How to analyse what investors have done during this turbulent semester in the financial markets? Did they prefer active management or passive management? Is this a harbinger of a change in trend, or just a temporary rebalancing after two years marked by the Covid 19 pandemic?

A sharp decline in flows

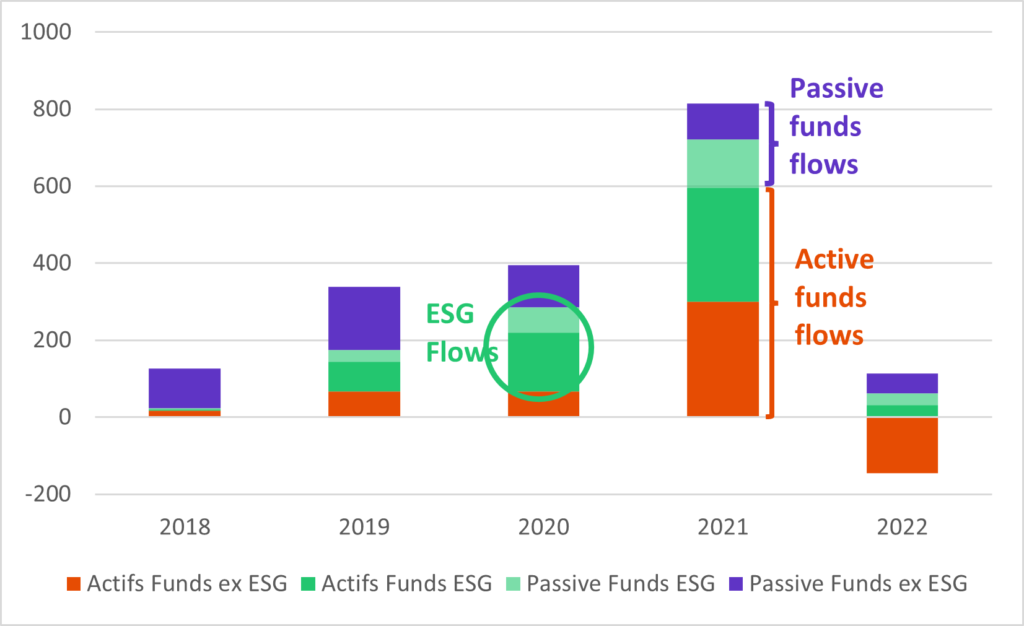

In this context of geopolitical crisis and uncertainties about the evolution of the economy, fund market flows posted total outflows of €32 billion. Passive management is resisting with €80 billion in inflows compared to €113 billion of outflows for active management in the first semester.

Annual flows on mutual funds domiciled in Europe since 2018

Source: BSD Investing, Morningstar from 1/1/2018 to 30/6/2022

ESG funds did well

Flows towards sustainable investments continued to be positive with a total of €62 billion, 52% of which is for active management. Despite the underperformance of sustainable funds, particularly due to their underweight in the energy sector, which performed strongly in the first half of the year, investor interest for sustainable funds continued to be sustained, reflecting once again a structural evolution of portfolios.

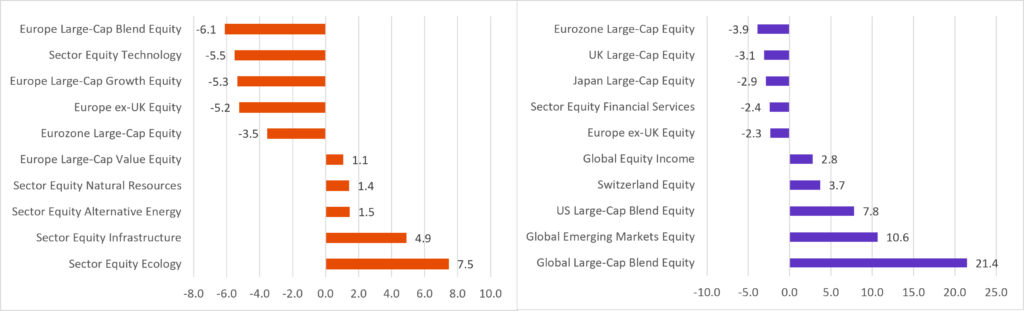

On equities, strong rotations between style and sectors

Although flows have decreased significantly in this segment, for active management, there was a rotation from large-cap funds in Europe and the Eurozone as well as from growth & technology funds in these regions towards value, green (alternative energy, ecology) and infrastructural segments as illustrated in the graph below. For passive management, flows were mainly concentrated in US Emerging, and Global Equities (MSCI ACWI).

