Based on BNPP AM, Invesco & WisdomTree market insights and our proprietary research, we provide a simple and easily achievable methodology that does not require a new nomenclature for efficient selection of thematic funds.

Viewing stocks through a thematic lens instead of a more classic sectoral or regional lens has the undeniable advantage to tap into human’s innate need for stories. Whilst it can be challenging for human beings to connect purely with numbers, we are culturally programmed to react and bond with stories and narratives. Thematic investments enable investors to link their vision of the world and its evolution directly to their investment strategies. They provide an innovative investment approach, breaking from traditional silos like countries, sectors, factors, or regions. Investment themes typically span various economic cycles. This is particularly important to remember in times of short-term volatility, such as those we have seen in markets in 2022.

BNPP AM (access the full paper) and Invesco (access the full paper) studies suggest that thematic investing is not opportunistic. Many of the themes are multi-generational. They affect not just investors’ lives now, but those of their children and grandchildren. See for example the case for Hydrogen thematic with projections until 2050 in Clean energy: Investment case for wind and hydrogen by Invesco. It is therefore all the more important to choose the right investment themes as their impact on performance is to be considered over the long run.

Not all funds look alike

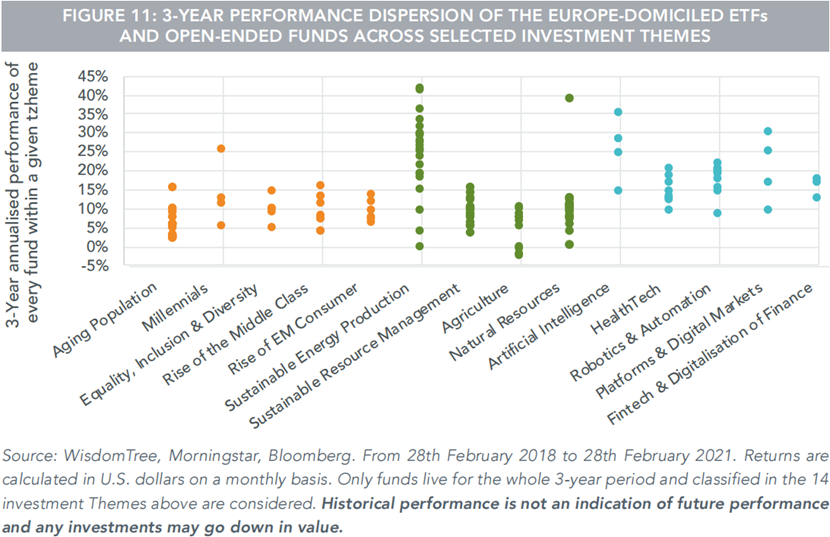

However, this evolution in asset management also creates risks for investors as they force us to rethink how we evaluate these tools in the context of fund selection as well as asset allocation especially that the dispersion in performance between funds claiming to harness the same theme can be incredibly wide as shown in the figure below (access WisdomTree full study).

This figure shows the last 3-year performance of every Europe-domiciled ETF and open-ended fund for a set of investment themes. In each of the 14 themes below, the difference between the best performing and the worst-performing fund is higher than 5% on average per year. In Sustainable Energy Production, the difference is 41.7% every year for three years. The opportunity cost in picking the wrong thematic fund even within a well-defined theme like Artificial Intelligence (AI) or HealthTech can be very high.

The first challenge is the complete absence of a recognised nomenclature to organise thematic investments. Unfortunately, there is no universally approved classification. Traditional benchmarks or peer groups are not helpful to investors in this task.

To help fill that gap, some asset managers such as WisdomTree and BNPPAM developed thematic classification that splits the universe into investment themes (access WisdomTree classification, BNPP AM classification). In the following, we will describe our new Thematic fund selection approach based on academic research for a pragmatic use by asset allocators. This approach is intently built so that it doesn’t require a thematic nomenclature.

Back to basics:

Before describing our thematic investment fund selection approach, let’s get back to asset allocation basic objectives. Our first intent as asset management professionals is to maximise a portfolio return under a given risk budget. Thus, even if new non-financial constrains or objectives are added to the previous ones, they do not annihilate them. Once we agree on that, our methodology will seem quite obvious and straightforward.

Thematic, an active decision:

We were inspired by David Easley, David Michayluk , Maureen O’Hara and Talis J. Putnins definition of activeness of an ETF in their paper «The Active World of Passive Investing» (Review of Finance, 2021).

They assert that ETFs can play a role in active funds management in two ways:

- Either the ETF’s holdings are themselves actively managed by the ETF issuer with the objective of delivering an excess risk-adjusted return, what they term “active in form,”

- Or the ETF is designed to track a narrow segment of the market (e.g., a sector) and so can be used by active investors as an efficient way to place a bet on a particular exposure, what they term “active in function.”

Choosing a benchmark that embraces or departs from the market (active in function) and/or choosing holdings that depart from the chosen benchmark (active in form) are two different ways to actively manage a portfolio. This definition could include actively managed mutual funds and be applied to Thematic Investing strategies. According to ESMA, in the “Cost & Performance report 2022”, ETFs adopting these two types of strategies are referred to as active ETFs. This is particularly the case for factor ETFs and smart beta. By extension, this also applies to thematic investment strategies which provide exposure to a specific segment of the market.

The choice of a thematic is indeed a bet on a particular exposure and thematic strategies are designed to track a narrow segment of the market. These funds, whether they are actively or passively managed, are active in function and, thus, should be compared to a broader benchmark/index in order to assess the relevance and suitability of the thematic. Thus, with this methodology, we do not try to compare themes between them but all the thematic funds and ETFs, whatever their themes. This allows us to judge the relevance of a manager’s active allocation and stock picking choices and to compare them to those of other thematic funds. This also allows assessing the ability of index providers to select and implement the right thematic and to compare them directly to other thematic funds. At this stage and for this purpose, there is no need to create a new classification standard or nomenclature specific to thematic strategies. The choice of a theme by a manager is therefore considered as an active decision to deviate from his investment universe in the same way as the overweight or underweight of a sector or the overweight or underweight of a given stock. In order to be considered in a portfolio, a thematic investment either under an index or non index fund format, as any other allocation decision, should enhance the risk-return profile of this portfolio. Considering that, this is the first intent of asset allocation.

This leaves us with an answered question, what benchmark to choose?

Benchmark choice: Old benchmarks are the new benchmarks

The choice of the benchmark would depend on the geographic exposition of the strategy. This allows us to compare thematic funds and group them according to their unique commonality, their initial investment universe.

- If it is exposed to a unique geographic zone it should be benchmarked to the broader benchmark of this zone. Let’s take the BNP Paribas EASY ESG Eurozone Biodiversity Leaders PAB UCITS ETF as an example, as it is exposed to equities from the Eurozone. The selected benchmark should be the largest developed countries index (MSCI EMU).

- When the fund is exposed to more than one geographic area, it is considered global and must be compared to the entire investable market, including all market capitalization sizes, such as the MSCI ACWI all cap index. The choice of the target capitalization size is also an active allocation choice, and a broad index makes it possible to take this into account. Let’s consider for example the WisdomTree Artificial Intelligence UCITS ETF, we compare it to the MSCI ACWI Index.

Marlene Hassine Konqui & Ahmed Khelifa, CFA

Leave a Reply

You must be logged in to post a comment.