The explosive growth of private markets has been one of the most significant developments in capital markets in the last two decades. More money is being raised in private markets than in public markets each year. This trend may be challenged by the current high-interest rate environment.

Venture capital has helped power a dramatic expansion in private markets in recent decades. The number of public companies in the United States has declined from a peak of more than 8,000 in 1996 to roughly 4,000 today. At the same time, the number of U.S.-based VC-backed companies has ballooned to an estimated 54,000 from a figure less than 5,000 in the year 2000.

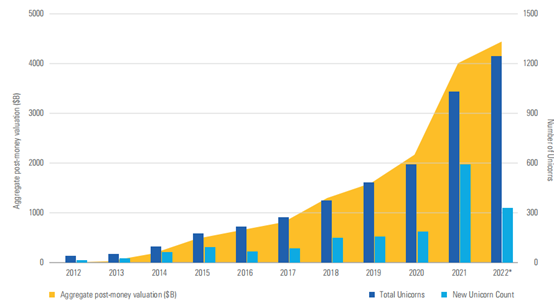

The ranks of unicorns now exceed 1,300 globally and their collective value is roughly $4.5 trillion (Harnessing Unicorns: Demystifying the venture capital market with the Morningstar PitchBook Global Unicorn Indexes). Due to this increase in available capital, many young companies are choosing to remain private longer. The list of companies backed by venture is long and essential to public markets—Hewlett Packard, Apple, Amazon, Salesforce, Google, Airbnb, and Uber to name a few.

Furthermore, private markets provide pure plays on certain industries to which investors can obtain public market exposure only through large conglomerates. In addition, private markets permit wider geographical diversification than their public counterparts (Asset Allocation and Private Markets: A Guide to Investing with Private Equity, Private Debt, and Private Real Assets. 2021. Cyril Demaria, Maurice Pedergnana, Rémy He, Roger Rissi, and Sarah Debrand). As the private fund market has been growing, the number of publicly listed companies has been declining. Kahle and Stulz (2017) show that there are fewer public companies now than 40 years ago, and that current listings are on average much larger and older than 20 years ago. The decline in U.S. listings has effectively resulted in a drastic decline in the number of small-cap stocks and especially small-cap value stocks (Should defined contribution plans include private equity investments?, Forthcoming, Financial Analysts Journal). Finally, Flynn and Ghent (2022) and Feldman et al. (2021) show that, even within the industry, private firms have different growth dynamics than public ones such that an investor that only has access to publicly traded equities is less able to invest in the market portfolio even with appropriate reweighting of stocks towards their composition in the US economy. The trend by small companies and some industries away from public markets toward private markets thus suggests that access to private markets is increasingly important for diversification

Investor activity in venture capital has followed alongside these trends accordingly. In 2021, more than 24,200 unique investors made a deal into a U.S.-based VC-backed company in 2007 that figure was below 3,500 (Harnessing Unicorns: Demystifying the venture capital market with the Morningstar PitchBook Global Unicorn Indexes).

Unicorns: The Private Public Bridge

This year marks 10 years since the term “unicorn” was coined in reference to privately backed companies with billion-dollar valuations. The term “unicorns” was created a decade ago to describe companies that have raised $1 billion or more in funding. These startups were rare and remarkable, with Facebook, LinkedIn, Workday, and Twitter leading the way in 2013.

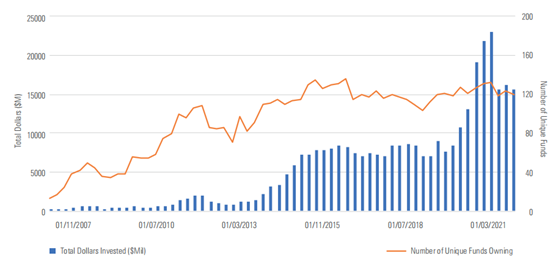

Unicorns and what they symbolize are important for investors across both private and public markets. Late-stage and crossover investors look to unicorns as the opportunity to invest in the next public tech giant that is still in the early stages of growth. Mutual fund ownership of private-market securities in the U.S. has skyrocketed over the last 15 years, the total market value of private-market holdings in mutual funds reached nearly $23 billion in late 2021, up from $110 million in 2007

Mutual Fund Assets Invested in Private Equities Have Grown Steadily

A global phenomenon

While the U.S. remains the home to 723 unicorns, which collectively make up more than 50% of the total market size, China and India have experienced the fastest growth in recent years. Since 2020, the number of unicorns has increased in China by 63%, totaling 284, and the number of unicorns has increased in India by 200%, totaling 66 (Morningstar Unicorn Market Monitor: Q4 2023).

Growth Of Unicorns by Numbers and Assets

- The number of unicorns has surged from 87 to 1,381 over the course of a decade.

- The total market value captured by unicorns has soared from $235 billion to $4.5 trillion.

