Filters

Newsletter – BSD Investing white paper

What are the issues surrounding existing relative performance comparison calculations? What are the solutions to correct and improve the process? What is the contribution of this innovative approach and why the need to use it to build optimal portfolios?

Newsletter – Wednesday, 6th April 2022

In March 2022, against a backdrop of a rebound in the equity market, Eurozone equity funds experienced massive outflows. Unlike the previous 2 months, these outflows affect both active and passive funds. However, since the beginning of the year, the outflows of passive funds remain half those of active funds: respectively -2.4 billion euros against -4.7 billion euros (Sources: BSD investing, Morningstar 31/3/22).

Active funds vs ETFs: what is happening to European equity funds since the beginning of 2022?

Have investors favoured active management or ETFs on European equity funds at the beginning of 2022? How have active funds vs. ETFs performed in this segment? What impact for portfolio construction?

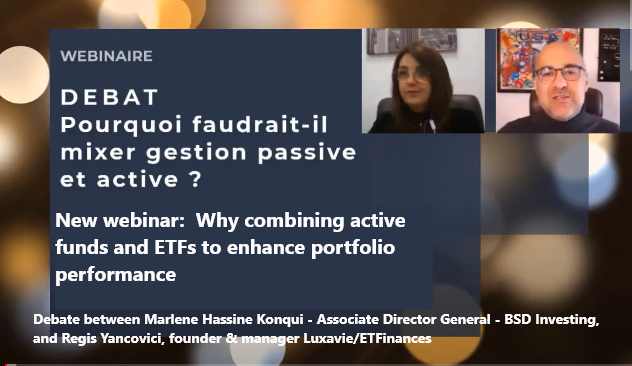

Latest webinar: Why choosing between active funds and ETFs

Marlene Hassine Konqui latest webinar on the topic showing the interest of combining active funds with ETF to enhance portfolio performance. (You can active english subtitles to view the translation)

ETF / Active management: between myths and reality

Marlène Hassine Konqui, member of the SFAF ETF commission , discusses the myths in this debate, which prevent optimal investment decisions from being made.

New elements in the active / passive fund debate

Jean Marie Catala and Arabelle Conte for AFG shared their view on the debate relying on BSD Investing research.

What role have ETFs left to active management in 2021?

What is the weight of active ETFs in the portfolios? Are investors still interested in active management? What is the role of active funds and ETFs in the portfolios?

Searching for the grail to build all-weather portfolios

Amin Rajan in the Financial Time highlights that “institutional investors have moved on by embarking on a “third way” that […]