AuM & Flows Compass Worldwide Active/Passive funds - 2022

Êtes-vous intéressé par toutes les informations pour avoir une vision juste des encurs et flux des fonds actifs / passifs domiciliés en Europe (year to date analysis as of 31st December, 2022) ?

Tous les éléments sont dans l'analyse suivante :

- In Europe in 2022 passive funds dominated the flows.

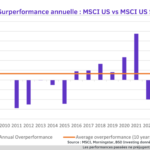

- In 2022 passive fund flows dominated at €107bn vs active for €230bn of outflows funds. The trend turned negative vs H2 of 2021. Equity passive fund flows were above those of active at €57bn vs €76bn of outflows respectively. This is opposed to H2 of 2021. The trend turned negative in 2022 vs H2 of 2021. Total equity funds witnessed yearly record outflows over 5 years. Even in fixed income passive funds dominated the flows with €60bn vs €147bn of outflows for active funds. This is opposed to H2 of 2021. The trend turned negative in 2022 vs H2 of 2021. Total fixed income funds witnessed yearly record outflows over 5 years.

- In terms of assets passive funds represent almost a third of the total in Europe mutual funds asset under management (24%). The percentage is higher for equity at 34%. Both active and passive fund assets have shown a strong increase compared to 2008 +8% p.a. and +17% p.a. respectively. In 2022 the trend is decelerating for active with -5% for active funds and +17% for passive funds. Active fund assets reach €7.9trn vs €2.5trn for passive funds. European mutual fund assets are down -0% vs 2020 and represent 29% of mutual funds worldwide.

Pour découvrir l'analyse complète

vous devez être abonné

262 résultats

| Type | Univers de fonds actifs & passifs | Région | Stratégie | Période | Téléchargement | ||

|---|---|---|---|---|---|---|---|

| Other | BSD INVESTING Expert Voice | ||||||

Special issueIn this Expert Voice, Marlène Hassine Konqui talks about the mission of BSD Investing, an independent firm devoted to research and portfolio construction. She explains why the active/passive decision is often so difficult to make. And she describes the innovative firm’s areas of research and tools, which will enable investors to make a fair and efficient selection between active and passive. |

|||||||

| Other | BSD INVESTING Parole d'Expert | ||||||

Special issueDans cette parole d’expert, Marlène Hassine Konqui explique la mission de la société BSD Investing, une société indépendante dédiée à la recherche et à la construction de portefeuille. Elle souligne pourquoi la décision d’investir dans des fonds actifs et/ou passifs est souvent difficile à prendre et décrit les domaines de recherche et outils innovants de son entreprise qui permettent aux investisseurs de faire une sélection efficiente entre les fonds. |

|||||||