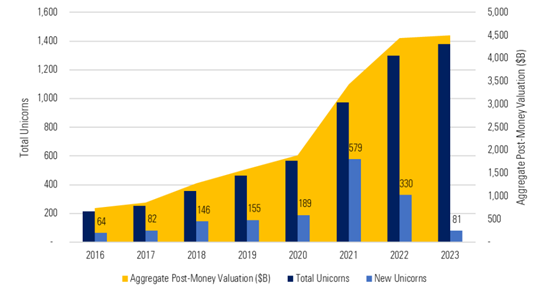

- Unicorns are living longer than ever, with their average life span to exit increasing from 6.9 years to an impressive 10.7 years, a sign that private companies have ample access to capital to sustain their growth.

2023 Headwinds:

In 2023, investors grappled with higher borrowing costs and heightened geopolitical risk.

Late-stage venture-backed companies have encountered major obstacles as a result of decreased deal activity and a stagnant exit environment, both of which greatly impact valuation and performance. Businesses with limited cash reserves have struggled to secure additional funding. Yet, companies that are leading the way in cutting-edge fields like AI, life sciences, and cybersecurity have managed to attract significant investments (Morningstar Unicorn Market Monitor: Q4 2023).

- A year of underperformance

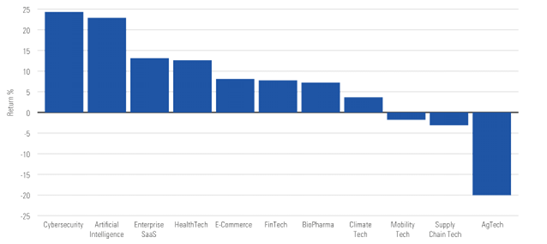

The Morningstar PitchBook Global Unicorn 500 Index and Morningstar PitchBook US Unicorn 100 Index gained 14.39% and 8.74%, respectively, in 2023, underperforming their public market counterparts, the Morningstar Global Markets Index and Morningstar US Market Index, which saw gains of 22.13% and 26.44%.

- Decline in valuations

Deal values experienced a decline in most cases as traditional VC investors have taken a materially cautious look, and non-traditional investors(non-VC ones) have lost their appetite.

- Growth slows down

Growth Of Global Unicorns By Number And Assets

IA and Cybersecurity: A Bubble or an Exception

The Cybersecurity Unicorn Index achieved an impressive 24.3% return in 2023, outperforming other industry segments. This success can be attributed to the remarkable gains of notable public companies in the sector, such as CrowdStrike, Palo Alto Networks, and Zscaler.

The AI Unicorn Index was the second-best performer, returning 22.93% for the year. The index benefited from the quick and wide-ranging adoption of AI technology leading to multiple private funding up rounds, coupled with strong-performing public AI stocks. Amazon, Google, Meta, Microsoft, and Nvidia led public markets higher in 2023, based in part on their market leadership and high revenue growth in emerging generative AI applications. These companies drive private valuations higher based on comparisons with their share prices and their willingness to invest in startups. More broadly, AI infrastructure innovators were the best-performing stocks during the fourth quarter (Morningstar Unicorn Market Monitor: Q4 2023).

Performance Of Morningstar PitchBook Unicorn Industry Vertical Indexes

Private Market Challenges:

Private market (PM) investing entails some noteworthy challenges. For instance, analyzing returns is problematic, owing to stale pricing that arises from relatively illiquid trading. The task is further complicated by the difficulty of calculating correlations between private and public asset returns. Also, volatility is a poor proxy for risk in PMs. Rebalancing is harder to implement than in public markets. Secondary markets in private assets are not reliable venues for disposing of holdings; in 2008–2009, discounts to net asset value soared to 50% for leveraged buyout funds and more than 70% for venture capital funds. Fees are higher than those for public investments. Factor analysis is inapplicable because of the sparsity of trading activity (Asset Allocation and Private Markets: A Guide to Investing with Private Equity, Private Debt, and Private Real Assets. 2021. Cyril Demaria, Maurice Pedergnana, Rémy He, Roger Rissi, and Sarah Debrand).

Startups remaining in the private arena for longer periods may be convenient for entrepreneurs and profitable for venture capitalists, but it comes at a cost to investors and undermines the principle of equal access to information upon which robust securities markets are based.

Underpinned by data from PitchBook, a leading provider of private-market data and research and an independent subsidiary of Morningstar, the Morningstar PitchBook Global Unicorn Indexes TM provide insight into what’s happening just over the horizon of the public markets in the late-stage VC market. The indexes employ a statistical model to estimate more frequent valuations for private companies. The first of its kind, the model leverages valuations from the company’s last funding round along with private-market and public-market comparable data to determine constituent pricing (Morningstar PitchBook Global Unicorn Index).

Marlene Hassine Konqui & Ahmed Khelifa, CFA

Leave a Reply

You must be logged in to post a comment.