August wasn’t July

While performance across all themes was positive in July, with 21 themes outperforming the MSCI ACWI, August saw a downturn, with negative performance in all themes, and only 6 themes surpassing the MSCI ACWI, according to the WisdomTree European thematic monthly update. Year-to-date, 13 themes have outperformed the global equity benchmark, showing a slight reversal from July when 16 themes were leading. Tech-related themes, such as “Semiconductors” and “Blockchain,” continue to yield the highest returns. An example of a well-performing fund in these themes is the Wisdomtree artificial intelligence UCITS ETF.

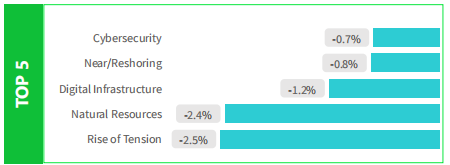

Top 5/Bottom 5 by performance in August

Top 5/Bottom 5 by YTD performance

What does this tell us about market expectations: Fear of higher for longer?

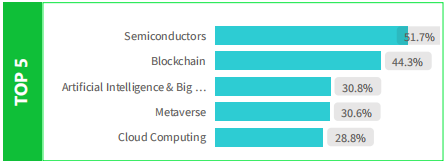

In Europe, Assets Under Management (AUM) in thematic Exchange Traded Funds (ETFs) and open-ended funds decreased by 5% in August, totaling $317 billion. This decline was primarily driven by negative performance but not exclusively so. In August, both ETFs and open-ended funds experienced negative flows, with outflows of $633 million and $182 million, respectively. This could be indicative of investors factoring in a new risk that had not been fully priced into the market until now: the risk of central banks maintaining interest rates at current levels for a longer duration than initially anticipated. This risk emerged following recent data indicating the strong resilience of the U.S. economy, which could result in a slower deceleration of inflation. This new factor could widen the performance dispersion both across and within investment themes.

AuM in Thematics by Region (Last 10Y)

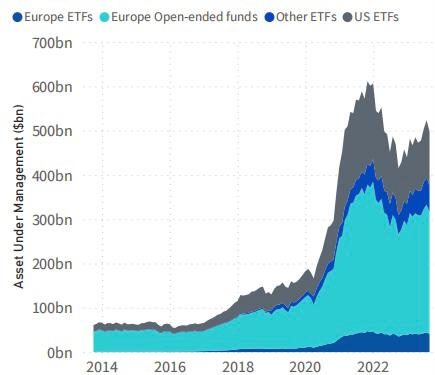

High Performance Dispersion Across and Within Themes Persists:

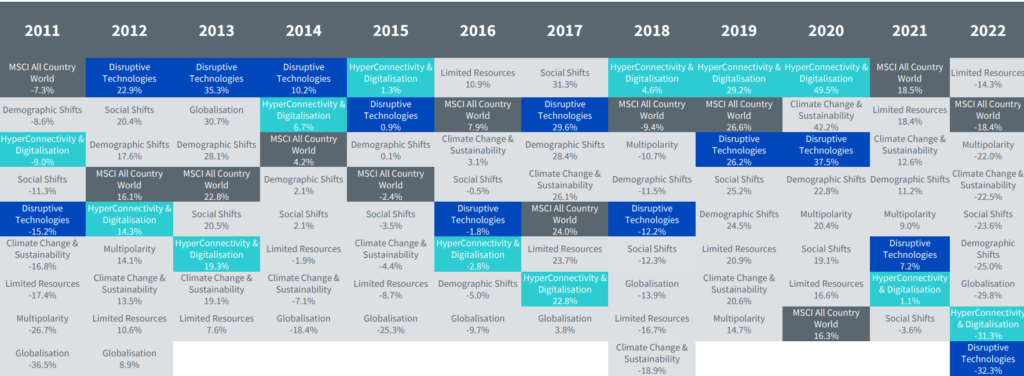

Thematic annual returns exhibit significant volatility, and the dispersion of returns within the same thematic category remains substantial, as illustrated in the figures below. Uncertainty regarding the trajectory of interest rates could potentially result in an even higher level of dispersion (WisdomTree European thematic monthly update).

Dispersion of YTD performance of all ETFs and mutual funds by themes in Europe

Thematic annual returns ranking

Mind concentration and crowded stocks:

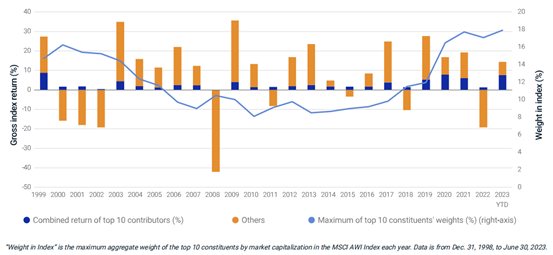

The performance of global equity markets in the first half of 2023 exhibited high concentration, with the top 10 return contributors responsible for 53% of the MSCI ACWI Index’s return of 14.3% through June 30. Index concentration reached its highest level since 1999, with the top 10 constituents by market capitalization collectively reaching an aggregate maximum weight of 18% during the first six months of the year. The AI-driven rally has elevated market concentration to levels not seen since the 1970s, underscoring the influence of a few large firms in shaping recent market returns and the necessity of diversified thematic strategies to mitigate the risk of bubbles (see “Differentiating your AI exposure from the Nasdaq-100 GB | WisdomTree Europe“).

In 2023, concentration in the MSCI ACWI Index reached its highest level since 1999

The majority of returns in the MSCI USA Index at mid-year were driven by a select group of seven major companies. This resurgence in tech stocks is noteworthy, especially in light of the tech decline experienced after these firms reached their peak during the COVID-19 period.

What lessons can investors in today’s largest firms draw from history?

Historical data indicates that market-leading firms have often struggled to keep pace with the broader market over time, highlighting the challenge that the largest firms face in maintaining their leadership positions. To explore what happened to leading companies in past eras, refer to the latest MSCI study available via this link (“AI’s Moment and Insights from Themes Past“).

Key takeaways:

- Shift in Flows and Performance, a “Higher for Longer” Fear: In Europe, flows in August toward Thematic Investing strategies were negative. This trend could signify that investors are considering a new risk that hadn’t been fully factored into the market until now: the risk of central banks maintaining rates at current levels for an extended period.

- Uncertainty Regarding Interest Rate Trajectory Could Lead to Even Higher Dispersion: This underscores the importance of an appropriate fund selection methodology specific to Thematic strategies, such as BSD Investing and L’ALLOCATAIRE Thematic Leaderboards (our Leaderboard offer).

- The AI-driven rally has driven today’s market concentration to levels not seen since the 1970s, emphasizing the need for diversified thematic strategies to avoid bubbles (see “Differentiating your AI exposure from the Nasdaq-100 GB | WisdomTree Europe“).

Marlene Hassine Konqui & Ahmed Khelifa, CFA

Leave a Reply

You must be logged in to post a comment.