Gold specificities make it a controversial or at least a misunderstood asset class. As a relatively niche investment, its characteristics and market price drivers are poorly understood by the market at large. The first questions investors need to answer are: Is it a commodity or a currency, a safe-heaven or an inflation hedge?

To help investors building more efficient portfolio, we detailed below what are the best economic and financial market conditions to invest in Gold based on the following articles based on academic research and major gold Asset Managers market insights (Invesco, WisdomTree).

Dollar Hedge? Not so perfect

One factor that separates gold from other precious metals is that there are large above-ground stocks which can easily be mobilised. As a result of gold’s liquidity, it often acts more like a currency than a commodity. But unlike most currencies, its supply cannot be increased at the click of a few buttons following a monetary policy meeting. As such, it has a historical “super-haven” status. While central banks may expand their monetary base in the face of economic turbulence, gold cannot be debased in the same way. This typically makes gold an excellent hedge against geopolitical and financial market turbulence. However, on its own, central bank balance sheet expansion has failed to keep gold prices higher. In the post-COVID-19 period, inflation has risen, but gold has faced other headwinds making it difficult to observe a permanent effect of balance sheet expansion on gold. So this argument should not be considered alone when considering to include gold into an asset allocation.

Safe-haven status? Short but powerful effect

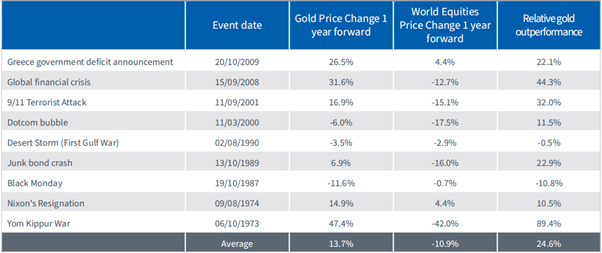

Gold is also viewed as a ‘safe-haven’ asset, meaning that during periods of economic uncertainty or heightened geopolitical risk, investors have historically turned to the precious metal for protection, pushing its price up. As such, gold can act as a form of ‘portfolio insurance’ and help provide downside protection during market turmoil. WisdomTree analysis shows that when the Geopolitical Risk (GPR Index) has risen 2 standard deviations above its historic average (indicating heightened geopolitical tension), gold has risen 6.1% on average, while the S&P 500 Equity Index has fallen 7.4% in those months. Figure 1 shows how gold has performed after a range of key financial and geopolitical events (access WisdomTree full study).

Gold’s performance after financial and geopolitical events

and Equities are based on the S&P 500 Index. Past performance is not a reliable indicator of future returns.

The shocks that send equity prices lower can often trigger a rise in the gold price, as investors rush to buy into the safe-haven aspect of the metal. For example, during the Global Financial Crisis, the price of gold rose to its highest level in 30 years while stock markets plummeted. Several months after the COVID-19 pandemic started, gold reached a new high surpassing US $2000/oz for the first time on 5th August 2020 (source: Bloomberg). As such, gold is often considered a ‘defensive’ asset, and is typically used by investors as a hedge against financial system risk, extreme events and market turbulence.

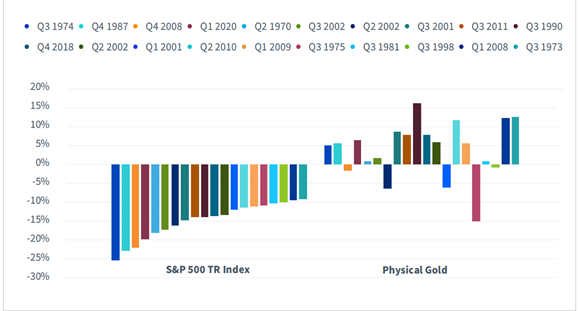

If we look at the worst 20 quarters of equity performance since 1968, gold has outperformed equities in 19 of them. Moreover, gold has had a positive return in 15 of those quarters. In fact, on average, gold has outperformed equities by 18.5% in those 20 quarters.

Gold performance vs S&P 500 during the 20 worst quarters for S&P 500

It remains though a challenging exercise to predict market turmoil episodes which makes a tactical exposure to gold only as a hedge from geopolitical and financial crisis quite tricky especially that Gold can be volatile, in some years the metal has posted close to 30% gains (2010), while in other years it has posted close to 30% losses (2013).

Inflation hedge? A central bank affair

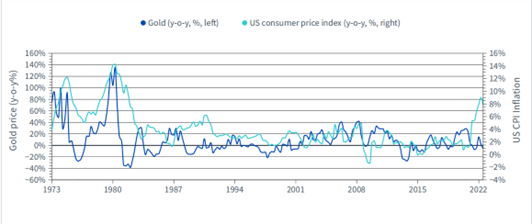

Since 1971, gold has returned an average of 15% per annum when inflation has been above 3%, compared to a 6% annual return when inflation has been below 3%1. Of course, the answer is not so simple. Gold tends to be less desirable by investors when inflation pressures come from demand “pulling” prices higher, as the market prices in an expectation that central banks, particularly the Federal Reserve, will control rising costs through conventional monetary policy. A strong US Dollar and rising bond yields – both often accompany rising interest rates – are also generally seen as headwinds to gold because the former makes it more expensive for non-US buyers and the latter increases the opportunity cost of holding non-yielding assets such as gold. A well-documented downside of gold is that the asset does not generate any cash flows. Therefore, unlike other asset classes such as equities, bonds and property, it does not pay investors any income. This means that for investors to profit from gold, its price must increase. However, in an age when other defensive assets like government bonds were providing negative yield-to-maturities, gold’s zero yield was looking very attractive (access Invesco full study).

However, when inflation is “pushed” higher, for instance from a sudden unexpected event or crisis, gold tends to be a more effective hedge. We saw this in the 70’s when oil prices spiked, and wage growth and other inflation pressures meant simply raising interest rates was less effective (access WisdomTree full study).

Gold price vs inflation between 1971 to 2022

Past performance is not a reliable indicator of future returns.

More than inflation dynamics, it seems that gold performance during inflation periods depends on central bank’s response. When central banks policy leads to higher real bond rates, gold underperforms.

Gold sweet spot: If you had a crystal ball

A thriving environment for gold would be an environment of:

- economic uncertainty and important geopolitical risks

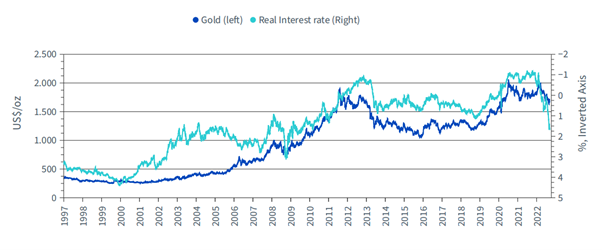

- negative real bond yields: (access WisdomTree full study)

Gold vs real rates (Treasury inflation protected securities yield)

Past performance is not a reliable indicator of future returns.

- stagflation: It’s worth highlighting that the greatest real returns for gold have been during times of stagflation (access Invesco full study).

Gold vs other asset classes returns in different macro regimes

Such an environment is unlikely to occur often and geopolitical or financial crises are hard to predict. The coronavirus-driven performance that has helped gold to its highest level ever in August 2020 could not have been predicted. This means that it is hard to be invested in gold during crisis without being invested in gold on a longer-term basis.

Marlene Hassine Konqui & Ahmed Khelifa, CFA

Leave a Reply

You must be logged in to post a comment.