As seen in our article untitled, Adding Gold to portfolio: The When?, Gold offers an attractive potential of diversification when added to a portfolio allowing to maximise risk adjusted return of the portfolio. Yet, academic research highlights a point of vigilance when investing in gold, the type of gold funds chosen is at least as important as the decision to invest in this precious metal (Gerald R. Jensen, Robert R. Johnson & Kenneth M. Washer (2018) All That’s Gold Does Not Glitter, Financial Analysts Journal).

What are the options currently available for investors to invest in Gold? What is the current size of investors’ portfolio in those products? Are all those products offering the same performances?

To help investors building more efficient portfolio, we answer those questions based on the following articles based on academic research and major gold Asset Managers market insights (Invesco, WisdomTree).

How to get exposure to Gold?

For this asset class again the development of products has created a risk of confusion between products that may look the same but are not the same especially in terms of risks but also in terms of performances.

To date, the existing supply of gold in Europe is mainly made up of ETCs. There are no Gold UCITS ETFs in Europe because ETF should provide diversification and therefore cannot be on a single asset. The only existing ETFs are thematic ETFs based on a basket of equities linked to the gold thematic, ie investing on gold mining equities. Existing vehicles include physically backed or synthetic Gold ETCs, Trust or Gold mining equity ETFs

In Europe, physically backed or synthetic Gold ETCs or Gold mining equity ETFs allow to get exposure to gold:

Gold ETFs and shares in gold mining companies

An alternative approach to investing in gold is to purchase shares in gold mining companies. One advantage of this approach is that when the price of gold is rising, gold mining stocks can often rise faster than the price of gold, as they are essentially a leveraged play on the gold price. However, the downside to this approach is that gold mining stocks can be quite volatile at times and when the gold price is falling, gold mining stocks can decline more than the price of gold. Mining companies are also exposed to a number of other factors that can affect their share prices, therefore, the returns from gold mining stocks may not reflect the movements in the price of gold. On the positive side, these are UCITs ETFs, i.e. offering diversification and the same level of guarantees offered by these types of ETFs

Gold ETCs:

Gold ETCs offer a convenient way to invest in gold because they are listed on stock exchanges and can therefore be bought and sold just like regular stocks. The key advantage of gold ETPs is that they eliminate many of the issues associated with buying gold bullion,

such as high transaction and storage costs. We can distinguish two types of ETPs:

Physically-backed gold ETCs

The key feature of physically-backed gold ETCs is that these ETCs hold a certain quantity of gold bullion in a secure vault on behalf of investors. The advantage of this type of ETC is that investors can be assured that each ETC is backed by an entitlement to high-quality, securely stored physical metal. In terms of return, physically-backed ETCs generally attempt to provide investors with a return equivalent to the movements in the gold spot price, less management and storage fees.

Here are some physical gold ETC examples:

Invesco Physical Gold EUR Hedged ETC

Synthetic gold ETPs

Synthetic gold ETCs are different to physically-backed ETCs in that they do not own any physical gold. Instead, they invest in gold synthetically via futures, options and swap contracts. The advantage of synthetic gold ETCs is that they can sometimes be cheaper than physically-backed gold ETCs, as they don’t have to pay the costs associated with storing physical gold. The downside to synthetic ETCs is that they are more complex than physically-backed ETCs and carry an extra level of risk due to their financial engineering and use of derivatives. Returns can also differ from spot price gold movements due to the way these ETCs are constructed. These risks have been highlighted in the COVID-19 pandemic, where we have seen the prices of gold in derivative instruments such as futures and options differ widely from the spot market price.

Here are some synthetic gold ETC examples:

What is the size of the portfolios invested in Gold?

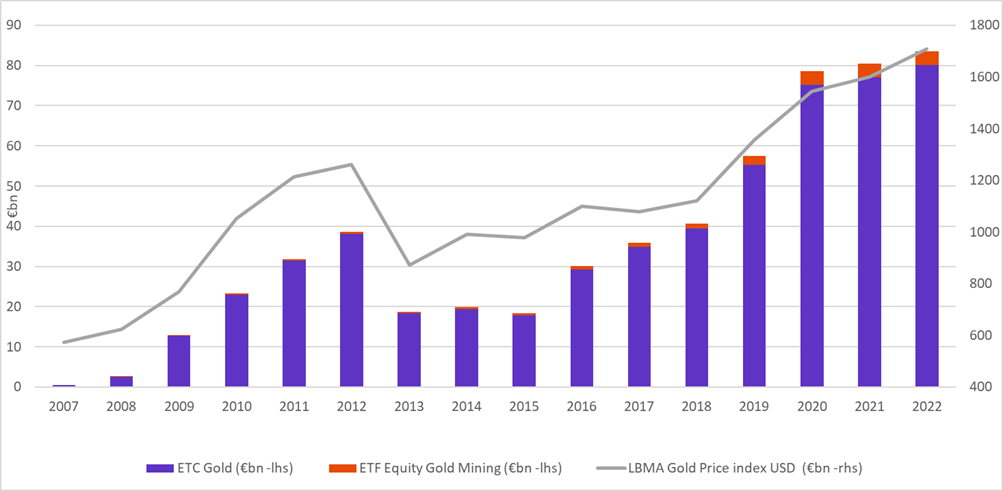

Worldwide, there are 136 ETPs in this Gold segment for a total of €196bn. The United States is the leading market with €104bn in assets under management. Trusts, which are securities listed on over-the-counter stock exchanges, constitute 80% of outstanding amounts in the United States. European domiciled Gold ETP AuM amounts to €84bn. The rest is divided between products domiciled in South Africa, Canada and Hong Kong. In Europe, gold ETCs account for the vast majority of these products. ETFs on mining stocks currently represent only 4% of assets. The size of the market in Europe has doubled since 2018. The evolution of assets under management appears strongly correlated with the price of gold as shown in the chart below.

