Have investors favoured active management or ETFs on European equity funds since the start of 2022? How have active funds vs. ETFs performed in this segment? What impact for portfolio construction?

Flows to European equity active funds vs ETFs: a snapshot since the beginning of 2022

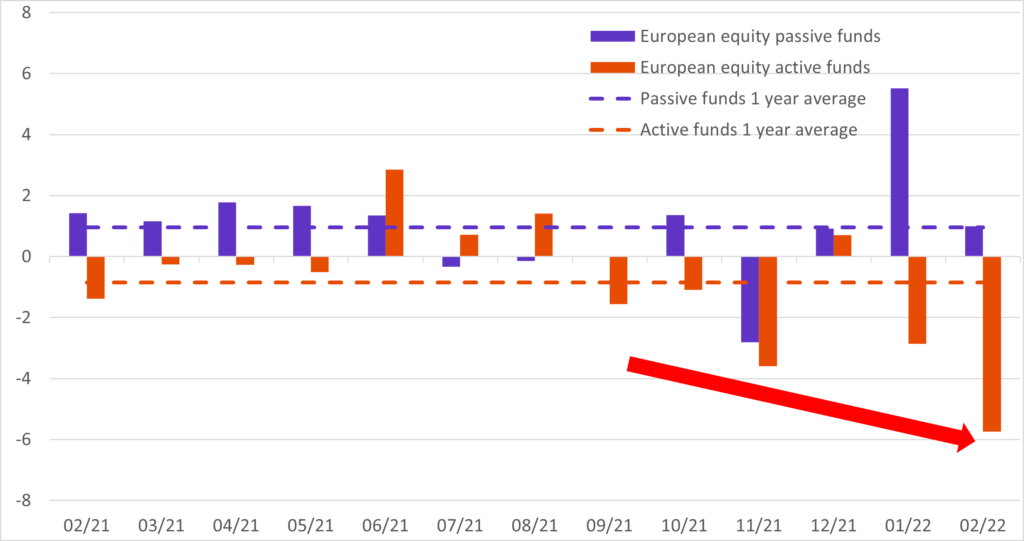

In a declining market, given the uncertainties related to the current geopolitical situation, flows to funds domiciled in Europe on the European equity markets were down by €2.1 billion between January and February. This figure hides a very heterogeneous situation between active and passive management. Active management recorded very strong outflows: nearly €9 billion between January and February 2022, with a steep acceleration in February. Flows to passive management remained positive at €6.5 billion though most of the inflows were in January (1).

Monthly flows to European equity active and passive funds

Sources: BSD Investing, Morningstar, data in €billion from 1/2/21 to 28/2/22

Important geographical & sectorial differences

Broad European active equity funds recorded €3.2 billion in outflows while passive funds raised more than €3.9 billion. This contrasts with fairly muted yet positive flows towards the Eurozone active equity funds: €1.5 billion for passive funds, €500 million for active funds.

Geography really mattered at the start of the year. Indeed, UK equity funds were the most affected by the outflows from both active and passive funds: €4 billion in outflows from active funds and €2 billion from passive funds across January and February 2022. Contrary to UK funds, Swiss equity funds raised €1.4 billion for passive funds, €500 million for active funds.

Passive funds also captured sector related flows. The Energy sector attracted €176 million and €344 million in January and February respectively. The Financial Services sector saw a huge collect in January, €995m, but significant outflows in February in the aftermath of the Ukraine crisis.

A weak start of the year for active managers

Since the start of 2022, in this challenging context, the performance of active managers in European equities has been poor: only 26% managed to outperform their passive counterparts. Looking at the last 10 years, this is the lowest level observed in the first two months of any given year. In 2021, over the same period, 31% of active funds had outperformed passive funds. To put things into perspective, the best start of the year for active managers was in 2018, when nearly 70% of active funds had outperformed passive funds.

In addition, active managers underperformed passive funds by 1% over the first two months of the year. It was similarly poor in the first two months of 2021 with 1.3% underperformance , making the start of both 2021 and 2022 some of the worst relative performance periods over the last ten years.

Active managers were penalized at the beginning of 2022 by an overexposure to the technology and industrial sectors that underperformed the MSCI Europe index, as well as an underexposure to the energy sector that outperformed the index.

Impact on portfolio construction

Tactical reallocations into passive funds across Europe as well as into certain sectors less sensitive or even benefiting from the current crisis, are consistent given the current level of market uncertainty. To date, the sector positioning of active managers has heavily weighted on relative performance and it will be critical to analyse how the current geopolitical context continues to affect the investment choices of active managers.

Accurate and regular monitoring of flows and performance between active and passive funds provides a clear picture of what investors are doing and how active managers’ investment decisions are faring in different market phases. This is key to making more efficient allocation decisions.

(1) flow data as of 28/2/2022. (2) Performance data as of 4/3/2022, more details on www.bsdinvesting.com. Sources: BSD Investing & Morningstar.

Marlene Hassine Konqui

Leave a Reply

You must be logged in to post a comment.