Have investors favoured active management or bond ETFs in early 2022? How have active funds vs. ETFs performed in this segment? What impact for portfolio construction?

A regular and optimal analysis of the performance and flows of active and passive management in Europe, carried out from BSD Investing’s proprietary database* and Morningstar’s data, helps to answer these questions. A new look at the world of portfolio management.

What have been the flows to bonds since the beginning of 2022?

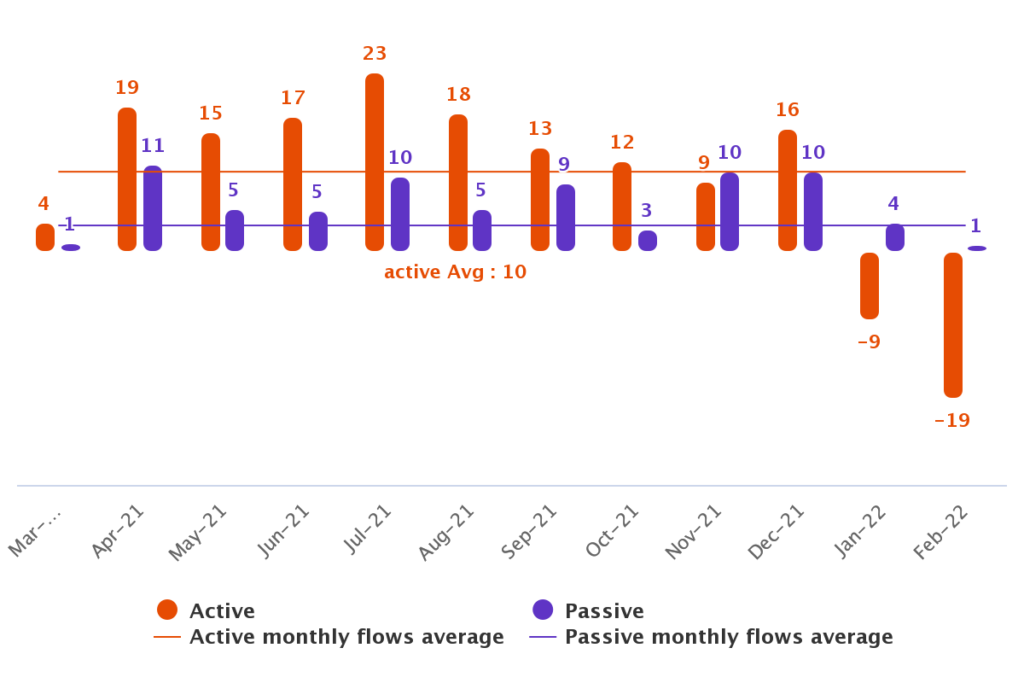

In a context of strong uncertainties about the economic impact of the current geopolitical situation, flows to funds domiciled in Europe on the bond markets were down sharply. Active management recorded a very strong outflow: €28 billion between January and February 2022. Flows to passive management are down, but remain positive with €5 billion raised over the same period(1).

Monthly flows to active and passive bond funds

Are there any differences between the segments?

Developed country government bond funds were almost the only category of funds to have collected over the period benefiting from the investor search for protection. Funds on European govies captured the majority of this collection, €5.8 billion out of €7 billion for this segment as a whole. Active funds attracted more than half of these flows. On passive funds, the collection is equally divided between funds on European govies and US govies, 1.5 billion euros on each. All other categories recorded outflows.

What are the performances for bond funds at the beginning of the year?

Since the beginning of 2022, in this difficult context, the performance of bond managers has been declining: only 31% manage to outperform their passive counterparts. This is the lowest level observed in the first two months of the year in 10 years. Only active funds, in the government debt segments of developed countries, are doing well. 66% of active funds outperform passive funds on European government debt. In the other segments, emerging debt, good quality corporate debt or high-yield in euros or dollars, less than 50% of managers manage to outperform their passive counterparts. While historically active managers outperform more widely in the bond segment than in equities, is this reversal temporary or sustainable? To be continued.

What impact on portfolio construction?

Against a backdrop of uncertainties about the evolution of interest rates and credit spreads, investors have been looking for protection and have exited nearly all other categories of the bond market. Traditionally, active management dominates flows in this segment. However, in this market context, flows to passive management have been more resilient, perhaps even benefiting from tactical repositioning by some investors as well as the difficulty for active managers to currently generate outperformance.

Accurate and regular monitoring of flows and performance between active and passive funds provides an accurate picture of what is outperforming and thus makes more efficient allocation decisions.

(1) flow data as of 28/2/2022. (2) Performance data as of 25/2/22022. Sources: BSD Investing & Morningstar.

Marlene Hassine Konqui

Leave a Reply

You must be logged in to post a comment.