The development of sustainable index and non-index funds has been very rapid over the past three years, particularly in 2021. In the uncertain context of 2022, have investors continued to invest in sustainable funds? Did they favour sustainable index or non-index fund? Article 8, Article 9, where are the portfolios after the reclassifications? Is the increase in the assets under management of sustainable funds accompanied by a change in fund benchmarks? What lessons can be learned for portfolio construction?

Europe accounts for the bulk of the assets in sustainable funds worldwide

In a context of a sharp market decline and sustainable fund underperformance, ESG funds’ assets under management decreased by -37% compared to the end of 2021 to reach €2 trillion at the end of December 2022 and represent 83% of sustainable fund assets under management worldwide.

In Europe, flows to sustainable funds remained positive in 2022

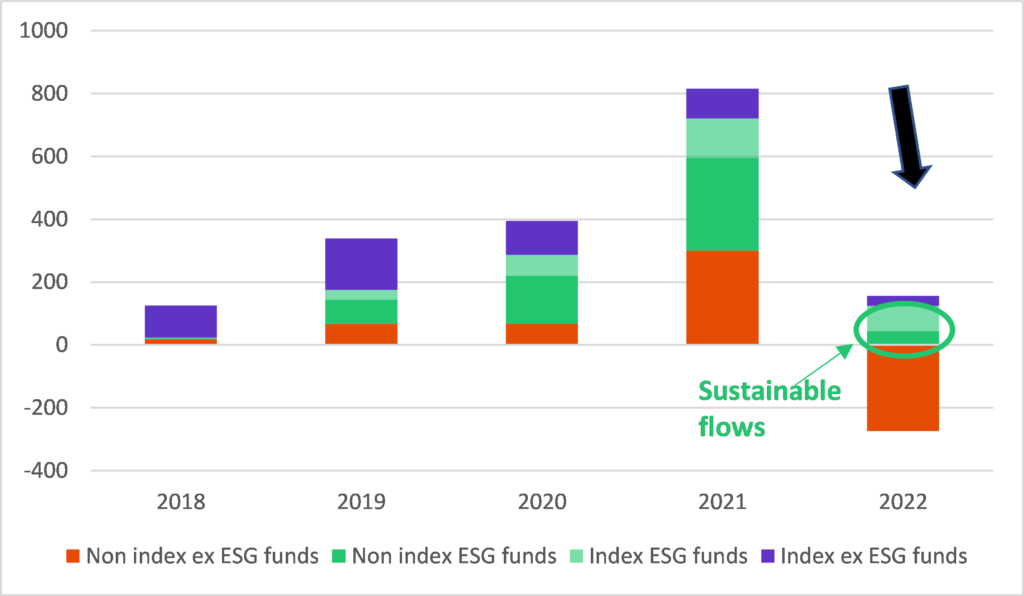

While flows worldwide declined significantly, in Europe, flows to sustainable funds remained positive with €124billion of net inflows. This is not the case in the United States, where flows to sustainable funds recorded only €1bn of inflows, a pause after the record year of 2021.

Flows to sustainable index funds were higher than to non-index funds

Flows to sustainable index funds exceeded flows to sustainable non-index funds respectively €80bn vs. €44bn.

Flows to sustainable index fund represented 70% of total flows to index fund.

Concerning non-index funds while flows in 2022 were negative, flows to non-index sustainable fund remained positive.

Annual flows to index and non-index funds in Europe

Differences in flows according to asset classes

Equity sustainable index funds gathered two third of index funds inflows. For example, inflows towards index funds on Paris Aligned Benchmark like the Franklin STOXX Europe 600 Paris Aligned Climate UCITS ETF , the Franklin S&P 500 Paris Aligned Climate UCITS ETF or the Franklin MSCI China Paris Aligned Climate UCITS ETF, represent 8% of total equity index funds.

The share of fixed income sustainable index fund flows grew from 24% in 2021 to 35% in 2022 of total sustainable index funds from all asset classes.

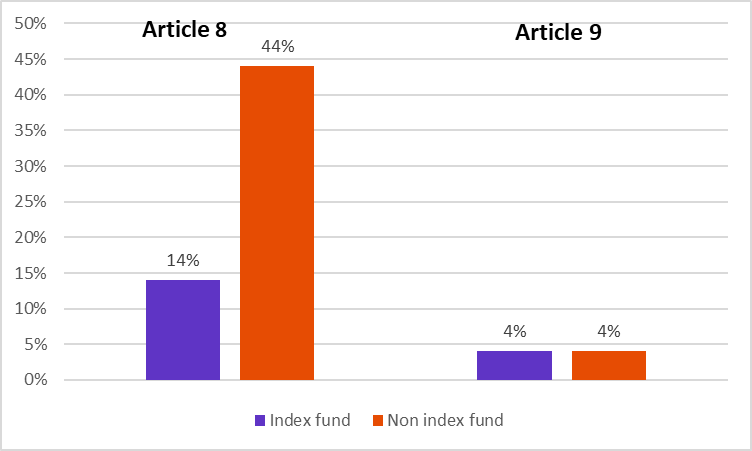

Sustainable funds: Article 8 or Article 9, where are index funds vs. non index funds?

The evolution of the regulations requires the classification of funds between Article 8 and Article 9. Article 8 funds are those that incorporate social or environmental characteristics. The so-called Article 9 funds are those with a sustainable objective such as those of climate transition including a precise decarbonization trajectory or those whose objectives are aligned with those of the Paris Agreement. At the end of December 2022, non-index fund, which has more room for manoeuvre, classified 4.4% of funds as Article 8 funds compared to 1.4% of index funds. The Franklin Global Equity SRI UCITS ETF is an example of those article 8 index funds. The gap is smaller for Article 9, which represents 4% of non index funds and 4% of index funds.

% of assets of index and non-index funds classified Article 8 or 9

Is the increase in the assets of sustainable funds accompanied by a change in fund benchmarks?

The answer differs depending on the management style. Almost all sustainable index funds track ESG indices. This is not the case in non index-funds, where only 2% of funds have a sustainable benchmark. Each management style therefore has a different answer to this problem. The question raised is that of the role of sustainable indices as a vector to help achieve sustainable goals. The answer is obviously not clear-cut. MSCI’s constructive proposal to introduce the notion of double benchmarking or “parallel benchmarking” could represent an alternative to be considered to optimize portfolio management while preserving visibility on outperformance compared to traditional indices weighted by market capitalizations. This approach also helps to improve transparency on the sustainability objective and also on the tracking of progress towards the achievement of these objectives. Click here to read the full article with a particular focus on climate.

What lessons can be learned for portfolio construction?

It is interesting to note that in this crisis phase, flows to index and non-index sustainable funds continue to be positive, confirming the structural rotation towards sustainable portfolios. Those developments point out the need to highlight the new challenges that ESG investments arise in order to build efficient portfolios and to bring new solutions to overcome those challenges. Discover here Ahmed Khélifa, cfa article on the topic.

Marlene Hassine Konqui

Leave a Reply

You must be logged in to post a comment.