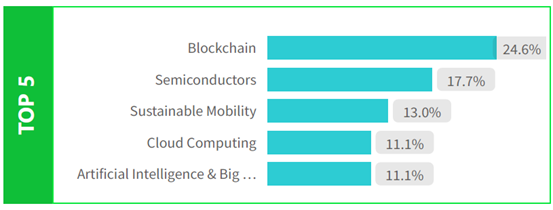

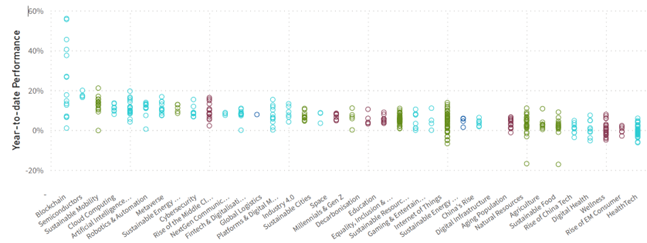

Year-to-date, technology-focused thematic strategies have rebounded strongly with Blockchain leading the way (+24.6%). “Semiconductors” and “Artificial Intelligence & Big Data” also benefitted from the news frenzy unleashed by ChatGPT in the last few months (an example of good performing fund on this thematic WisdomTree Artificial Intelligence UCITS ETF). “Cloud Computing”, “Artificial Intelligence” and “Sustainable Mobility” closed the top 5 best-performing themes. Another example of good performing fund is the WisdomTree Cloud Computing UCITS ETF.

Top 5/Bottom 5 by YTD performance

However, thematic annual returns are very volatile and dispersion of returns within the same thematic remains also very important as shown in the figures below.

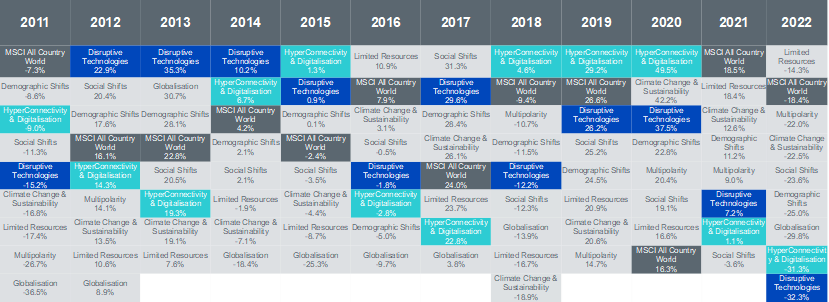

Thematic annual returns ranking

Dispersion of YTD performance of all ETFs and mutual funds by themes in Europe

Thematic investing is gradually becoming part of the institutional investor toolkit after primarily being popular among retail investors. As the potential for innovation in shaping the future equity market becomes clearer and more accepted, some asset owners are considering innovation investing in earlier stages of asset allocation.

But additional limitations and challenges other than returns volatility and dispersion exist, such as the small number of companies that have meaningful economic linkage to any single theme. This restricts the thematic-investment universe and can result in both a restrained investment capacity and high tracking error, which may potentially be undesirable for large allocations.

• Where does thematic investing fit in the asset allocation process?

• How can portfolios be constructed to capture innovation-driven themes while

providing a suitable level of capacity and liquidity?

• How might a traditional allocation framework, such as sector, country and style factor, be adjusted to incorporate an innovation allocation?

We will answer all these questions by presenting three new approaches to construct Thematic portfolios in the following article: News MSCI new approaches to construct Thematic portfolios.

Ahmed Khelifa, CFA