Thematic funds have attracted investors’ interests due to their unique ability to tap into human’s innate need for stories. Is this interest still strong at the beginning of 2023? How to select the right thematic? How to rank thematic funds without the limitation of current lack of nomenclature standardisation? Discover, exclusively in this newsletter, BSD Investing latest thematic leaderboards that rank both active and passive thematic funds with a special focus on Global thematic funds.

Investors’ interest toward thematic funds: A rotation in Q1 2023

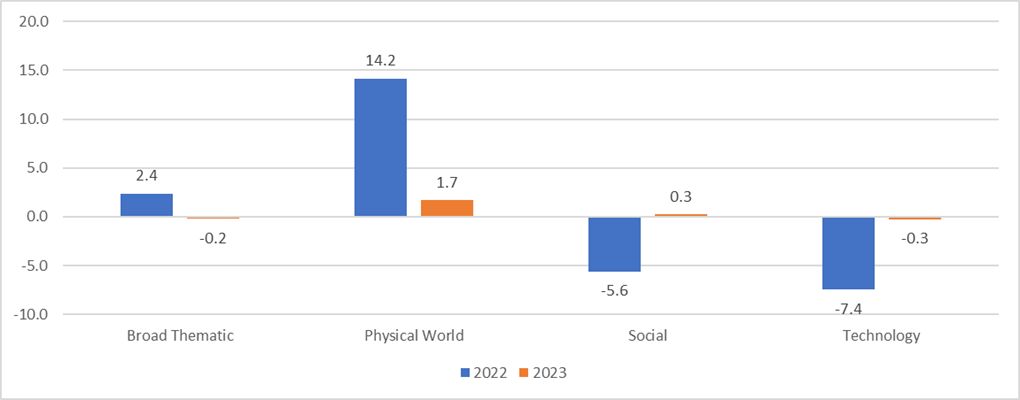

Flows toward thematic funds in Q1 2023 continue to be sustained, with already half of total 2022 flows gathered: 2.1bn€ in QI 2023 vs 4.1bn€ in 2022. Going into details, Q1 2023 inflows indicate a trend reversal with the end of technology funds outflows. Artificial intelligence funds and future mobility funds are starting to see some inflows. On the other side, a deep slowdown of flows of physical funds is observed. Those funds (mainly energy transition funds) are suffering from market expectations of a pivot in central banks monetary policies favouring growth stocks. See on the topic Ahmed Khelifa article: Thematic rotations : A new indicator of investors expectations?

European domiciled thematic fund flows in 2022 & Q1 2023

Are thematic ETFs passive strategies?

David Easley, & Al gives a definition of activeness of an ETF in their paper «The Active World of Passive Investing» (Review of Finance, 2021). They assert that the ETFs replicating a benchmark that departs from the market (active in function) and/or those choosing holdings that depart from the chosen benchmark (active in form) are two different ways to actively manage a portfolio. In fact, ETFs can play a role in active fund management in two ways:

Either the ETF’s holdings are themselves actively managed by the ETF issuer with the objective of delivering an excess risk-adjusted return, what they term “active in form,”

Or the ETF is designed to track a narrow segment of the market (e.g., a sector) and so can be used by active investors as an efficient way to place a bet on a particular exposure, what they term “active in function.”

According to ESMA, in the “Cost & Performance report 2022”, ETFs adopting these two types of strategies are referred to as active ETFs. This is particularly the case for factor and smart beta ETFs. By extension, this also applies to thematic investment strategies which provide exposure to a specific segment of the market.

A new methodology to select thematic funds

Therefore, in our methodology, those ETFs that do not follow a traditional passive benchmark (Sector, Factor, ESG, Thematic..) are included in active fund universes and compared to passive funds following a broader traditional benchmark in order to assess the relevance and suitability of the strategy. The choice of the benchmark will depend on the geographic exposition of the strategy to compare those funds and group them according to their unique commonality, their initial investment universe. Read all the details about our new methodology in the following article “ Thematic investing: A new fund selection methodology by BSD Investing & L’allocataire “ disclosed in our previous thematic newsletter.

