Based on BNPP AM, Invesco & WisdomTree market insights and our proprietary research, we assess here the place of these investments in investors’ portfolios in Europe.

Strong development of the Offer

There are now about 700 funds listed in the Thematic category (Source Morningstar). Thematic funds are not new. Early ones date back to the late 60s. On the threshold of the 2000s, the European market already had more than twenty funds. However, it was not until 2018 that this type of fund experienced a real growth in terms of number of new issuance.

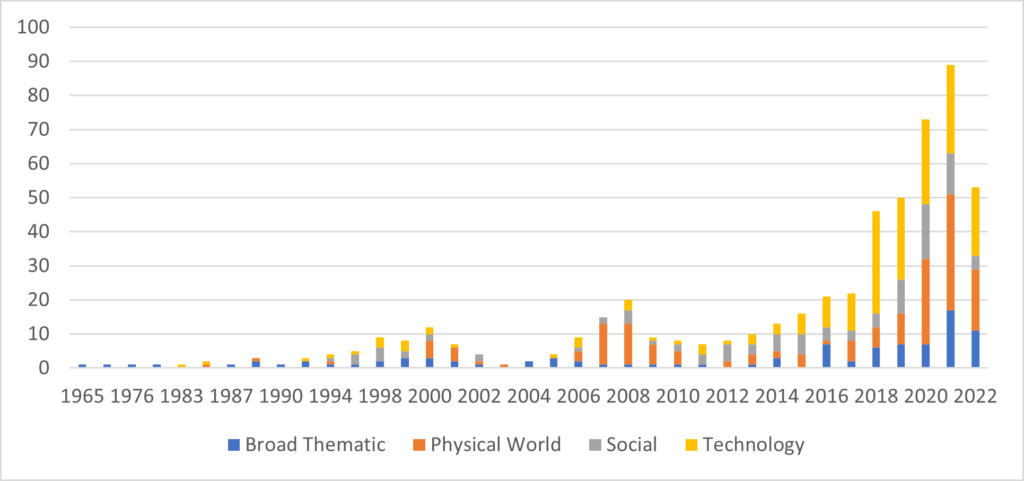

Number of thematic funds launched per year

All the themes can be classified into 4 major sub-parts, technology, social, physical world (resource) and global, and have experienced a strong development. The year 2022 notes a slowdown, namely in the social theme.

What do thematic funds represent in investors’ portfolio in Europe?

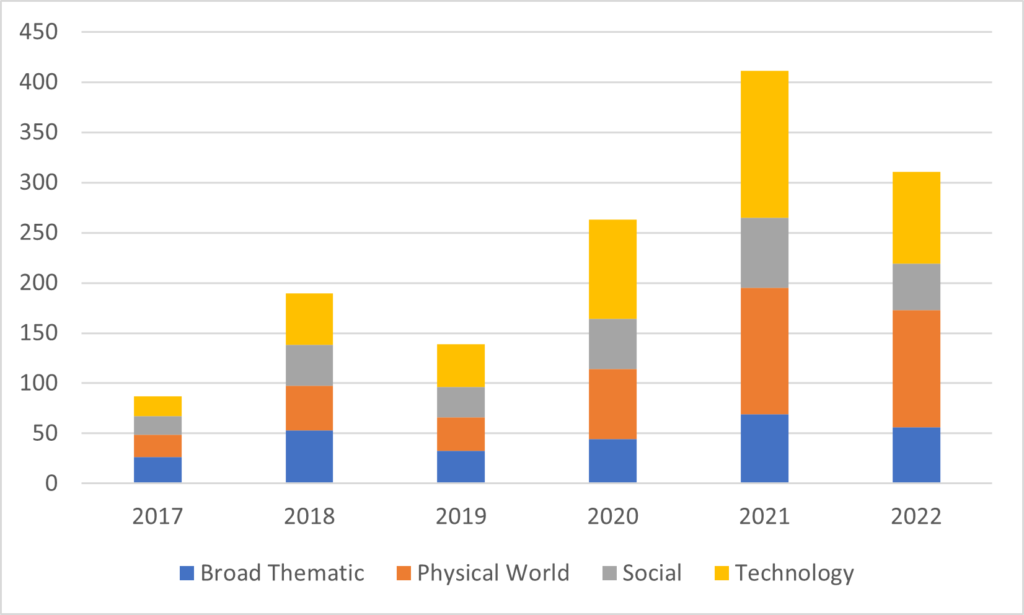

The total outstanding amount of these funds reached €311bn at the end of 2022. The growth of these assets under management has been very strong, almost quadrupling since 2017 while at the same time the outstanding amounts of equity asset management have grown over the same period by only 25%. At the end of 2022, thematic funds accounted for nearly 7% of equity asset under management, a relatively small part of investors’ portfolios.

