Ahmed Khelifa, cfa, and Marlene Hassine Konqui explore this key topic, based on prominent academic research (namely CFA Institute research foundation) and market insights (from Invesco and Hashdex), looking at the definition of an asset class, and the set-up of a framework to determine whether an asset can be considered an asset class. They answer the following questions: Do assets within the crypto assets show a similar behavior to market events? Does the asset class add diversification to a portfolio? Do crypto assets have the capacity to absorb a meaningful proportion of an investor’s portfolio? What are the available investable vehicles to a European asset allocator?

How to assess whether crypto assets can be considered an asset class?

Asserting whether crypto assets can be considered as an asset class or not could be a quite perilous enterprise given its incomparable volatility levels

Greer (1997) defines an asset class as “a set of assets that bear some fundamental economic similarities to each other, and that have characteristics that make them distinct from other assets that are not part of that class.” Additionally, CFA Institute build a framework of five criteria that will help in effectively specifying asset classes for the purpose of asset allocation. The framework mainly consists in looking at the homogeneousness of the asset class, its diversifying potential, and the liquidity and transaction cost. Additionally, it checks if the assets are mutually exclusive and if they cover the majority of all possible investable assets. We will focus on the 3 first points today.

Do assets within the crypto asset class show the same behavior to market events ?

To be considered an asset class, assets inside the asset class should be relatively homogeneous, i.e. they should have similar attributes from a descriptive as well as a statistical perspective

Crypto assets are clearly different from all other assets relative to the disruptive technology they use (blockchain) but also to a whole new revenue and business model they created. Blockchain, smart contracts (programmable money) and NFTs have created a new paradigm and are disrupting various domain among which the finance industry with the advent of Defi (decentralised finance). Their indisputable added value also requires new fundamental approaches specific to crypto assets that traditional finance can’t capture. We will come back to that in a coming paper. Yet today we will start with analyzing correlations inside crypto assets.

Similarities in correlations levels between individual crypto assets (intra asset correlation) may be a good indicator of whether it is a homogeneous asset class and have a similar statistical behaviour to market events.

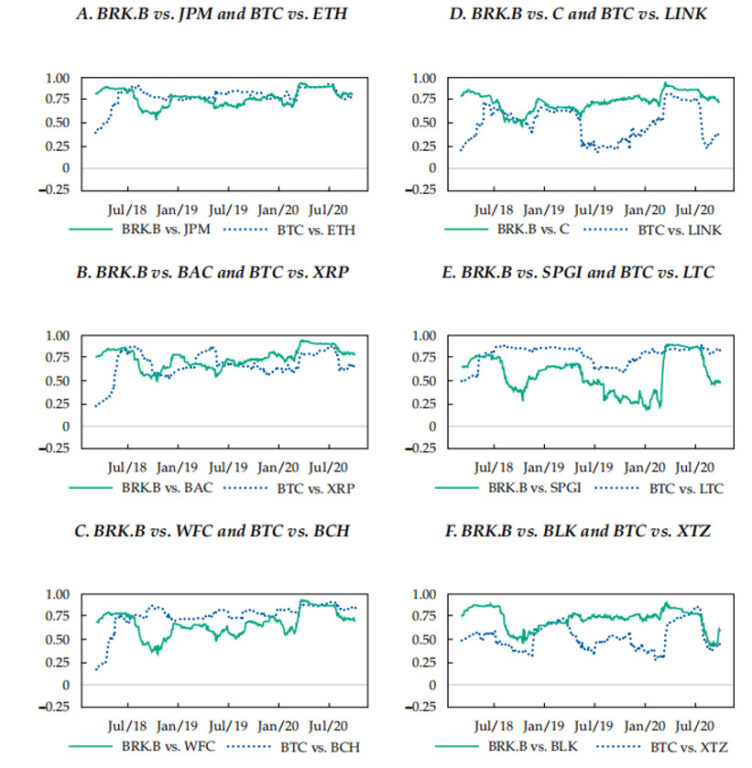

According to Matt Hougan and David Lawant (Cryptoassets the guide to bitcoin, blockchain and cryptocurrency for investment professionals, CFA Institute Research Foundation 2021, CFA Institute Research Foundation 2021), individual cryptoassets have historically exhibited correlations that are akin to the correlations exhibited by individual equities within the same market sector. The charts in Figure below compare the correlations (on a 90-day rolling basis) of bitcoin (the largest cryptoasset) with the next nine largest cryptoassets and of Berkshire Hathaway (the largest financial stock by market capitalization) with the next nine largest financial stocks held by the largest financials ETF, the Financial Select Sector SPDR Fund.