New leaderboards to ranks thematics funds

Thanks to our methodology, all funds either index or non-index can, now, be ranked together taking into account all their specificities (costs, performance, impact of stock selection either when creating the index or managing the portfolio on performance….). We have put in place two types of rankings based on BSD Investing unique proprietary database aiming at giving a fair view between active and passive fund performances.

BEST BSD INVESTING ACTIVE FUNDS: top 15 active funds showing the highest outperformance consistency vs passive funds following the same benchmark.

BEST BSD INVESTING MIXED FUNDS: top 15 active & passive funds showing the best risk adjusted historical performance.

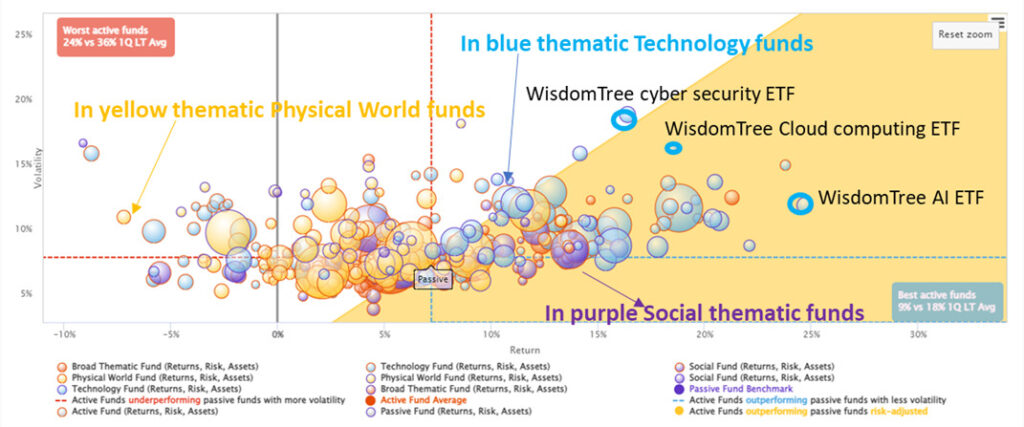

Focus on Thematic funds with a global geographic exposure

Funds with multiple geographic exposures should be compared to a broad market index with a global exposure, i.e. the MSCI ACWI index. The graphic below shows the risk return of all those index and non-index thematic funds on the MSCI ACWI exposure over the 1st quarter of 2023 (the index funds have a purple outline, the non-index funds an orange outline). Technology thematic funds (bubble filled with blue in the graph below) have clearly outperformed all other thematics in Q1 2023, while physical world thematic funds (environment) have clearly underperformed. This quarter nearly 40% of all active funds of this category have a better risk adjusted return than the MSCI ACWI Index vs 28% on average. WisdomTree Cloud Computing UCITS ETF, WisdomTree Cybersecurity UCITS ETF & WisdomTree Artificial Intelligence UCIT ETF are good examples as they show a better risk adjusted return than the benchmark over the period (in the yellow area of the graph below).

BSD Investing leaderboards currently include both funds from environment thematic on one side and on technology on the other side. For example the WisdomTree Artificial Intelligence UCITS ETF (highlighted with a strong purple outline on the graph below) is included in the BSD INVESTING BEST ACTIVE FUNDS leaderboard. To view the whole leaderboard on this thematic click on this link.

Q1 2023 active vs. passive MSCI ACWI thematic fund risk, return

The yellow area of the graph shows funds that outperformed the benchmark on a risk adjusted basis (best Sharpe Ratios).

Conclusion

The new BSD Investing & L’Allocataire methodology to compare thematic fund performances goes beyond nomenclature. It allows to avoid the consequences of the current lack of nomenclature standards in the market and the variety of the offer which make it difficult to compare the different strategies and accentuate the difficulty of optimal selection. On BSD Investing website you can access each quarter to our active & passive leaderboards to help selecting the best thematic funds.

Marlene Hassine Konqui

Leave a Reply

You must be logged in to post a comment.