Have investors favoured factor or sector strategies in this chaotic context? What is the place of Smart Beta in investors’ portfolios? Has the turbulent economic and financial context of 2022 called into question investors’ appetite for sustainable investing? What happened in August on the flows?

Marlene Hassine Konqui, a member of the SFAF ETF Committee, analyzes 2022 flows to index and non-index funds, using BSD Investing’s proprietary database and Morningstar data to make fair comparisons and make optimal investment decisions.

A return to grace of Smart Beta

In Europe, while Smart Beta’s strategies represent only 5% of the assets under funds of index funds, they total 12% of inflows (according to Morningstar’s classification), or €9 billion since the beginning of the year. These strategies collect 17% of flows to equity index funds, 70% of which toward dividend strategies and the rest toward value and risk-oriented strategies. For comparison, Smart Beta’s strategies accounted for 7% of flows in 2021.

In the United States, Smart Beta strategies represent 15% of outstanding index funds and 28% of inflows in 2022, almost twice as much as in 2021 when Smart Beta accounted for 15% of flows. This is a record over the last 5 years. Note that 46% of flows to US equities in 2022 are flows to Smart Beta index funds. This figure is to be compared with 31% in 2021. In 2022, 50% of smart beta flows went towards dividend strategies, 16% towards the Value factor and 15% towards the Growth factor.

Sector strategies favored

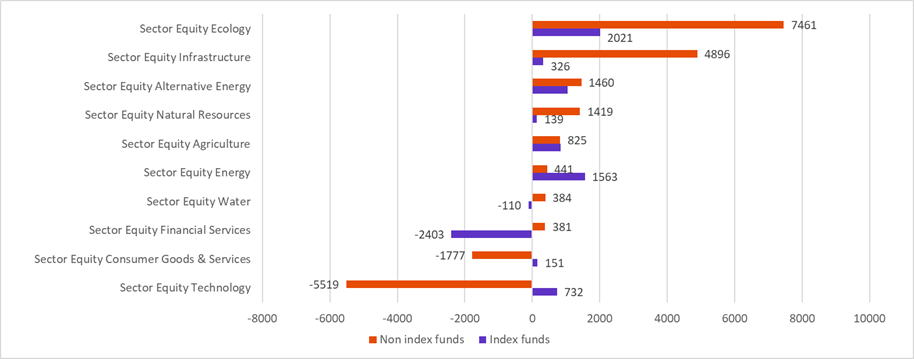

While the flows on index and non-index equity funds totaled less than €20 billion since the beginning of the year, flows toward sector funds have reached €16 billion. 66% of these flows are towards non-index funds, 25% towards index funds. Non-index sector funds recorded inflows of €10billion, while non-index equity funds saw outflows of €35 billion over the year. In this segment, investors have favoured the Ecology, Infrastructure and Alternative Energy sectors this year to the detriment of funds in the technology and consumer goods sectors, which recorded outflows. The flows of index sector funds represent 11% of the total flows. In this segment, outflows of funds from the financial sector and inflows into the energy sector are to be noted. They reflect more tactical positions taken by investors thanks to index funds in a context of rising rates and energy prices.

Flows to sector funds (M€)