Evolution of gold ETP assets since 2007

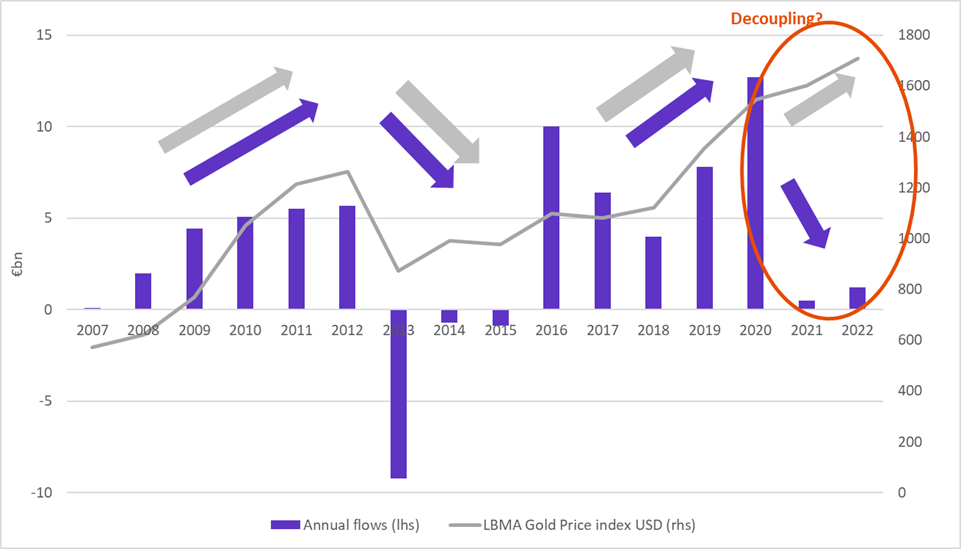

What are the flows to these products?

After growing strongly in 2019 and 2020 given the COVID-19 crisis and rising uncertainties, flows to gold products almost dried up in the 2021 market recovery, with the end of quantitative easing. In 2022, except a slight rebound in March during the outbreak of the Ukrainian crisis, flows remain very limited despite the continued rise in gold prices. The World Gold Council estimates that on average over the last 10 years, between ETPs account for 3% of global demand for gold. The rest is divided between 51% for jewelry, 26% for bars and coins, 8% for technology and 12% for central banks.

Evolution of flows to gold ETPs since 2007

Are the performances of all these Gold ETPs similar?

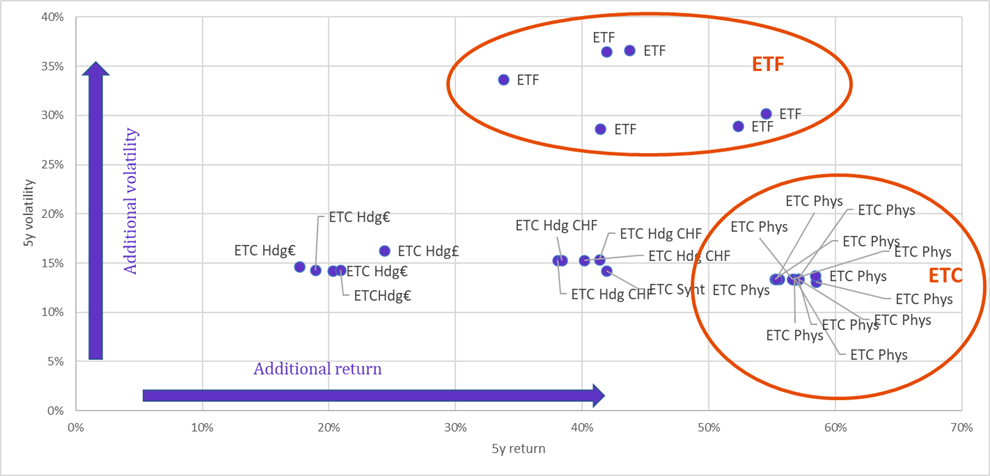

Academic research, and in particular the article All That’s Gold Does Not Glitter, by (Gerald R. Jensen, et al., Financial Analysts Journal-2018), shows that the risk-return ratio of different products used to invest in gold can be significantly different.

What about products listed in Europe? The performance of physical ETCs is very similar, as shown in the chart below of risk-return over the last 5 years of different types of gold investment vehicles. The performance of ETFs on mining stocks is lower over the period with higher volatility.

Return-risk between 2017-2022 of gold ETPs

Here we can clearly distinguish three different risk-return profiles, those of physical ETCs, those of synthetic ETCs (hedged, with the currency effect to be taken into account) and those of ETFs on the mining industry. The choice of the instrument with which one is exposed to gold can therefore lead to significantly different effects on the performance of a portfolio. This confirms the results obtained later by academic research and demonstrates that the question of how to include gold is almost as important as when or why.

Marlene Hassine Konqui & Ahmed Khelifa, CFA

Leave a Reply

You must be logged in to post a comment.