Have investors favoured active management or ETFs to invest in emerging equity markets since the beginning of the year? How have active funds vs. ETFs performed in this segment? How to improve portfolio construction?

A regular and optimal analysis of the performance and flows of active and passive management in Europe, carried out from BSD Investing’s proprietary database* and Morningstar’s data, helps to answer these questions. A new look in the world of portfolio management.

What are investors doing at the beginning of 2022?

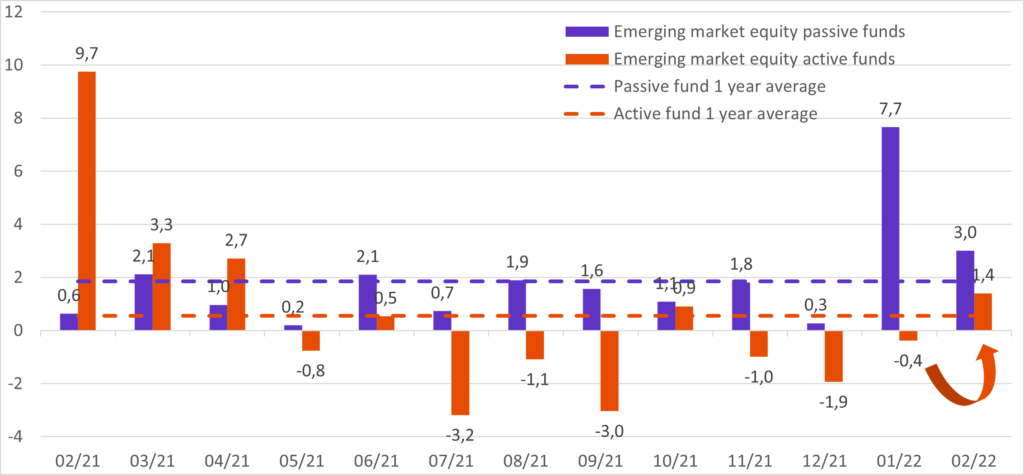

Over the months of January and February 2022, funds domiciled in Europe, on the equity markets of emerging countries recorded a rebound in inflows with 11.9 billion euros of inflows. Almost all these flows were directed to traditional funds and not sustainable funds, unlike flows across all other segments. Passive funds were the main beneficiaries of this rebound, with €10.7 billion in inflows since the beginning of 2022. However, it is interesting to note that after almost six months of outflows, inflows to emerging equity active funds rebounded in February to 1.4 billion of euros(1).

Monthly flows to active and passive emerging market equity funds

ddd

What was the performance of emerging market equity funds over the past 10 years?

Over the long term, emerging market equity markets have been rather favourable to active funds. Over 10 years, taking into account all the active funds that have existed in the category over the entire period and comparing their performance with the ETFs each over their respective lifetimes, 54% of active funds outperform passive funds. When we no longer look at the number of managers who outperform, but the amount of outperformance, the photo is even more favorable to active funds with a positive outperformance between active and passive funds, 71% of the time.

What is the performance of emerging market equity funds at the beginning of the year?

Since the beginning of 2022, the performance of active managers has been declining. Over the period, the environment is more favourable to passive funds: only 37% of active funds outperformed passive funds. This level is close to the 10-year low reached in the first two months of 2015, a year marked by the slowdown in the Chinese economy. In 2021, over the same period, 60% of active funds outperformed passive funds. In addition, the annual outperformance spread of active versus passive funds, calculated daily since the beginning of the year, is negative all the time. However, there is an increase in the dispersion of the results of active funds, which could be synonymous with a future improvement in the performance of active funds (2).

What to remember to improve portfolio construction?

Despite the acceleration of the decline in emerging markets in February in the context of geopolitical uncertainties related to the war in Ukraine, the decline remains less in the first two months of the year than in developed markets. Investors seem to be trying to reposition themselves rather tactically in these emerging markets. Once the exclusion of Russia from the MSCI Emerging Markets Index on March 9, 2022 (about 3% of the index) has passed, the analysis of flows, particularly to active funds in this area, will confirm whether this is a more sustainable trend change. To be continued.

Accurate and regular monitoring of flows and performances between active and passive funds provides an accurate picture of what is outperforming and thus allows to make more efficient allocation decisions.

(1) flow data as of 28/2/2022. (2) Performance data as of 18/2/22022. Sources: BSD Investing & Morningstar.

Marlene Hassine Konqui

Leave a Reply

You must be logged in to post a comment.