Filters

Event Active-Passive Management, Behind the Scenes of Selection

How do asset allocators and fund selectors Integrate financial innovations especially ESG strategies into fund selection and allocation (active ETFs, […]

Newsletter The ESG Break – Q2 2024 ESG funds quarterly update for institutional investors

Click here to subscribe to our newsletter – Thursday 16 May 2024 – The ESG Break – […]

Climate and ESG Strategies: The Performance Gap

2023 wasn’t the best year for ESG ETFs. How do we explain the performance gaps between ESG indices and traditional […]

Newsletter: 2024, Saving Private Assets?

Click here to subscribe to our newsletter – Thursday 29 February 2024 – 2024, Saving Private Assets? […]

Saving Private Assets

The explosive growth of private markets has been one of the most significant developments in capital markets in the last […]

Newsletter Macro Realities: 2024 a leap in the dark

Click here to subscribe to our newsletter – Tuesday 30 January 2024 – Macro Realities: 2024 a […]

2024: A Leap in the Dark

The year 2023 was marked by surprising events on both the economic and geopolitical fronts. Setting aside unpredictable armed conflicts, […]

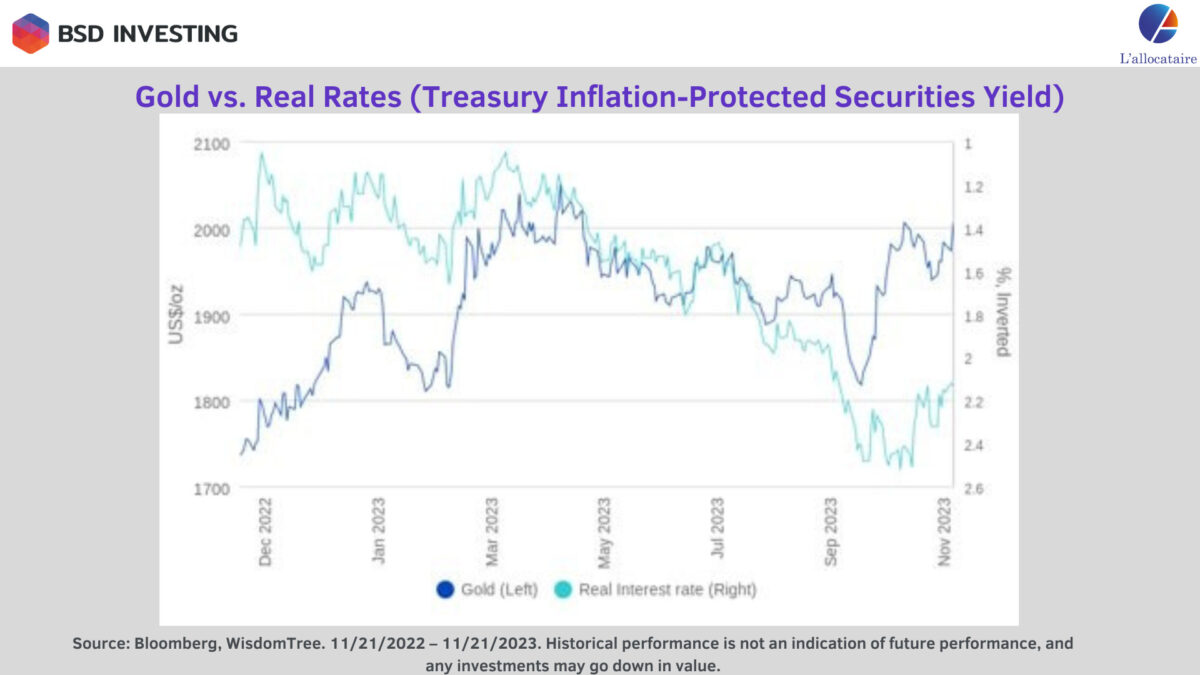

Portfolio Construction: When uncertainty Feeds Gold

How far will Gold price go? Gold is testing the $2K resistance, driven by geopolitical uncertainty, recession fears, and central […]

Newsletter: Gold Q1 2024: rising above and beyond

Click here to subscribe to our newsletter – Thursday 14 December 2023 – Gold Q1 2024: rising […]

Newsletter: The Crypto Comeback- Q4 2023 Quarterly update for institutional investors

Click here to subscribe to our newsletter – Thursday 23 November 2023 – Q4 2023 Crypto Room: […]