High correlation levels between crypto assets suggest that they react in a same way to market regime changes and their technological and business model specificities suggest that they are indeed a homogeneous asset class.

Correlations between Bitcoin and top crypto assets vs top 10 S&P 500 stocks since 2017

Does the asset class add diversification to a portfolio?

To be considered an asset class, it should be diversifying and should not have extremely high expected correlations with other asset classes or with a linear combination of other asset classes.

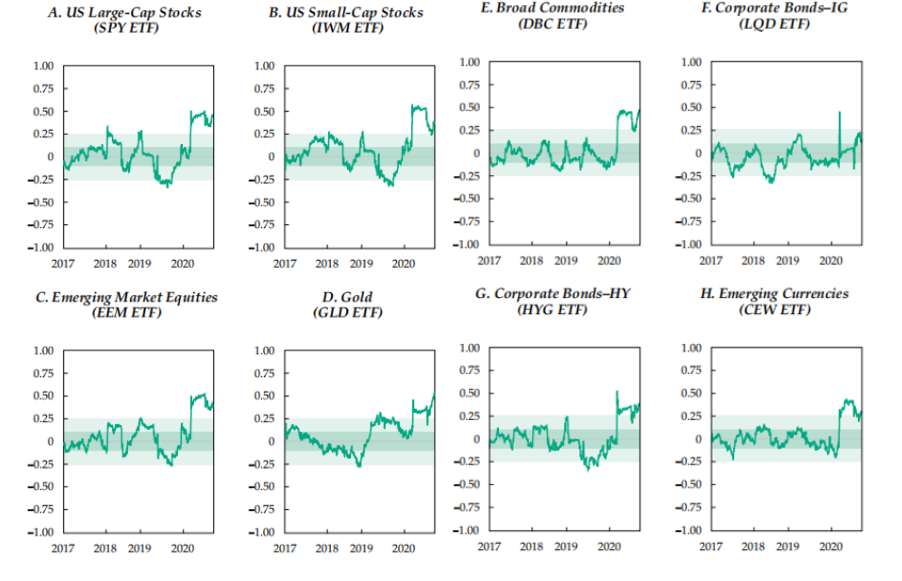

Correlations of bitcoin with other asset classes have historically been low, as shown in the following charts measuring 90-day rolling correlations between bitcoin and major risky asset classes (equities, commodities, bonds) since 2017. Even during market crisis, they remain at low level, showing their interest in terms of diversification. In fact, the graphs show that they did increase, during the coronavirus-related market crisis in the spring of 2020 and after central banks monetary policy started rate hikes, though they generally remained below 0.5 (with a resulting R2 of 0.25 or less). Apart from these periods, the correlations are small to negligle i.e. inside the light green band highlighting small correlation levels between –0.25 & 0.25, and the dark green band highlighting negligible correlation levels between –0.10 & 0.10.

Correlation between bitcoin and other major risky asset classes

For an asset class to be a good diversifier, it also should enhance portfolio’s risk-return.