Evolution of the thematic fund assets since 2017 (€bn)

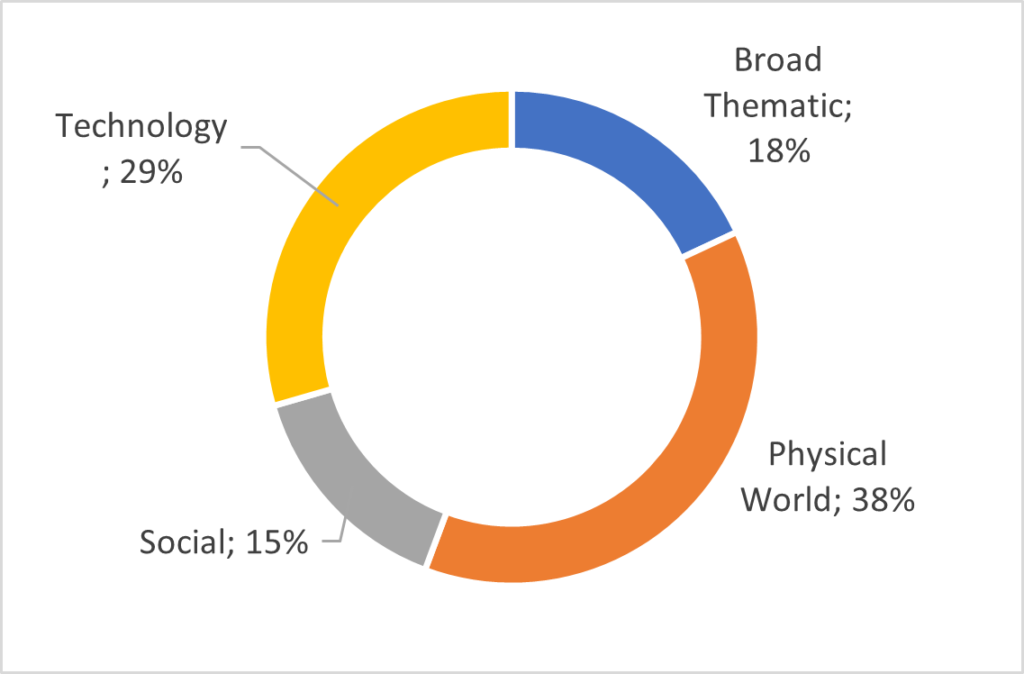

Themes on the Physical World segment (Energy transition, food, logistic & transport and resource management) arrive in first position with nearly 40% of assets, followed by technology.

Asset breakdown of thematic investing

What flows in 2022 towards thematic strategies?

