The huge volatility of 2022 for crypto assets including the crypto broker FTX saga have triggered many questions concerning the future of crypto investing especially for institutional investors. In a volatile Q1 2023 experienced by financial markets in 2023, one of the two main crypto currencies experienced the latest phase of its upgrade. What are the implications of this upgrade for investors? have crypto assets confirmed their stake in investors’ portfolios? Have crypto flows rebounded? Toward which crypto segments flows have been going year to date? What crypto asset sector has performed best in 2023?

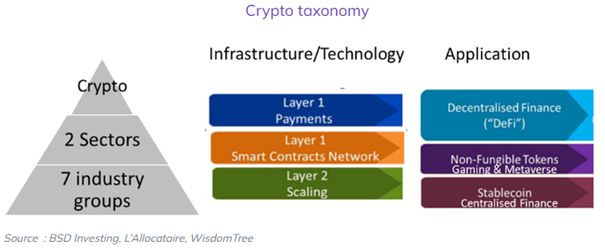

In our article titled “All Cryptos are not currency”, we laid the basis of a taxonomy for crypto assets using the GICS classification as a model. Based on Wisdom Tree classification for crypto assets (click here to access the whole study), BSD Investing & L’Allocataire have defined 2 sectors (infrastructure/technology and Application, and 7 related industry groups (see graph below), to classify digital assets into distinct and easily understandable categories. Using this classification, we could answer our initial questions.

What are the implications of the Ether latest Shapella upgrade for investors?

Ethereum remains the most widely adopted smart contract blockchain and has more than double the number of total developers compared with any other blockchain network. Because Ethereum accounts for 19% of the total crypto market and has a $204 billion market cap, the asset is fairly liquid and remains one of the favourite assets to own among institutional investors, along with Bitcoin (source: Withdrawal of staked Ether and related rewards expected in March 2023 WisdomTree Mars 2023).

Proof-of-stake vs proof-of-work, Bitcoin vs Ethereum: Clash of the Titans

Any transaction on the blockchain needs to be validated. Bitcoin and Ethereum used to have the same validation process called proof-of-work. This process slows down transaction speed impeding network scalability and thus its adoption and use in other applications.

Bitcoin: a proof-of-work validation process

Miners are computers that are scattered around the world and form a critical part of the bitcoin network. Their job is to aggregate groups of valid new transactions. At any given time, thousands of these computers are competing with each other for the right to settle the next block. The competition involves solving a challenging mathematical puzzle, and miners can propose a new block only if they solve the current puzzle. Whoever finds the solution first is entitled to a reward, which consists of newly minted bitcoin and potentially transaction fees, which have been paid by the entity initiating the transaction. The reward is significant: Each new block currently comes with a reward of 6.25 newly minted bitcoin. This payment is what incentivizes miners to perform the work necessary to verify transactions and maintain the database.

Ethereum: a proof-of-stake validation process

Ethereum used to work on proof-of- work like Bitcoin but, in order to process more transaction volumes in time and accelerate its network, a migration to a proof-of-stake technology was initiated.

Unlike a blockchain that works with Proof-of-Work (PoW) consensus like Bitcoin, and where it is necessary to solve complex mathematical equations to validate a transaction and get the rewards associated with it, PoS (proof-of-stake) works in a different way, in a Proof-of-Stake system, it’s not the computing power that counts, but the number of project tokens in your possession. To be allowed to run a central node and thus participate in the transaction verification process, you must block a certain number of tokens- Ether for instance- by putting them in “stake”. In proof-of-stake systems little or no energy is consumed in mining; instead, Valdators lock up assets in escrow in exchange for securing the network.

Ethereum Shanghai (Shapella) Upgrade: The last step into proof of stake

Ethereum network underwent a perilous technological transition in the way it validates transactions from Proof-of-Work (PoW) to Proof-of-Stake (PoS). Already from September 2022, it has been possible for validators to stake Ether (ETH) in a smart contract on the Beacon Chain but it has not been possible to withdraw the staked ETH or earned rewards yet. A new upgrade to the Ethereum network called the Shanghai Upgrade or Ethereum Improvement Proposal EIP-4895 ended the process of migration to proof-of-stake validation process allowing validators to withdraw staked ETH and guaranteeing liquidity to stakers. Staking is a way by which anyone that has ETH can lend them to validators to participate in the transaction validation process and earn rewards by doing so. Stakers receive a yield /return for adding liquidity to the system.