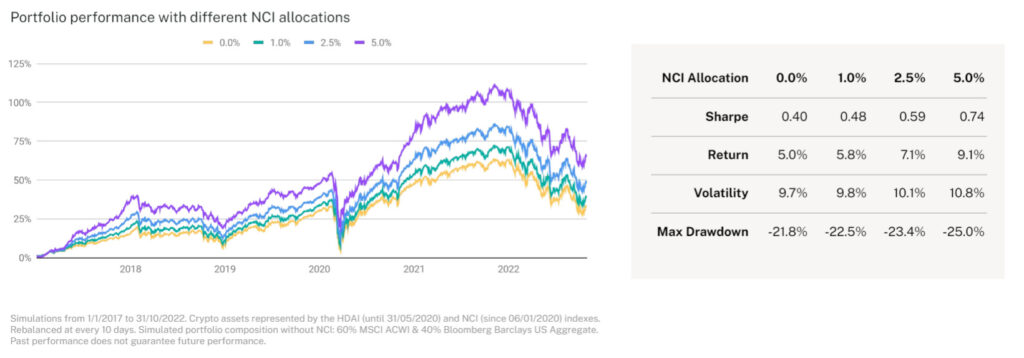

The following figure shows how a modest allocation to a diversified crypto index can significantly improve the risk adjusted return of a traditional 60-40 portfolio. For example, adding only 2.5% of a diversified crypto index to a 60-40 rebalanced portfolio improves its Sharpe ratio by almost 50% and this includes 2022 market decline until end of October. Thus, for an over 5 years period, a consistent 2.1% excess return is added to the portfolio total return while it only adds 0.4% volatility. Click here to access the full study.

Portfolio simulation including crypto assets

Differences between correlations within crypto assets and between crypto assets and other asset classes combined to the fact that crypto assets pushes up the efficient frontier in portfolio construction validates the second point of the CFA Institute framework to consider crypto as an asset class.

Do crypto assets have the capacity to absorb a meaningful proportion of an investor’s portfolio ?

Focus on liquidity and transaction costs

To be considered an asset class, the asset should contain a large percentage of liquid assets. Liquidity and transaction costs should be favourable for an investment.

We compared the Crypto Assets market cap (end of October 2022) first to the largest equity Index (MSCI ACWI IMI) covering approximately 99% of the global equity investment opportunity set then to MSCI Emerging Market capitalization. We found that Crypto assets already represent 13% of equity emerging markets cap and 1.3% of all equity investable market. More details about the full investable universe for European asset allocators by clicking here.

An interesting paper of Invesco analyses crypto market structure and shows the incredible investment that has occurred in crypto infrastructure—including the development of regulated custodians, the launch of regulated futures contracts but also the volumes settled and locked into the various blockchains. This led to reduced transaction costs and a market that can absorb relatively important transaction volumes.

Click here to access the full report

To the question of whether crypto can be defined as an asset class regarding the CFA institute framework, the answer is yes. Crypto assets tick all the needed boxes. However, investors should not neglect new risks that come with this new asset class. Even if blockchain technology is considered safe, software bugs can lead to considerable amounts of losses and crypto fundamental analysis is still nascent. Additionally, the current crash, which has some hints of the subprime crisis, is even raising fears of important contagion effects. Yet even traditional asset classes experienced crashes on financial markets, which, at the end, have proven to be beneficial in terms of regulations, liquidity management and processes.

Now that we’ve demonstrated that Crypto can be considered as a new asset class, let’s see what are the different ways or financial instruments that give access to it.

What are the available investable vehicles to a European asset allocator?

Thematic Blockchain ETFs:

Even if these instruments are equity ETFs and can’t be considered, strictly speaking, as belonging to crypto asset class (considering that an asset can’t belong to more than an asset class at a time), they give an exposure to the most valuable aspect of crypto assets -its blockchain disruptive technology. They usually include listed companies that either use blockchain technology in their processes or have a minimum turnover generated from it. These instruments combine benefits of potential blockchain adoption to low stock market volatility relative to crypto.

These instruments also avoid crypto custody and fraud problems. One of the most liquid instruments in Europe is the Invesco CoinShares Global Blockchain UCITS.

Single asset ETPs:

These can be either ETPs, ETCs or ETNs and offer direct exposure to a single crypto asset such as Bitcoin. These are good instruments for buy and hold investors, but represent a bet on a single crypto. Investors need to be confident on the potential and future adoption of the specific asset.

Providers of these instruments can be historical financial Asset Managers such as Invesco, WisdomTree.

Index and Factor ETPs:

These instruments offer an exposure to a diversified basket of crypto assets avoiding making a bet on a single blockchain or application. More about these strategies in the following article.

Marlene Hassine Konqui & Ahmed Khelifa, CFA

Leave a Reply

You must be logged in to post a comment.