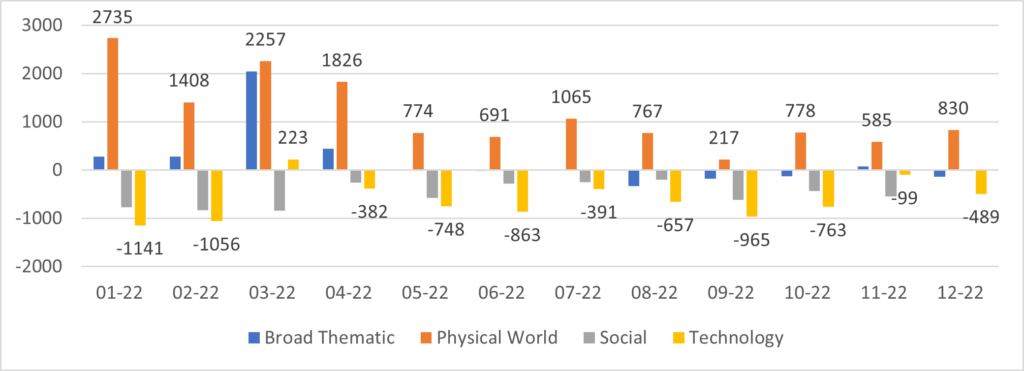

Flows towards themes were very strong from 2017 to 2021. The slowdown is noticeable in 2022. However, inflows remained positive at €3.5bn compared to a decline of €25bn for all equity funds in Europe. These flows were mainly directed towards the Physical World (Energy transition, food, logistic & transport and resource management) category and more than compensated for the outputs of technological themes. These flows have been distributed almost equally between index and non-index funds, even though index funds represent only 10% of assets invested in thematic funds.

Flows to thematic funds in 2022

What place for thematic index funds in investors’ portfolios?

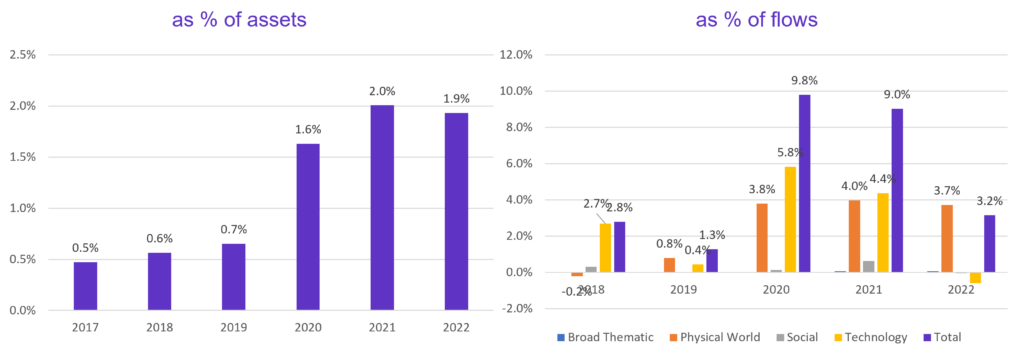

Thematic index funds represent 2% of equity index fund assets, a still limited number. Yet This represents a quadrupling in 5 years from 0.6% in 2018. And flows towards those funds continue to be sustained despite a slowdown in technology thematic index fund flows due to market conditions. Flows towards environmental thematic (Physical World) index funds consistently represented 3% of all equity index funds flows for the past 3 years. Additionally, as stated in the previous paragraph, worth noticing that in 2022, index funds represent 48% of all flows towards thematic funds vs 10% on average between 2018 and 2021.

Thematic index funds relative to equity index fund

Thematic investings: Winners and losers in 2022

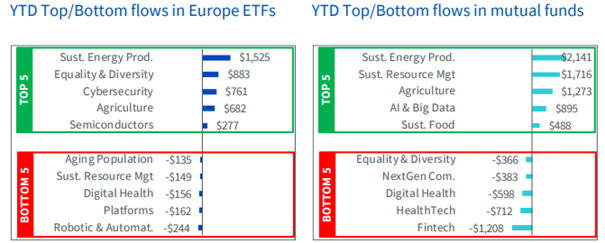

In terms of sub-theme in 2022 and using the thematic classification of WisdomTree, flows have clearly revolved around “green” themes. In total, sustainable energy production and sustainable resource management have collected the most flows. The themes of technological change continue to suffer outflows, except cybersecurity and AI & Big Data. See latest WisdomTree quarterly thematic update for more details.

Winning themes and losers in terms of flows in 2022

The challenge of thematic investing for fund selectors

The consequences of the lack of nomenclature standards are so important that it significantly impacts the selection universe and therefore allocation decisions. Information as simple as the size or flows of the universe of thematic investments largely dependent on this nomenclature, is already a challenge for the fund selector.

A second consequence of the lack of nomenclature standards and the variety of the offer is to make it difficult to compare the different strategies and accentuate the difficulty of optimal selection. This highlights the need to build an appropriate approach that goes beyond nomenclature. See on this topic our article : “Thematic investing: A new fund selection methodology by BSD Investing & L’allocataire“.

Marlene Hassine Konqui & Ahmed Khelifa, CFA

Leave a Reply

You must be logged in to post a comment.