How far will Gold price go? Gold is testing the $2K resistance, driven by geopolitical uncertainty, recession fears, and central bank pivot expectations. However, gold faces both headwinds and tailwinds, making any prediction hazardous. In the following article, we’ll enumerate some gold market drivers that could allow each investor to draw their own conclusions in line with their macroeconomic scenario.

When Gold Shines

Before delving into gold price drivers, let’s look at what happened in European investors’ portfolios:

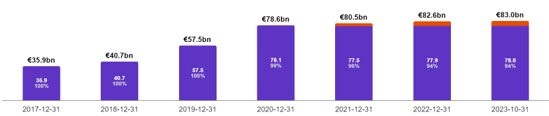

GOLD ETPs A.U.M since 2018

In 2023, flows in Gold ETPs were negative until October at a European level. However, the trend inverted due to the outbreak of armed conflicts between Hamas and Israel, pushing gold prices beyond the $2K resistance. This inversion in flows was also true at a global level.

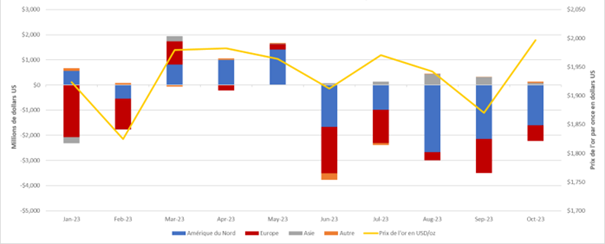

Monthly flows in USDM/ Gold ounce price in USD

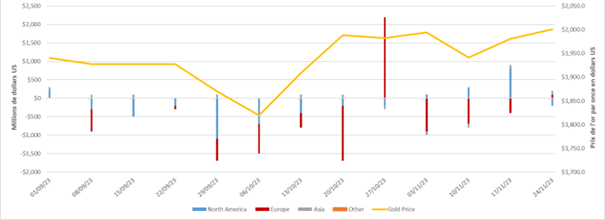

Weekly flows in USDM/ Gold ounce price in USD

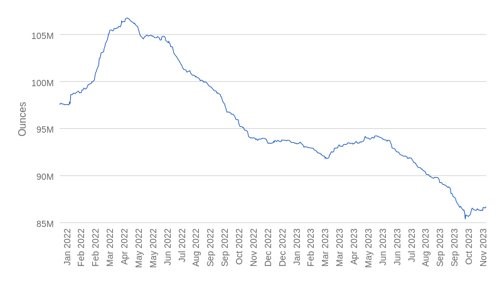

Gold in Exchange Traded Products Worldwide

What’s next for Gold?

The fight for institutional investor attention is going to be difficult when defensive assets like US Treasuries yield over 5% on the 2-year and close to 5% on the 10-year, compared to the zero-yielding asset that is gold. However, gold has proven to be a very effective hedge against financial, geopolitical, and inflationary risks.

Geopolitics and Gold

Gold is viewed as a ‘safe-haven’ asset, meaning that during periods of economic uncertainty or heightened geopolitical risk, investors historically turn to the precious metal for protection, pushing its price up. Gold can act like a form of portfolio insurance and help provide downside protection during market turmoil. A WisdomTree analysis shows that when the Geopolitical Risk (GPR Index) has risen 1 standard deviation above its historic average, gold has risen 9% year-on-year (y-o-y) on average, while the S&P 500 Equity Index has fallen 8.6% y-o-y in those months.

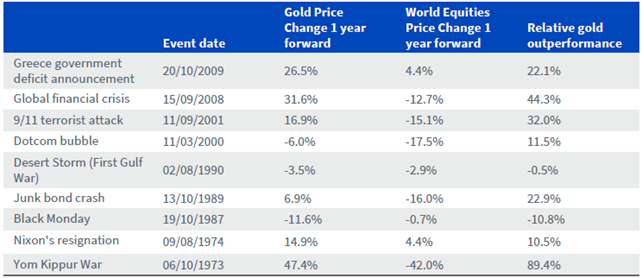

Gold’s Performance after Financial and Geopolitical Events

While we don’t know how prolonged or severe the war will be, destabilization in the Middle East serves as a reminder that geopolitical, financial, or economic stress can flare up at any moment, and the best time to have an ‘insurance asset’ is before the event takes place. Gold is thus a valuable strategic asset.

Bond Markets and Gold

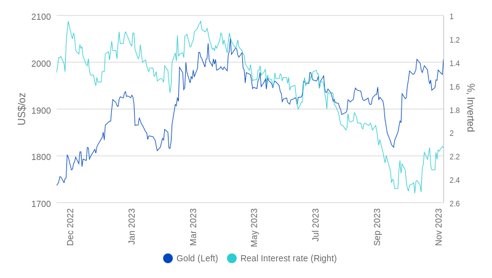

Markets are expecting a long pause after the latest rate hikes. That has driven 10-year nominal Treasury yields to the highest level since 2007 and real yields to their highest since 2008. Gold, however, is holding its own, with the yellow metal continuing to defy the historic real yield-gold relationships.

Gold vs. Real Rates (Treasury Inflation-Protected Securities Yield)

Bond yield curve inversions (10-year yields below 2-year yields) are usually predictive of recessions. Gold tends to perform strongly in recessions. The lag between an inversion and a recession can be long, usually more than a year. We are at least 15 months into the current inversion, and we are not yet in a recession. However, markets are jittery and expressing anxiety about what is to come. In recent weeks, the yield curve has become less inverted. However, that shouldn’t be interpreted as a positive sign for the economy. The very few past examples don’t offer us good insights into what that means for the economy or gold.

The outcome of the forces at play is highly uncertain, and predicting whether gold price’s current resistance would become a floor at $2K depends on various factors that we’ll try to enumerate here:

- Geopolitical risks: Not only armed conflicts in the Middle East but also U.S. and China trade relations and any other problems that could arise in a deglobalizing world.

- Inflation and real interest rates levels

- The global economic picture: Even if a recession is highly probable in Europe, the last unemployment figures in the U.S. highlighted an increase in uncertainty regarding to the U.S. economy. Even if gold performed well during recession periods, uncertainty is an even better fuel for gold prices.

Marlene Hassine Konqui & Ahmed Khelifa, CFA

Leave a Reply

You must be logged in to post a comment.