The year 2022 has been a difficult year for fixed income funds both in terms of flows and performances due to the central bank regime shift and interest rates hikes. Are fund performances improving at the start of 2023? Is there a trend reversal in flows since the end of 2022? Which of index or non-indexed funds are favoured by investors in this asset class?

Panorama of fund performances

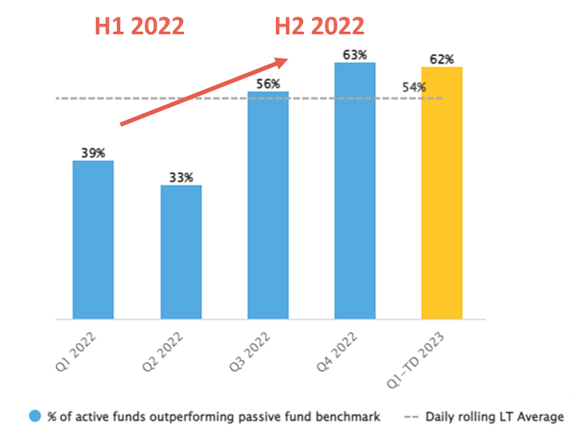

For the full year 2022, 43% of fixed income active managers outperformed passive management. This figure masks a contrasting situation throughout the year. In the first half of the year, in a context of geopolitical crisis and an uncertain economic environment, few active managers managed to outperform passive management, on average 36% over the first two quarters. In the second half of the year, in the wake of the Fed’s policy change and the rebound in the market, there was a significant improvement in the performance of active management as shown in the graph below with an average of 60% of active managers outperforming passive management over the two quarters.

In 2023 (until the end of February), the improvement continues to be sustained with 62% of active managers outperforming passive funds. In nearly all universes (US & Euro high Yield, Euro Govies, Global Corporate bonds Euro hedged, Global Bond Euro & US Investment grade bonds) more than 50% of active managers outperformed passive funds. After one of the most challenging environments for fixed income since the 1970s, active managers benefited from their ability to move along the inverted yield curve and adapt the duration of their portfolios.

Quarterly % of fixed income active funds outperforming passive funds

Even Active ETFs such as those of Franklin Templeton : Franklin Euro Green Bond UCITS ETF, Franklin Euro Short Maturity UCITS ETF, Franklin USD Investment Grade Corporate Bond UCITS ETF are showing those improvements in performances.

Fixed income fund flows: record outflows in 2022

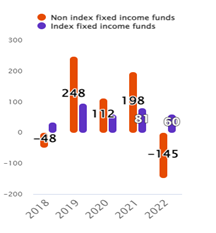

In a context of spiking inflation and the response from central banks, fixed income funds saw record outflows of €85bn in 2022. Those outflows mainly came from active funds (€145bn) while index funds continue to enjoy €60bn of net inflows. In a period of uncertainties and significant volatility, investors tend to favor passive funds for their reactivity and liquidity.

Yearly Fixed Income active/passive fund flows (€bn)

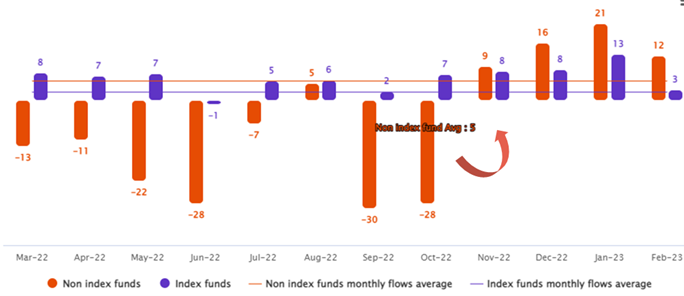

A trend reversal in non-index net inflows in 2023?

In the wake of the market rebound since November 2022, with expectations of an end to FED hawkish policy and end of interest rates hikes, and higher yields, fixed income non index fund flows experienced a trend reversal with €58bn of net inflows (until the end of February 2023). Flows toward index funds continued their trend with €32bn of inflows during the same period.

Fixed Income Monthly flows (€bn)

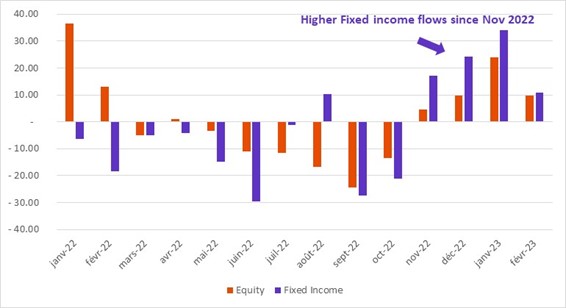

A preference of investors toward bond vs equity?

Equity vs Fixed income index & non index fund flows

In current context, investors seem to favor fixed income over equity, with fixed income flows overall doubling equity flows since November 2022 (until February): respectively €48bn vs €86bn. This may appear counter intuitive, due to the highly volatility experienced by the bond market and to high interest rates uncertainty; Yet as explained by Stephen Dover, CFA, Chief Investment Strategist, Head of Franklin Templeton Institute in his article “Quick Thoughts: Is normal really what we want?” and also by Ahmed Khelifa in his article “Bond Market Volatility hits 5 years’ time high: What impact on interest rates curve?”, this reflects the fact that investors are expecting Yield curve normalization in the coming months which may lead to bonds overperformance on absolute and risk adjusted bases relative to equity markets.

Marlene Hassine Konqui

Leave a Reply

You must be logged in to post a comment.