Ethereum Shanghai (Shapella) Upgrade: The implication for investors

This upgrade will be significant for the industry as it creates a yield against which all other token yields can be benchmarked. Since the go-live date of the first Ethereum Proof-of-Stake chain launched in 2020, the concept of staking has been on the mind of investors as they demanded yield in a low rate environment. By locking up, or ‘staking’ Ethereum, to validate transactions on the network, a yield could be generated in the form of newly minted ether rewards.

In 2020 (an environment where treasury yields were quite low and crypto prices were climbing) this seemed to be a reasonable yield-generating alternative investment to many investors. With Treasury yields now, reaching 5% (2 years US treasuries), yields offered by staking Ethereum became less interesting. The new yield levels that would be offered by staking following the latest Ethereum evolution (Shapella upgrade) will define relative attractiveness of crypto yield to other yield generating assets mainly fixed income.

Around 14% of the Ethereum supply is staked and has been inaccessible for withdrawal — until now. Depending on the demand to unstake and possibly liquidate ETH positions, this could further apply downward price pressure on the asset. On the other hand, it’s also reasonable to view the Shanghai upgrade as a catalyst for increased staking demand, as the inability to withdraw may have driven potential investors away. In either view, it is important to note that, as the amount of Ether staked decreases, the yield increases, and vice versa, which may offset any extreme shifts in demand. The final result will determine yield levels for the crypto universe and either confirm its place as an interesting standalone yield generating asset in investor’s portfolios or downgrade it to a passing fad.

Discover more on the possible implication of this latest evolution on crypto investors in the following article: Ethereum Shanghai upgrade is a success.

After the volatile 2022, have crypto assets disappeared from European investors’ portfolios?

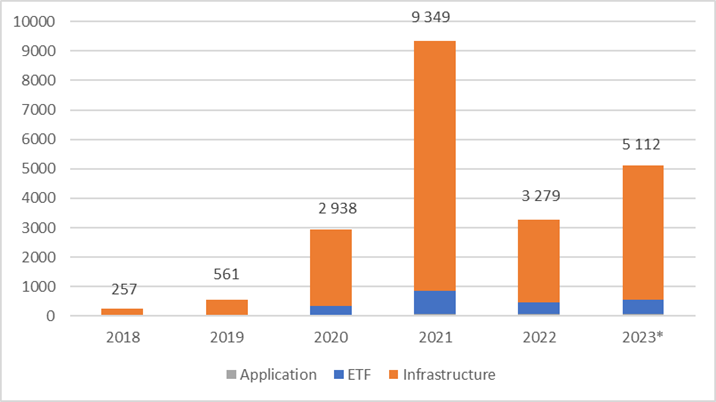

Crypto assets are relatively small in investor portfolios, with a total of assets under management of €5.1bn (at the end of March 2023, Source Morningstar, BSD Investing), up 56% since the end of 2022. Even retreated of the exceptional year of 2021, the growth appears steady.

ETP Crypto assets since 2018 (€Millions)

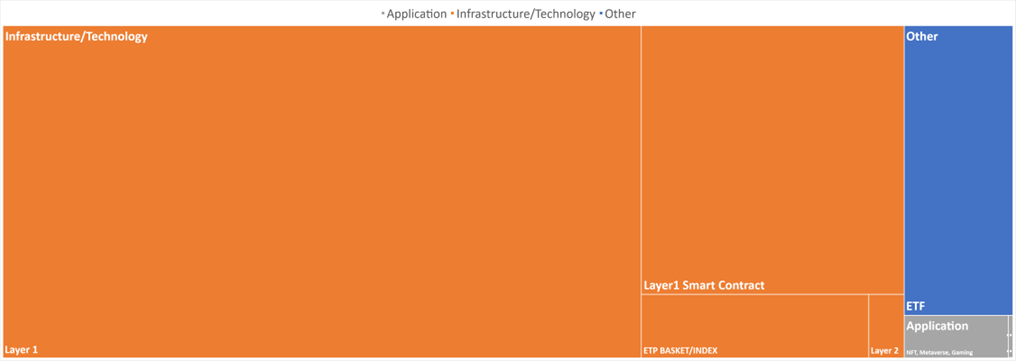

What crypto market segments are hold in investors’ portfolios?

