Did investors prefer active management or ETFs in February 2022? In which geographical areas or strategies have the flows been concentrated? What impact for portfolio construction?

Flows to Active Funds vs ETFs: February overview

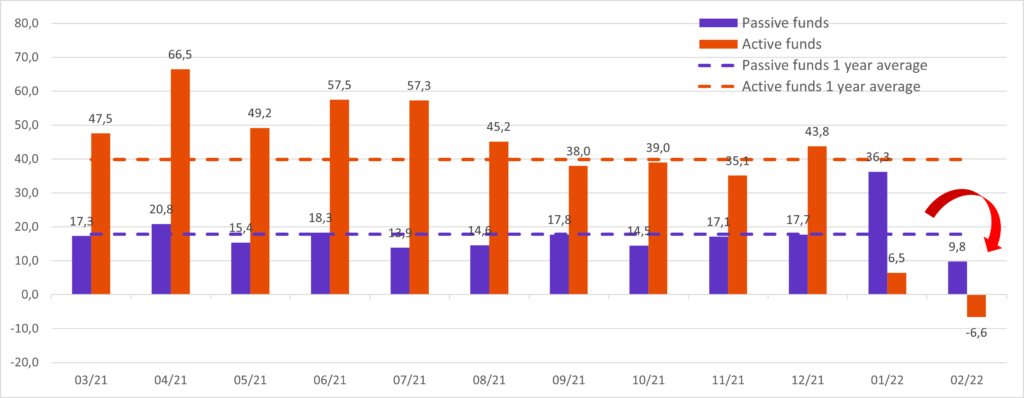

Flows in February 2022 were down sharply compared to the previous month, given the uncertainties related to the current geopolitical situation. Total monthly flows remained positive but only reached €3bn, compared to €60bn on average over the last 12 months. However, this figure hides a sharp contrast between active and passive management. Active management recorded outflows for the first time in 12 months, mainly due to significant flows out of fixed income strategies and despite continuous albeit smaller inflows into ESG equity funds. Flows into passive strategies remained positive at €9.8bn, supported by inflows into equity funds (1).

Monthly flows to funds domiciled in Europe active and passive

Sustainable funds: a major support for active flows in February…

Even though flows into ESG funds were down compared to previous months, they still reached €14.4bn. It is worth highlighting that in February, funds domiciled in Europe only recorded positive total inflows as a category thanks to ESG inflows.

Contrary to the general trend, a majority (58%) of ESG flows went into active strategies and most active allocations went into equity strategies (nearly €7bn). Passive ESG management attracted flows in both stocks and fixed income strategies.

…as opposed to traditional equity and fixed income flows dominated by passive funds

Fixed income funds were severely impacted by the current crisis, recording €18.7bn of outflows over the month. Active funds were hit the hardest with nearly €20bn in outflows while passive funds had a small but positive inflow of €1bn.

Looking at equity funds, even if inflows have halved compared to the previous month, the majority of assets were allocated to passive strategies: 60% of the €11bn collected in February.

The ‘flight to quality’ continued in fixed income

The strong outflows from active allocations in this segment impacted all fixed income strategies. The global bond and developed country bonds categories were the worst affected with nearly -€9bn, -€8bn of outflows respectively. High-quality and high-yield bonds were also impacted, recording -€4.5bn and -€3.5bn each.

Only European and US government bond strategies, both active and passive, saw inflows, playing their role as safe havens: €3.1bn for passive management, including €2.2bn in Treasuries, €2.3bn in euro area government bonds for active management.

Equity funds: important geographical differences

Looking at active equity funds, assets mainly came out of vehicles focused on Europe and the US with outflows of respectively €6bn and €2bn. Global and EM funds continued to raise assets, with €7bn of inflows in World, €4bn in ACWI and €1.5bn on EM equity focused strategies.

For passive equity funds, unlike active management, funds focused on developed countries raised assets, including on Europe. Only allocations to funds focused on Japan and ACWI have been reduced.

What lessons for portfolio construction

It is interesting to note that in this period of crisis, investors have made a clear decision to reduce their exposure to active strategies. In February, outflows were mainly centered on fixed income strategies, impacted by fears of rising rates and a return to inflation. Only flows into sustainable strategies, mainly into active equity funds, remained substantial, confirming the more structural rotation towards larger ESG portfolios.

Accurate and regular monitoring of flows between active and passive funds provides a clear picture of what investors are doing in different market phases. This is essential for making more effective allocation decisions.

(1) flow data as of 28/2/2022. Sources: BSD Investing & Morningstar.

Marlene Hassine Konqui

Leave a Reply

You must be logged in to post a comment.