Active ETFs (aiming to outperform their benchmark) have been gaining popularity since the beginning of the decade. After a particularly successful year in 2022, what is the position of active ETFs in portfolios worldwide in 2023? What trend do European portfolios follow? Flows towards traditional active management have been declining for several years, does this mean that investors have deliberately chosen to prioritize passive investments? The proliferation of new types of ETFs (active, smart beta, factor-based, thematic, ESG…) that involve active decision-making within the index has blurred the line between active and passive investments. What is the true place of active & passive strategies in investors’ portfolios?

What share do active ETFs have in portfolios worldwide?

Active ETFs (aiming to outperform their benchmark) are not new, but are gaining particular prominence, especially in the United States. In total, these active ETFs represent 6% of total ETF assets worldwide, primarily in the United States. Among bond ETFs, active ETFs account for 10% of assets. Over the past two years, there has been an acceleration of flows into this type of ETFs. At the end of the first half of this year, active ETFs accounted for 22% of global ETF flows, compared to less than 16% in 2011 and less than 4% five years ago. In terms of equities, active ETFs represent over 26% of ETF flows. This acceleration of flows confirms investors’ appetite for active ETFs and should lead to stronger weight in investors’ portfolios.

What is the trend for European portfolios?

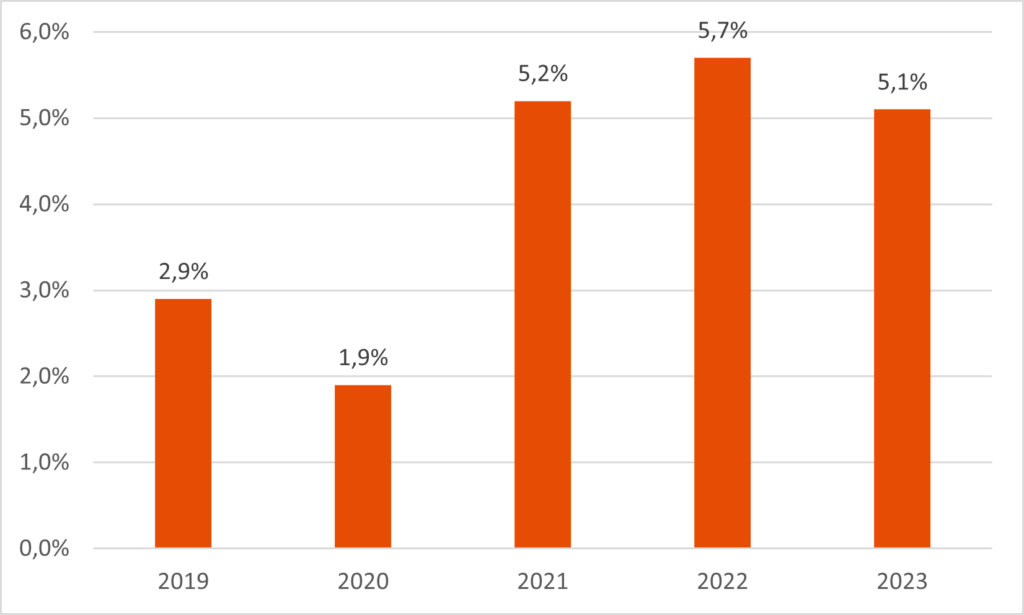

In Europe, active ETFs still represent only 2% of total ETF assets. In H1 2023, they captured nearly 5% of ETF flows, whereas they were almost non-existent in 2018, as shown in the graph below. For equities, active ETFs represent 9% of 2023 ETF flows.

Share of active ETFs in ETF flows since 2019

What is the true place of active strategies in investors’ portfolios?

As explained in Ahmed Khelifa’s article “Active ETFs in Europe: Mirage of the Best of Both Worlds or Unknown Reality? The Truth Is Elsewhere”, given the proliferation of new types of ETFs, academic research shows that there are many more active ETFs than commonly believed. In fact, it defines two types of active ETFs: those active in form (with components differing from the index) and those active in function (tracking a specific market segment or factor). In the latter case, the active investment decision lies at the index level, where the composition will differ and vary based on rebalancing, resembling more of an active investment in function. Active ETFs should thus include both types of ETFs.

If we have described the share of active ETFs in form above, what about the share of active ETFs in function within investors’ portfolios? This notably includes smart beta strategies, ESG strategies, or thematic strategies. Each of these strategies involves an active allocation decision and aims to outperform traditional indices. For confirmation, ESMA in its annual report on performance (ESMA Annual Statistical Report, Performance and Costs of EU retail Investment Products 2022) considers factor-based and sector-based strategies as active investments.

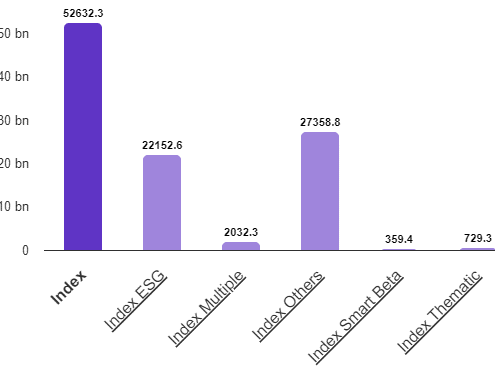

Within equity index funds, 51% of flows go to traditional passive index funds, and 49% go to ESG, smart beta, and thematic index funds, as shown in the graph below.

Flows to equity index funds – H1 2023

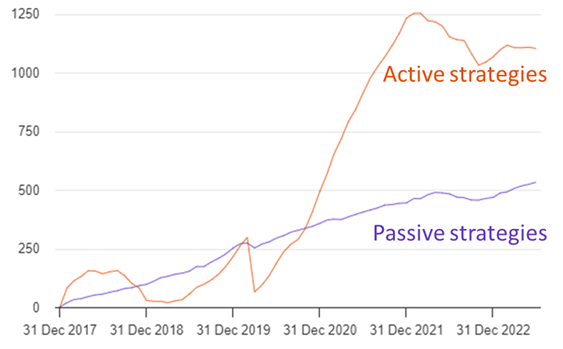

Overall, over the past five years, flows into active strategies (as defined in the preceding paragraph) represent 67% of total flows, compared to 43% when using the strict commonly accepted market definition. For equity funds, it is 69% of flows compared to 25% with the strict definition over the five-year period.

Flows to active and passive strategies in Europe over the past five years

Conclusion

The rise of active ETFs, whether in form or even in function, demonstrates investors’ appetite for active strategies aiming to outperform the benchmark. The next country to allow semi-transparent ETFs within a broader range of asset categories will benefit from this trend. Additionally, far from invalidating the role of active management, this confirms the importance of both active and passive management styles in generating performance within portfolios.

Marlene Hassine Konqui & Ahmed Khelifa, CFA

Leave a Reply

You must be logged in to post a comment.