Classifying the digital assets landscape allows us to capture its breadth, depth, and track its evolution. In our article titled “All Cryptos are not currency”, we laid the basis of a taxonomy for crypto assets using the GICS classification as a model. Based on Wisdom Tree classification for crypto assets (click here to access the whole study), BSD Investing & L’Allocataire have defined 2 sectors (infrastructure/technology, and 7 related industry groups, to classify digital assets into distinct and easily understandable categories.

Using this classification, we could deep dive into crypto assets to answer the following questions: Are all crypto asset segments accessible through existing ETP products? What is the weight of each crypto asset sector in investor portfolios? Toward which sectors and industry groups are crypto assets flows going?

Are all crypto asset segments accessible through existing ETP products?

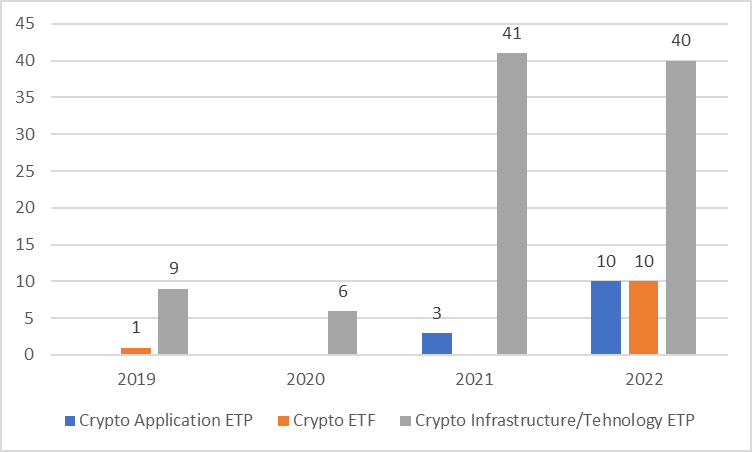

Crypto ETP growth is recent, with most of the growth starting in 2021. As explained in our article titled “What Crypto weighs in investors’ portfolios?”, the crypto ETP offering is diverse in terms of typology and structure of products and not all investment vehicles available to invest in Crypto assets are similar. Additionally, it is interesting to understand what market segments those products allow investors to access. As shown in the graph below, Crypto products currently mainly offer exposure to the infrastructure/ Technology sector, which represent nearly 80% (in number) of current issued products between 2021 & 2022. The rest is split between ETPs on crypto applications (mainly on Defi & Metaverse) and Crypto ETFs (giving equity exposure to Blockchain and Metaverse thematics).

Number of Crypto index funds launched per year

What is the weight of each crypto asset sector into European investor portfolios?

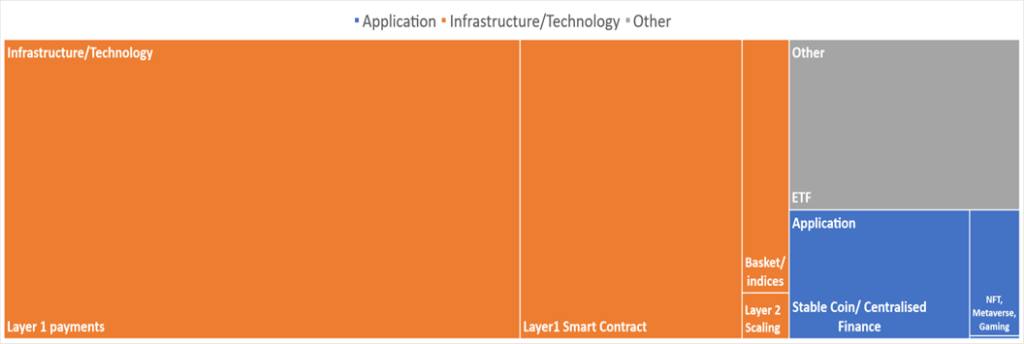

Crypto assets are relatively small in investor portfolios, with a total of assets under management of €3.2bn (at the end of December 2022, Source Morningstar, BSD Investing). Yet, they could be split into 3 parts. Firstly, the biggest part (77%) consists in infrastructure/Technology ETPs. Secondly, only 10% of current ETP products offer exposure to the Crypto application sector. And Thirdly, ETF assets on Crypto theme, classified as Other due to their specificities, represent 13% of the total.

Delving into the details, inside the Infrastructure/Technology sector two thirds of the assets are on Layer 1 payment products (like for example the WisdomTree Bitcoin ETP); 8 ETPs have assets above €100m in this group. 30% of the ETPs are in Smart Contracts (Ethereum, Solana, Cardano etc.) with 3 ETPs above €100M of assets. And the rest (5%) is comprised of crypto baskets and indices with no ETP above €100M of assets.

Inside the Crypto application sector, products mainly provide exposure to centralised finance, stable Coin & Metaverse. The average size per product is currently below €30M.

Crypto ETFs are classified in a dedicated segment. As specified in WisdomTree digital assets white paper (click here to access the white paper), in the same way that commodity-linked equities are fundamentally different from commodities as an asset class, digital assets are very different from blockchain equities and the fundamental difference shines through the different risk-return profile of both assets. An example of those ETFs is the WisdomTree Blockchain ETF. In this segment, only one ETP has assets above €100M.

European Crypto assets ETPs breakdown by sectors & industry groups

Toward which sectors and industry groups are crypto assets flows going?

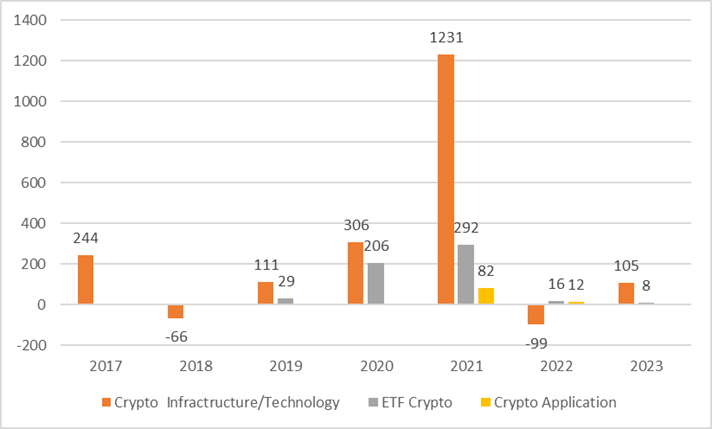

Flows mainly concern Infrastructure/ technology products. ETF flows are rather small and very volatile and sensitive to market conditions. The record year was 2021, with €1.6bn of net inflows. Despite market uncertainties and the FTX broker saga, outflows in 2022 were limited to €70M. Additionally, due to the rebounding market, flows have rebounded in January 2023 and already regained all that was lost in 2022. Those inflows have mainly come into the infrastructure/technology sector.

Crypto asset product flows since 2017

Conclusion

The development of Crypto ETPs in Europe is very recent and has been very fast. They mainly concern those offering exposure to the infrastructure/technology segment. Investors’ portfolios reflect this trend. However, these flows could soon extend to all crypto sectors as they expand. Our analysis of the evolution of flows to crypto assets also reveals that the introduction of crypto assets into investors’ portfolios through index funds (ETPs, ETFs, etc.) remains prudent but resilient. Their adoption has begun and should not stop there, even after the FTX saga.

Marlene Hassine Konqui & Ahmed Khelifa, CFA