Did investors favour active management or ETFs on Eurozone equities in March 2022? How have active funds vs. ETFs performed in this segment? What impact for portfolio construction?

Massive outflows from Eurozone equity funds

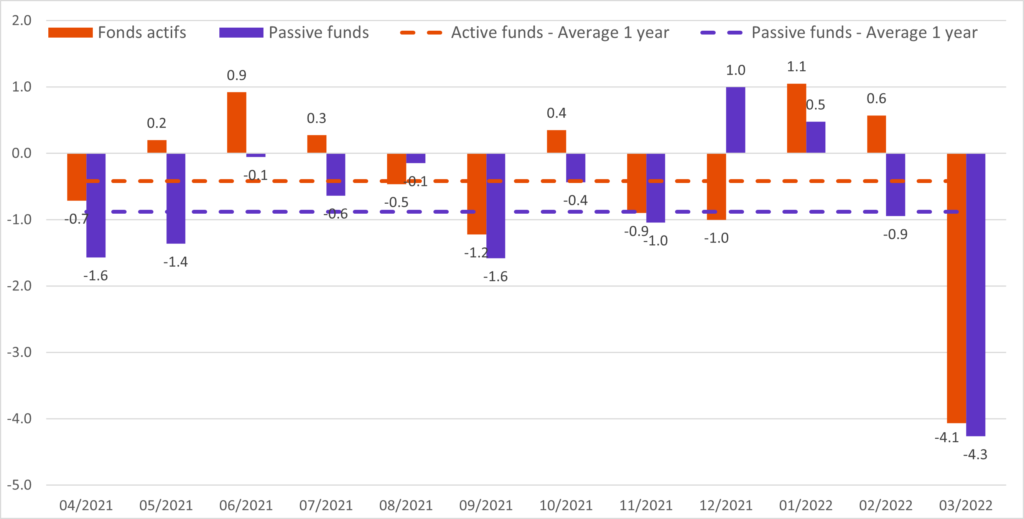

In March 2022, against a backdrop of a rebound in the equity market, Eurozone equity funds experienced massive outflows. Unlike the previous 2 months, these outflows affect both active and passive funds. However, since the beginning of the year, the outflows of passive funds remain half those of active funds: respectively -2.4 billion euros against -4.7 billion euros(1).

Monthly flows to active and passive Eurozone equity funds

Eurozone large-cap equity funds were the most impacted by outflows

Large-cap equity funds were the most impacted by these outflows. €3.2 billion in outflows from passive funds and €2.8 billion from active funds. The mid-cap equity segment also saw outflows of €300 million from active funds and €500 million from passive funds. Conversely, flows to small-cap stocks have been much more stable across both active and passive funds.

Improved performance of Eurozone equity active funds vs. ETFs since the beginning of 2022

Since the beginning of 2022, in a volatile context, the performance of active managers in Eurozone equities has been on the rise: 48% manage to outperform their passive counterparts. This is the second-highest level, observed over the first three months of the year, for 5 years. Active managers benefited until February 2022 from an overexposure to small-cap stocks that outperformed large and mid-cap stocks in the market decline. This overexposure was reduced in March 2022, allowing active managers to benefit from the market recovery. This improvement in relative performance is to be put in perspective of a year 2021 that had been particularly favorable to passive managers, with only 16% of active managers who had managed to outperform passive funds. 2015 holds the record for active managers, with 69% of active funds outperforming passive funds. But on average over 10 years, it has been difficult in this segment for active management to outperform passive funds, with 28% of active funds on average per year outperforming passive funds over 10 years(2).

What are the lessons to be learned for portfolio construction?

Unlike the previous month, equity funds, both active and passive, were impacted almost equally by outflows. It is interesting to note that after having held up well in the market downturn, passive funds in this area were finally largely impacted by outflows despite the market recovery in March.

The improvement in the performance of active managers at the beginning of the year is to be put into perspective in this segment where for the last 10 years passive management dominates. To be followed to see if this is confirmed in the coming months.

Accurate and regular monitoring of flows and performance between active and passive funds provides a clear picture of what investors are doing in different market phases and segments, and which may be different from conventional wisdom. This is essential for making more effective allocation decisions.

(1) Flow data as of 31/3/2022, (2)performance data as of 25/3/2022. Sources: BSD Investing & Morningstar.

Marlene Hassine Konqui

Leave a Reply

You must be logged in to post a comment.