| |

|

|

| |

How did factor strategies perform in 2023? Are the valuations of these factors still attractive? Are Smart Beta strategies still an important pillar of investors’ portfolios in 2023? Which strategies are experiencing the most significant inflows? What is the role of smart beta strategies in investors’ portfolios?

Click here to read the full article. |

|

|

|

| |

|

| |

The timing of the Fed pivot will be one of the main factors driving equity performance. As economies decelerate, recession fears grow, and inflation decelerates, central banks will need to start planning for some landing (soft or not). Such periods of monetary policy changes are always quite difficult for equity investors, and it is always good to look back at similar periods in the past to inform our current positioning.

The answer in the following article by Pierre Debru — Head of Quantitative Research and Multi Asset Solutions, WisdomTree Europe

Looking back at equity factors in Q1 2023 with WisdomTree

|

|

| |

|

| |

How have high dividend factor strategies behaved compared to bond total returns after hike cycles? While global equities have suffered heavy losses in 2022, they were still moderate compared to many drawdown episodes in the past. Stocks were down less than during the GFC and the Covid-19 crash, but also than during the 2015/16 correction and the 2018 US-China Trade War. Bonds, meanwhile, were down more than at any point in at least two decades. How have high dividend factor strategies behaved compared to bond total returns after hike cycles? The answer by Marcus Weyerer, CFA, Senior ETF Investment Strategist in

the following article.

|

| |

BSD Investing & L’Allocataire model portfolio update

|

|

| |

Combining active & passive funds to build optimal portfolios

|

|

| |

Click here to discover the performances of our dynamic portfolio allocation. Our mixed approach between active and passive management on this profile has generated an outperformance of 14% compared to the MSCI ACWI index (world equities) over 1 year (until 31/05/2023), and is up 13% year to date (against 8% for world equities). It is a factual proof that the combination of active and passive strategies is an under-exploited performance driver.

|

|

|

|

| |

|

|

| |

|

|

| |

LATEST NEWS

Portfolio Allocation: How to overcome ESG based asset allocation challenges?

ESG investing has now a place of choice in investors portfolios. Massive planned government investment plans are about to impact most developed countries economies’ as well as emerging ones. These investments are mostly linked to energy which could have an impact on future ESG investment performances. This arises new challenges in order to build efficient portfolios: Is there a fundamental economic and market rational for this keen interest to persist in the future? Can we talk about ESG as a risk factor with a related premium, based on past returns analysis? Finally, is there a solution to address the challenges of traditional benchmarking in ESG based Asset Allocation?

Click here to build effcient ESG portfolios.

|

|

| |

|

|

| |

LATEST NEWS

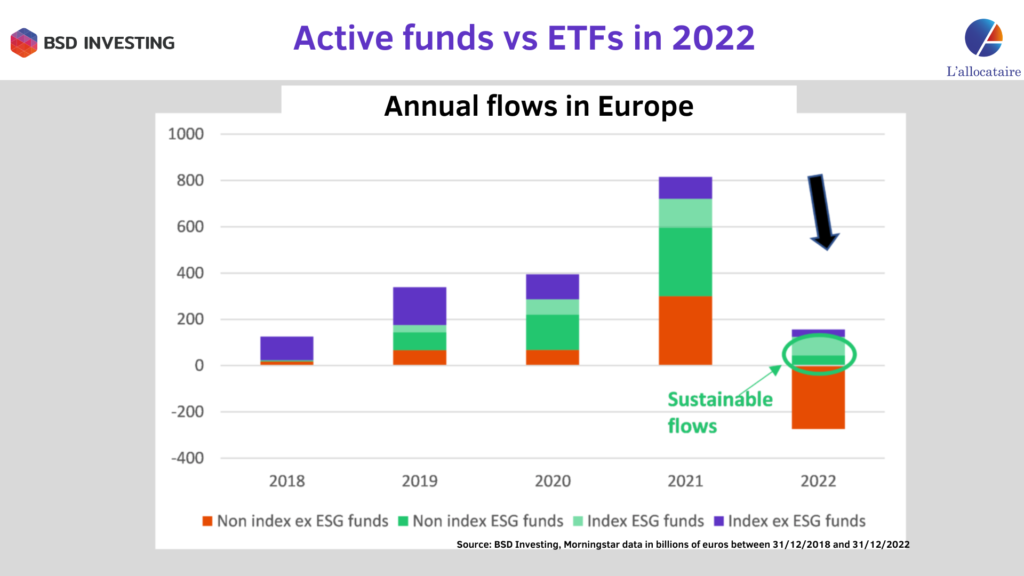

ESG Fund flows: Did the greening of investors’ portfolios continue in 2022?

The development of sustainable index and non-index funds has been very rapid over the past three years, particularly in 2021. In the uncertain context of 2022, have investors continued to invest in sustainable funds? Did they favour sustainable index or non-index fund? Article 8, Article 9, where are the portfolios? Is the increase in the assets under management of sustainable funds accompanied by a change in fund benchmarks? What lessons can be learned for portfolio construction?

Discover all the answers by clicking here.

|

|

| |

|

|

| |

LATEST NEWS

Thematic Investing : Separating the wheat from the chaff with BSD Investing new leaderboards

Thematic funds have attracted investors’ interests due to their unique ability to tap into human’s innate need for stories. Is this interest still strong at the beginning of 2023? How to select the right thematic? How to rank thematic funds without the limitation of current lack of nomenclature standardisation? Discover, exclusively in this newsletter, BSD Investing latest thematic leaderboards that rank both active and passive thematic funds with a special focus on Global thematic funds.

All our answers by clicking here.

|

|

| |

|

|

| |

Disclaimer

This website and all of its contents (analysis and research) is published by, and remains the copyright

of, BSD Finances or its licensors. The information contained within is for educational and informational

purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell

funds nor should it be viewed as a communication intended to persuade or incite you to buy or sell

funds. Any commentary provided is the opinion of the author and should not be considered a personalised

recommendation. The information contained within should not be a person’s sole basis for making an

investment decision. Please contact your financial professional before making an investment decision.

Should you undertake any such activity based on information contained on this website, you do so

entirely at your own risk and BSD Finances shall have no liability whatsoever for any loss, damage,

costs or expenses incurred or suffered by you as a result.

Care is taken to ensure that the information provided by BSD Finances is correct but it neither

warrants, represents nor guarantees the contents of the information, nor does it accept any

responsibility for errors, inaccuracies, omissions or any inconsistencies herein.

BSD Finances is a limited liability company registered in France with registered number 852 716 547

00017. Our registered office is at 8 rue de Moscou 75008 Paris. BSD Investing is part of BSD Finances.

|

|

|

Leave a Reply

You must be logged in to post a comment.