According to BSD Investing & L’Allocataire segmentation, Crypto assets could be split into 3 parts:

- Infrastructure/Technology : Firstly, the biggest part (89%) consists in infrastructure/Technology ETPs.

- Crypto application: Secondly, only 1% of current ETP products offer exposure to the Crypto application sector.

- Crypto Theme ETFs: And Thirdly, ETF assets on Crypto theme, classified separately due to their specificities, represent 9% of the total.

The Infrastructure /Technology sector Crypto is currently the biggest one could be also split into 3 industry groups (see all details about segmentation on this link):

- Layer 1 Blockchain Payment: the first blockchain technology was Bitcoin which allows for the simple transfer of value between two entities without a third party intervention and in a safe manner. These value transfer capabilities gave currency specificities to Bitcoin. There are also some centralized blockchains (Ripple and Stellar).

- Layer 1 Blockchain Smart Contracts/Programmable Money: Ethereum, allows participants to transact with each other without a trusted central authority, dependent on certain created conditions via a smart contract. Smart contract-enabled blockchains are the underlying infrastructure which allows other cryptos to be adapted. Competitors to Ethereum, are Solana and Cardano.

- Layer 2 Infrastructure: Layer 2 infrastructure networks are separate blockchains, built on top of Layer 1 technology. Their aim is to provide increased speed, or scalability. For example, it includes protocols such as Polygon.

Assets on ETPs on layer 1 crypto infrastructure are the more important. In this sector, decentralised native blockchains represent 54% of the assets, centralised blockchains 9%, and Smart Contract Blockchain 21%.

ETP Crypto assets by sectors in 2023

Are crypto flows rebounding in 2023?

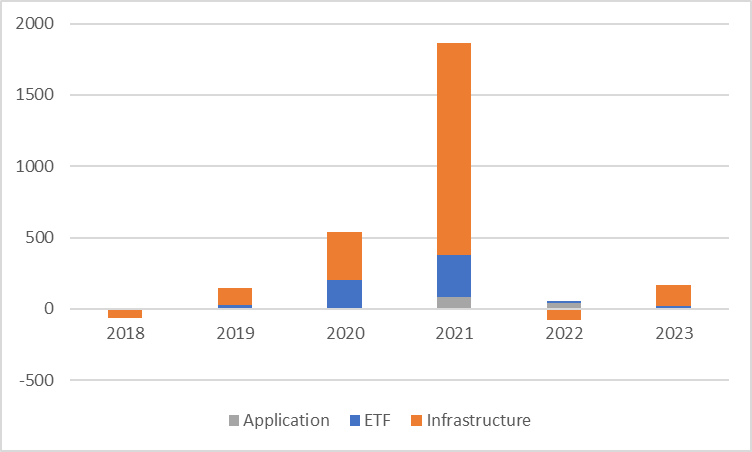

Historically, crypto flows have mainly concerned Infrastructure/ technology products. Those flows are rather small, volatile and sensitive to market conditions. The record year was 2021, with €1.9bn of net inflows. Despite market uncertainties and the FTX broker saga, outflows in 2022 were limited to €20M. In 2023, flows have rebounded to €168M above those of 2019. All that was lost in 2022, is already more than regained. 2022 has more been a wait and see year for crypto investors than a real crisis year, contrary to what one might have expected with all the media noise around the FTX saga. 2023 should definitely be a test year to see the confirmed interest of investors toward crypto investments.

Thanks to our segmentation, we can observe that most of the flows year to date 2023 concern ETPs on Crypto infrastructure layer 1 (84% of the inflows). In this sector, 77% of the inflows are focused on native blockchain (mainly Bitcoin), and 6% toward Smart Contract Blockchain. UCITS ETFs on equity investing in the Blockchain technology represent 12% of the flows. Crypto application is still a very small part of the market and has captured less than 1% of flows year to date (until April 30, 2023).