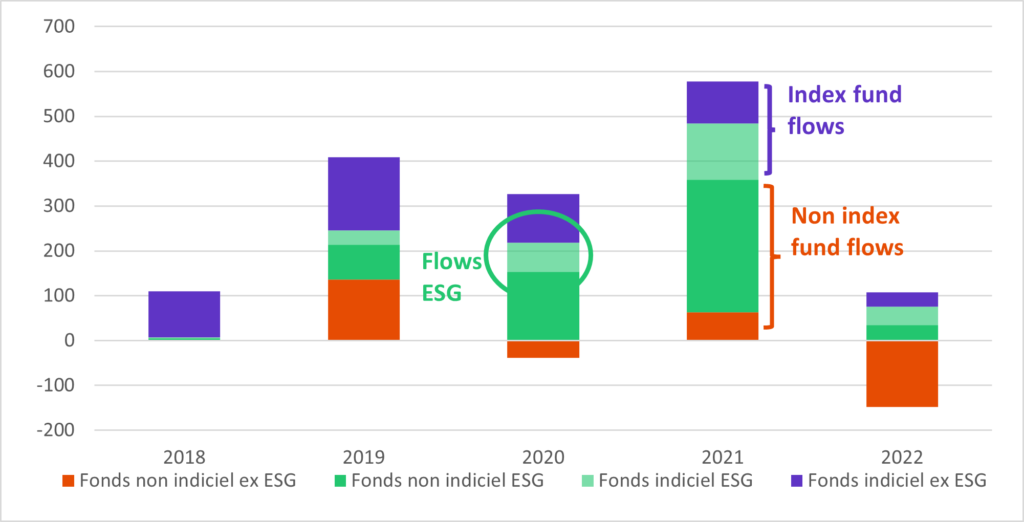

Over the year, in a context of sharp decline in flows, the attraction for ESG mainly in non-index funds and index funds continues

In this context of geopolitical crisis and uncertainties about the evolution of the economy, on the fund market, flows have posted outflows of €40 billion since the beginning of the year. Index funds are doing well with €73 billion in inflows compared to €113 billion of outflows for non-index funds since the beginning of the year. ESG flows totaled €75 billion in inflows over the same period, in both index and non-index funds. The performance of these funds was supported by the rebound in growth stocks this summer. However, as the analysis of long-term flows reveals, investors’ interest in responsible investment reflects structural changes in portfolios. The cumulative total of flows over five years still shows an advantage for sustainable non-index funds at €565 billion, compared to €265 billion for index funds.

Flows to funds domiciled in Europe (€ billion)

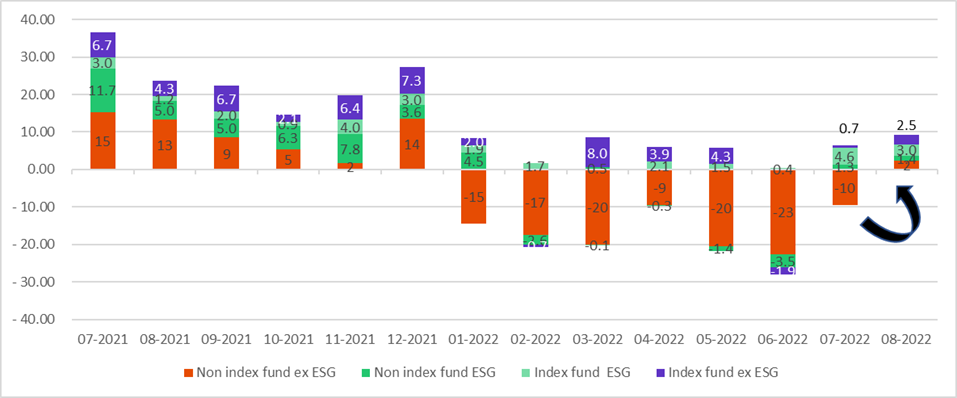

Total flows continue their negative trend in August 2022 despite the rebound in bond fund inflows

Flows to index funds were flat in August. Flows to non-index funds continued to be negative by €8 billion.

After 7 months of outflow from non-index bond funds, we witnessed a reversal in August, with the first month of positive inflows. In total, in August, non-index funds raised €4billion and index funds €6billion. These investments were supported by an easing of bond yields and expectations of smaller rate hikes, at least in the first half of the month.

Equity funds continued to see outflows in both non-index and index funds of €13 billion and €5 billion respectively. The rebound of the market and then the reversal at the end of August have led to a number of tactical reallocations.

Monthly flows on bond domiciled in Europe

Despite the very high sensitivity of flows to changes in the economic and financial situation and the tactical reallocations that we witnessed this summer, major trends continue, investors’ portfolios are becoming structurally more responsible and index funds are asserting itself as essential alongside non index funds, particularly on core portfolio strategies. In addition, due to current environment, factor and sector strategies are visibly regaining investor interest. Do these strategies deliver performance? Is it better to invest in sectors or factors? So many questions, key to portfolio construction that Ahmed Khélifa, CFA answers in the next article of our newsletter.

Marlene Hassine Konqui

Leave a Reply

You must be logged in to post a comment.