Did investors continue to focus on active management or ETFs for sustainable investments in the first quarter of 2022? Article 8 or 9 sustainable funds: where are the assets of ETFs vs active funds? Is the increase of sustainable fund assets accompanied by a change in fund benchmarks?

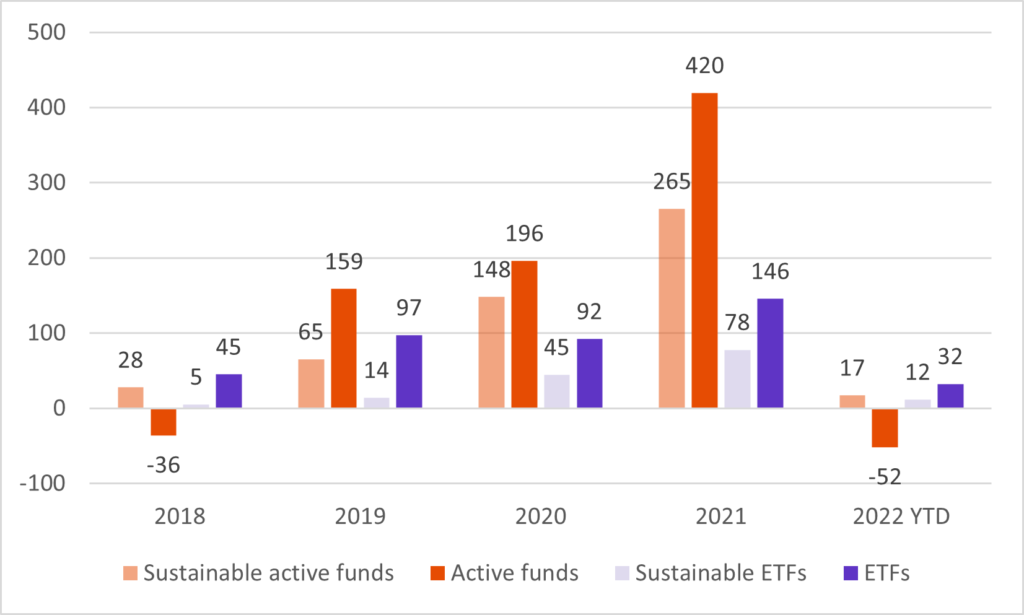

Flows to sustainable active funds vs. ETFs remained positive in the first quarter of 2022

Flows to active funds slightly outperform those to ETFs, respectively €17 billion versus €12 billion. This contrasts sharply with total flows where passive management clearly dominates and continues to raise €32 billion in a context of a geopolitical crisis. Active management, on the other hand, saw strong outflows at 52 billion euros. They are mainly due to massive outflows from fixed income funds of €44 billion. Active management was impacted by the consequences of the geopolitical crisis on the evolution of rates, spreads and inflation.

Flows to active funds and equity and bond ETFs

Differences in flows according to sustainable objectives

Flows toward funds incorporating ESG criteria accounted for two-thirds of ETF inflows and just over half of those to active funds in the first quarter. Impact funds captured a third of ETF flows and just under half of those to active funds in the first quarter. The use of active management is therefore balanced between ESG and impact funds. Rather, flows to ETFs are mainly directed towards funds incorporating ESG criteria.

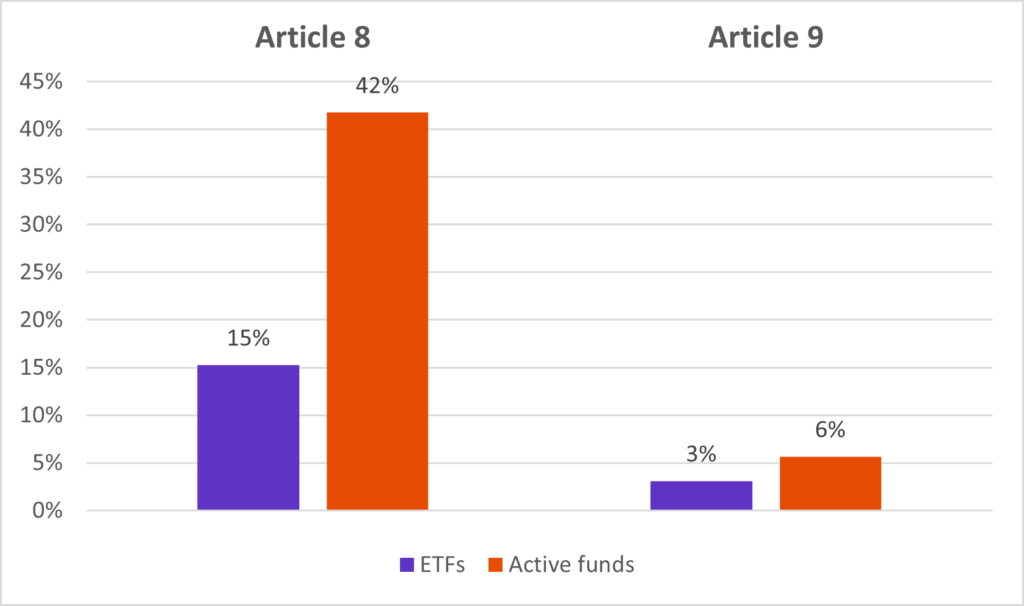

Article 8 or 9 sustainable funds: where are the assets of ETFs vs active funds?

Changes in the regulations require the classification of funds between Article 8 and Article 9. Article 8 funds are those that incorporate social or environmental characteristics. The so-called Article 9 funds are those with a sustainable objective such as those of climate transition including a precise decarbonization trajectory or those whose objectives are aligned with those of the Paris Agreement. At the end of March 2022, active management, which has more room for maneuver, classified 42% of funds (equities and bonds) as Article 8 funds compared to 15% of ETFs. The gap is smaller for Article 9 which represents 6% of active funds and 3% of ETFs. Index switches to ESG benchmarks should therefore continue within ETFs.

Active fund vs ETF assets classified article 8 or 9

Is the sustainable assets’ increase accompanied by a change in fund benchmarks?

The answer differs depending on the management style. Almost all sustainable ETFs replicate sustainable indices. This is not the case in active management where only 2% of funds have a sustainable benchmark. Each management style, therefore, has a different answer to this problem. The question raised is the role of sustainable indices as a vehicle to help achieve sustainable goals. The answer is obviously not clear-cut.

What are the lessons to be learned for portfolio construction?

Interestingly, in this crisis phase, only flows to active sustainable funds and ETFs continue to be positive, confirming the more structural rotation towards sustainable portfolios. Tracking the distribution of flows according to sustainable objectives allows to have a more precise idea of the specific use of each management style to achieve sustainable objectives.

(1) flow data as of 3/31/2022. Sources: BSD Investing & Morningstar.

Marlene Hassine Konqui

Leave a Reply

You must be logged in to post a comment.