Filters

Active fund vs ETF in 2021: Who is the winner?

What should we remember from 2021 active fund vs ETF performance to improve portfolio performance?

Active Funds vs ETFs: where did the flows in Europe go in January 2022?

Have investors favoured active management or ETFs to invest in bear markets? Have they changed their preference between active management and ETFs at the beginning of 2022 to invest in sustainable funds? What can we learn from these flows to improve portfolio construction?

Active fund vs ETF flows: who is the winner in 2021?

Have investors favored active funds or ETFs in 2021? Do they prefer active funds or ETFs to invest in sustainable funds? What about flows to traditional funds?

Interview Sphere : Le rôle du big data dans l’allocation entre gestion active et gestion passive

Découvrez l’interview de Marlene Hassine Konqui pour aider les investisseurs à construire des portefeuilles plus performants.

Marlene Hassine Konqui interview Citywire

Discover the new interview with Marlene Hassine Konqui by Citywire on BSD Investing, her role in helping investors know which […]

Data revolution, for an efficient use of statistics

For data revolution to also impact the allocation decision between active management and ETFs, investors should access up-to-date and quality data & analysis

What successful factor strategy in current environment ? By Franklin Templeton

As seen in BSD Investing year to date flows analysis, after years of lower interest, Smart Beta strategies have regained […]

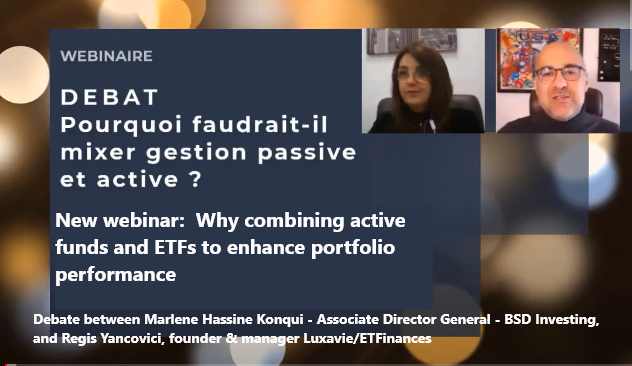

Latest webinar: Why choosing between active funds and ETFs

Marlene Hassine Konqui latest webinar on the topic showing the interest of combining active funds with ETF to enhance portfolio performance. (You can active english subtitles to view the translation)

ETF / Active management: between myths and reality

Marlène Hassine Konqui, member of the SFAF ETF commission , discusses the myths in this debate, which prevent optimal investment decisions from being made.

Does combining active management and ETFs improve portfolio performance?

Is asset allocation the only crucial choice to build optimal portfolios? Can we prove that combining active funds and ETFs within portfolios improves performance? Are there any solutions on how to combine active management and ETFs?