ETP Crypto flows since 2018 (€Millions)

What crypto asset sector has performed the best in 2023?

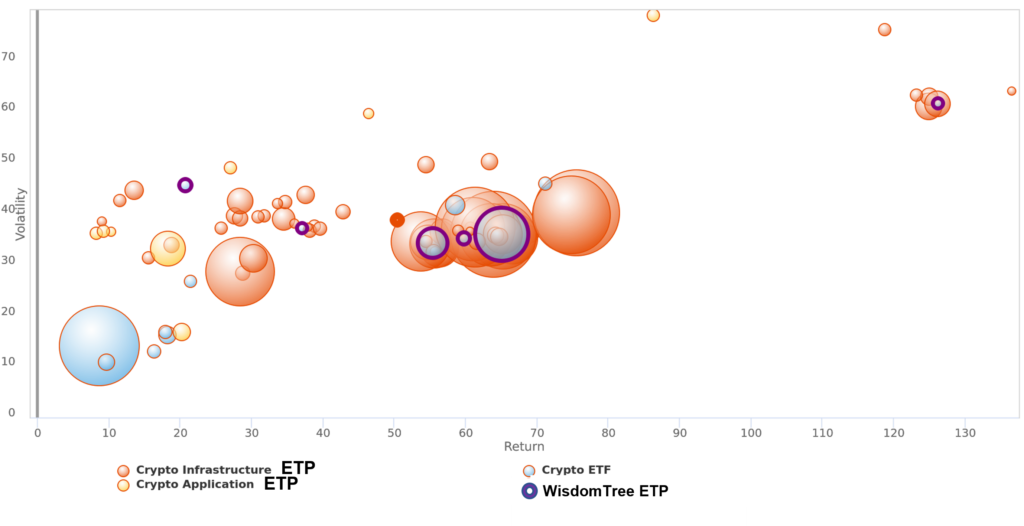

After a very difficult 2022 in terms of performance, the Crypto Infrastructure sector and especially the Layer one segment on native decentralised blockchain experienced a strong rebound year to date (until 30/04/23) with performances ranging from +20% to 130%. Solana & Bitcoin ETPs were among the highest performing. For example the WisdomTree Solana ETP is up 128% year to date, the WisdomTree Bitcoin ETP +70%, the WisdomTree Ethereum + 53%. This may be explained by two reasons:

- The first one is investors’ expectations of a pivot in central banks monetary policy which have a positive impact on growth investment themes. This can also be seen on tech equities like NASDAQ overperforming cyclical sectors (until Mai 2023).

- The second reason is the bank run and the SVB saga igniting the flame of enthusiasm for decentralized finance and in particular crypto money.

Crypto ETP on a basket or on an index of crypto currencies also enjoyed a significant performances. For example the WisdomTree Crypto Market ETP and the WisdomTree Crypto Mega Cap Equal Weight ETP were up 62%, and the WisdomTree Crypto Altcoins ETP +64% year to date (until 30/04/2023)

Crypto ETFs, sustained by buoyant equity markets, also registered positive performances although less impressive as seen in the graph below (blue bubbles for Crypto ETFs, Orange for Infrastructure ETPs and yellow for Application). For example, the WisdomTree Blockchain UCITS ETF is up 23% year to date.

Crypto ETP year to date performances

Conclusion

The final result of Shanghai upgrade for Ethereum will determine yield levels for the crypto universe and either confirm the crypto place as an interesting standalone yield generating asset in investor’s portfolios or downgrade it to a passing fad. This is an important step toward crypto global adoption by institutional investors. This move has already started and even retreated of the exceptional year of 2021, crypto ETP asset growth appears steady. After a wait and see 2022 year in terms of flows, 2023 should be scrutinized to follow the trend of this adoption by institutional investors.

Marlene Hassine Konqui & Ahmed Khelifa, CFA

Leave a Reply

You must be logged in to post a comment.