The year 2023 was marked by surprising events on both the economic and geopolitical fronts. Setting aside unpredictable armed conflicts, the resilience of the U.S. economy and the expected rebound in China, which did not materialize, took most investors by surprise. While the consensus expected an economic slowdown, the U.S. economy maintained its impressive trajectory, driven by a robust job market and consumer spending. This made it a challenging year for stock pickers, with a vast gap between equity factor styles, resulting in the narrowest market in history, where only 25% of stocks outperformed the S&P 500 (see Equity Outlook Soft Landing Calls For Tough Choices). Navigating such a landscape and predicting the right momentum became hazardous for professional investors.

Meanwhile, investors enticed by high yields and the promise of falling rates found themselves facing borrowing costs that seemed to stay “higher for longer.”

The year 2024 begins with surprising indicators:

2024 commenced with new and unexpected economic indicators for both the U.S. and Chinese economies, setting the tone for the rest of the year. The forces at play in 2023 persist, with two identifiable ones:

- Higher Inflation

- New and extended geopolitical tensions

1. Higher Inflation:

Identifying this risk is straightforward – resilient U.S. consumption, driven by a robust employment market, combined with higher commodity prices due to extended armed conflicts, could lead to increased inflation and, consequently, higher interest rates for a longer duration.

2. A Boiling Cold War:

The other identifiable risk is the expansion of armed conflicts. China might seize the opportunity to attack Taiwan, given the U.S.’s engagement on multiple fronts. Additionally, conflicts in the Middle East are beginning to impact international trade, with cargo ships being attacked in the Red Sea. We discussed in detail how armed conflicts are inflationary in our previous macro-dedicated newsletter Macroeconomic Realities from armed conflicts to inflation.

What to Do?

In such a context, taking a bet on a single factor or a particular market could be riskier than usual. Investing in broad index markets can reduce opportunity costs. The swing from euphoria to despondence could create opportunities. The Morningstar Wide Moat Focus Index, which selects U.S. wide-moat stocks with the lowest share prices relative to Morningstar analyst estimates of fair value, could capitalize on the roller coaster effect on equity prices, as it did in 2023 (Unlearn What You Have Learned About Investing: Lessons From 2023 by Morningstar Indexes).

However, some regions may prove more resilient, particularly economies not experiencing high inflation and those able to secure oil at discounted rates from Russia and Iran, such as China and India. As we’ll see, the Indian economy, less reliant on global demand, might demonstrate better resilience compared to the Chinese economy.

India: A Safe Haven?

The Indian economy boasts several noteworthy characteristics, including its youthful demographics and, more importantly, lower integration into the global value chain and reduced dependence on global demand. Consequently, the Indian stock market could serve as a refuge for investors seeking respite from global economic challenges.

No Alternative to Equities (TINA) Persists in Japan: Embracing Inflation

While much of the world grapples with taming inflation, Japan has emerged from COVID-19 lockdowns with accelerated growth and heightened inflation. Japanese equities have outperformed expectations, surging by 27.1% in H1 2023. This can be attributed to a combination of higher equity risk premiums, a weaker yen bolstering the Japanese export market, corporate reforms, and attractive valuations.

The Bank of Japan’s loose monetary policy sets it apart from major central banks like the Fed, ECB, and BOE, which have all been raising interest rates. This policy divergence has been a key factor in the yen’s depreciation. Japanese stocks benefit from the weaker yen, relatively lower valuations, and a long-awaited resurgence of inflation.

In conclusion, adopting a hedged exposure to dividend-paying Japanese equities would be a prudent approach given the weaker yen. Historically, a weaker yen has boosted the performance of Japanese exporters, enhancing their competitive edge. The WisdomTree UCITS Japan Equity ETF EUR Hedged serves as an excellent example of a Japanese currency-hedged strategy.

Geopolitics and Gold

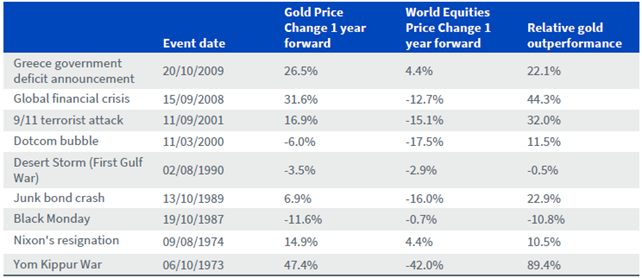

Gold is viewed as a ‘safe-haven’ asset, meaning that during periods of economic uncertainty or heightened geopolitical risk, investors historically turn to the precious metal for protection, pushing its price up. Gold can act as a form of portfolio insurance and help provide downside protection during market turmoil. A WisdomTree analysis shows that when the Geopolitical Risk (GPR Index) has risen 1 standard deviation above its historic average, gold has risen 9% year-on-year (y-o-y) on average, while the S&P 500 Equity Index has fallen 8.6% y-o-y in those months. GBSE – WisdomTree Physical Gold – EUR Daily Hedged.

We discussed this subject in detail in our previous article When Uncertainty Feeds Gold

Gold’s Performance after Financial and Geopolitical Events

What if nothing goes wrong?

Identifying risks in a portfolio construction process is key, but it doesn’t mean that these risks would materialize. We need to take into account the possibility that everything could be okay and force ourselves to adopt an optimistic view to assess what could happen in such a scenario. In a prospective scenario of continuing slowing inflation and a less restrictive monetary policy, crypto-assets would benefit the most, especially with the emergence of new financial products suited for institutional investors (Wisdomtree Physical Bitcoin ETP ). The stars may be aligning for blockchain technology and cryptocurrencies (see WHAT WORKED IN 2023 AND WHAT COULD WORK IN 2024?).

Marlene Hassine Konqui & Ahmed Khelifa, CFA

Leave a Reply

You must be logged in to post a comment.