Higher for Longer:

Even prior to the outbreak of the Israeli-Palestinian conflict, markets appeared to have already embraced a “higher for longer” scenario. The Federal Reserve’s upgraded projections for growth and unemployment beyond 2023, along with heightened rate projections for 2023 and 2024, took markets by surprise. The Fed’s caution is well-founded in light of prevailing challenges such as elevated oil prices, the resumption of student loan payments, the United Auto Workers strike, and the potential for a government shutdown.

Wars are inflationary:

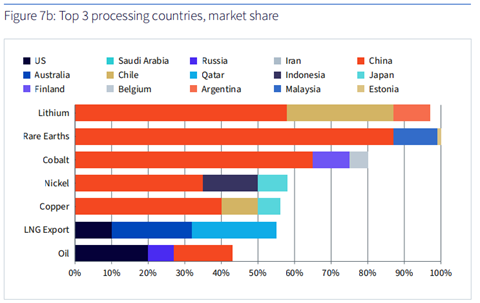

The recent conflicts in the Middle East have not yet exerted a significant impact on financial markets. However, they could potentially hasten the trend towards protectionism and deglobalization. Given China’s dominant role in processing key energy transition metals (see figure below), resource nationalization, “reshoring,” and policy measures to restrict commodity availability could impede the energy transition, rendering it more costly. This could lead to a “green arms race,” resulting in trade frictions and higher costs for critical raw materials—dubbed “greenflation” (see WisdomTree Market Outlook, October 2023).

More immediate implications may arise if conflicts extend to oil-producing countries like Iran, driving up oil prices and exacerbating an already persistent inflationary environment. Despite developed economies’ reduced dependence on oil compared to the 1973 oil crisis, the consequences could be substantial given the current high inflationary backdrop.

The European Economy and the Stagflation Threat

Some economies are more vulnerable than others, and Europe appears to be the most fragile region. Its industry, particularly in Germany, is already contending with headwinds, and private demand is heavily impacted by inflation. Germany’s export-oriented manufacturing sector is likely to face further challenges in the latter half of 2023 (see WisdomTree Market Outlook, October 2023).

Rising oil prices could pose a significant challenge to the European economy, potentially necessitating a more restrictive monetary policy with higher interest rates. This could result in lower valuations for growth stocks whereas cyclicals could suffer from lower demand due to higher inflation.

In this scenario, both cyclical and growth stock prices, as well as bond markets, could come under pressure leaving no safe heaven within European financials assets.

However, some regions may prove more resilient, particularly economies not experiencing high inflation and those able to secure oil at discounted rates from Russia and Iran, such as China and India. As we’ll see, the Indian economy, less reliant on global demand, might demonstrate better resilience compared to the Chinese economy.

India: A Safe Haven?

The Indian economy boasts several noteworthy characteristics. Firstly, its youthful demographics, but more importantly, its lower integration into the global value chain and reduced dependence on global demand. Consequently, the Indian stock market could serve as a refuge for investors seeking respite from global economic challenges.

No Alternative to Equities (TINA) Persists in Japan: Embracing Inflation

While much of the world grapples with taming inflation, Japan has emerged from COVID-19 lockdowns with accelerated growth and heightened inflation. Japanese equities have outperformed expectations, surging by 27.1% in H1 2023. This can be attributed to a combination of higher equity risk premiums, a weaker yen bolstering the Japanese export market, corporate reforms, and attractive valuations.

The Bank of Japan’s loose monetary policy sets it apart from major central banks like the Fed, ECB, and BOE, which have all been raising interest rates. This policy divergence has been a key factor in the yen’s depreciation. Japanese stocks benefit from the weaker yen, relatively lower valuations, and a long-awaited resurgence of inflation.

In conclusion, adopting a hedged exposure to dividend-paying Japanese equities would be a prudent approach given the weaker yen. Historically, a weaker yen has boosted the performance of Japanese exporters, enhancing their competitive edge. The WisdomTree UCITS Japan Equity ETF USD Hedged serves as an excellent example of a Japanese currency hedged strategy. Discover more on the best active & passive strategies on Japan equities in our latest newsletter: Q4 2023 Macro Realities: From Armed conflicts to inflation.

Marlene Hassine Konqui & Ahmed Khelifa, CFA

Leave a Reply

You must be logged in to post a comment.