Top 5 category equity fund inflows and outflows in H1 2022

Active Management Passive Management

Source: BSD Investing, Morningstar from 1/1/2022 to 06/30/2022

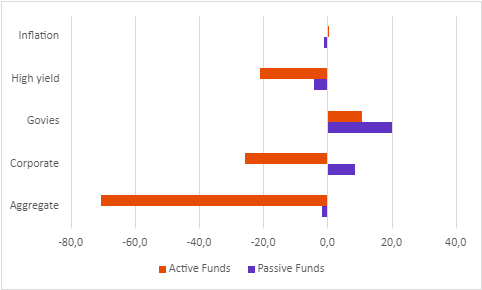

Massive bond fund outflows

Active bond funds suffered most of the €107 billion outflow after 3 years of very strong inflows. Global funds, good-quality corporate bonds, and junk saw the strongest outflows given expectations of recession and a significant rise in corporate defaults. Active and passive funds on government bonds collected, benefiting from the fly to quality and the increase in rate differentials between regions including US vs Europe.

Flows to active and passive bond funds in H1 2022 by strategy

Source: BSD Investing, Morningstar from 1/1/2022 to 06/30/2022

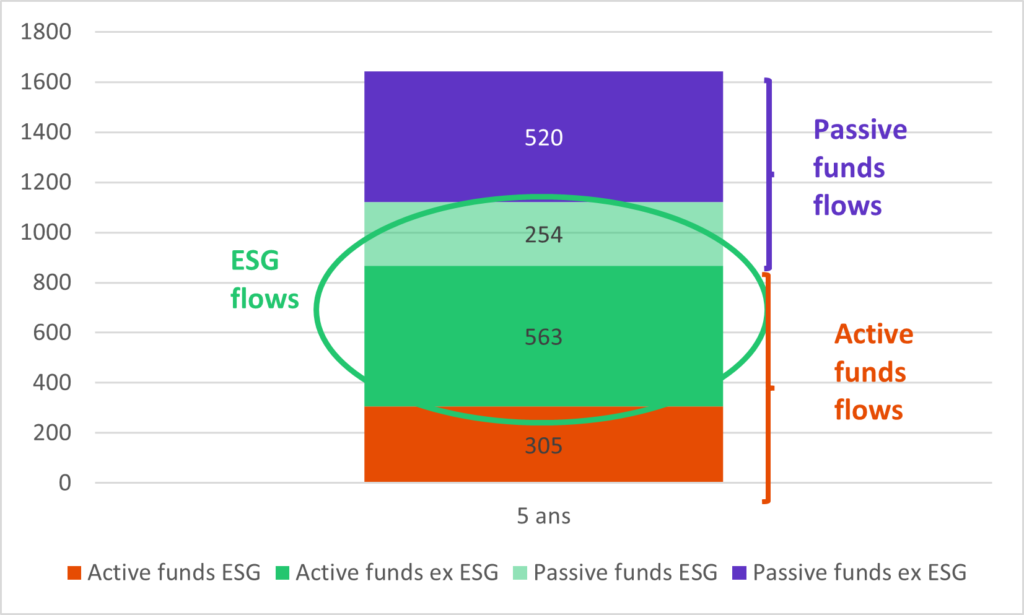

In Europe, unlike the US, long term cumulative flows remain favorable to active management

In a longer perspective, the cumulative total of flows over five years still shows an advantage for active management at €868 billion compared to €774 billion for passive management. It mainly flows to ESG management that drives these flows, 67% of flows from passive management and 63% from active management.

Cumulative flows over the last 5 years between active and passive funds

Conclusion

Despite the very high sensitivity of flows to changes in the economic and financial situation, major trends are continuing, investors’ portfolios are becoming structurally greener and passive management is asserting itself as essential alongside active management, particularly on core portfolio strategies.

Marlene Hassine Konqui

Leave a Reply

You must be logged in to post a comment.