While 2022 witnessed a sustained decline in crypto-assets, casting doubt on their appeal as an asset class, 2023 could mark the long-awaited opportunity to unveil their full potential. This article delves into the performance of crypto assets compared to other asset classes year-to-date, examining current drivers and forthcoming opportunities.

An Impressive Performance:

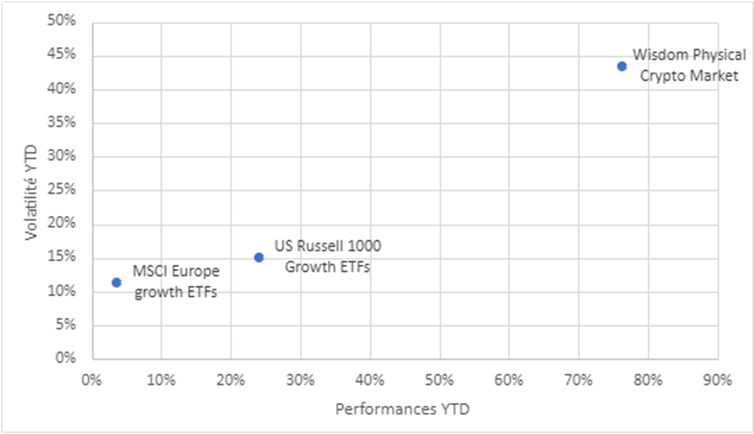

Upon discovering the risk-adjusted performance of a crypto basket in comparison to select growth equity indices, the results were astonishing. Subsequent data analysis revealed a logical correlation, as illustrated in the figure below thus highlighting our own hindsight bias. The following figure tells more than any analysis we could write.

Performances/Volatility of Crypto Basket vs. Equity Assets YTD

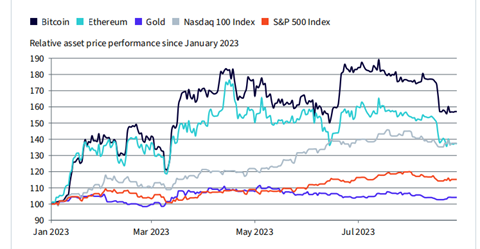

This figure compares the year-to-date risk-adjusted performances of a crypto index, representing the large-cap portion of the crypto market (the Wisdom Physical Crypto market), with two growth stocks ETFs reflecting European and US growth equity markets. Notably, Bitcoin and Ethereum have outperformed major stock indices and gold this year despite facing higher interest rates and regulatory uncertainty in the US.

Bitcoin’s price has outperformed other asset classes so far in 2023

As we can see, crypto outperformance is indisputable and asks for new questions, how to explain this impressive performance?

Crypto Performance Drivers:

1. Early Signs of Improved Liquidity:

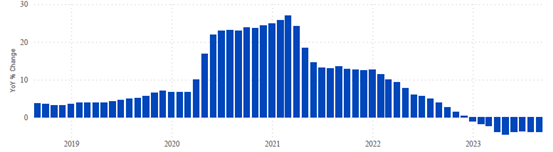

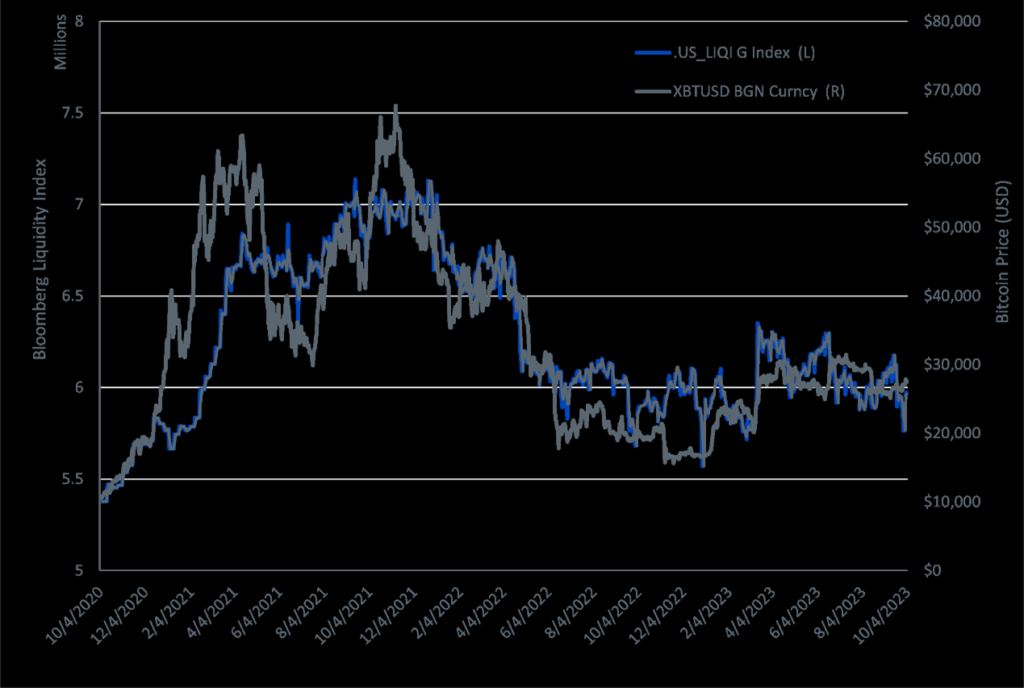

Crypto assets heavily depend on interest rates, liquidity, and money supply. While US money supply hasn’t turned positive yet, the second week of October 2023 witnessed a reversal in the US 10-year treasury note and an increase in the Bloomberg liquidity index, indicating potential improvements. However, these are early signs and don’t establish a trend.

US M2 Money Supply

Market Liquidity and bitcoin price

Historical performance is not an indication of future performance, and any investments may go down in value. Cryptocurrencies are a high-risk investment and may not be suitable for all types of investors. Cryptocurrencies can demonstrate higher volatility than other asset classes.

2. The BlackRock Effect:

The approval of a spot bitcoin ETF in the US could be a significant long-term catalyst for bitcoin. The crypto sentiment improved notably after BlackRock’s announcement of filing for a spot bitcoin ETF in June 2023. This move adds credibility to the crypto space, with a spot bitcoin product considered more efficient for gaining exposure to bitcoin

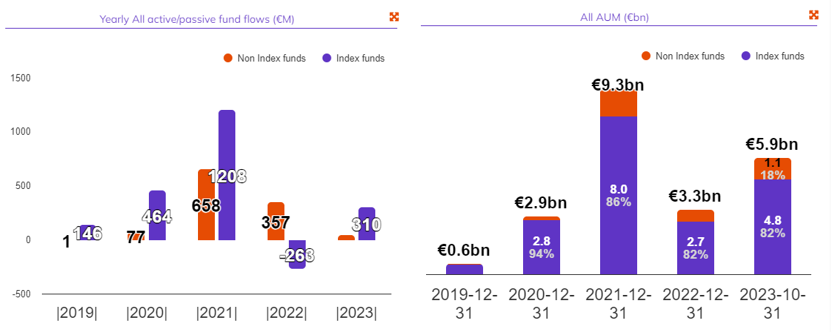

3. Positive Net Inflows from European Professional Investors:

Despite not being substantial, the return of professional investors in Europe indicates a shift in trend and sentiment. Assets Under Management are on track to reach 2021 record levels. The question arises: are investors using crypto-assets, especially bitcoin, as a macro hedge against geopolitical uncertainty or anticipating a pivot in monetary policy?

Crypto flows and AuM in Europe

Future Opportunities: Short-Term Prospective View:

The remarkable performance of crypto-assets in 2023 might only be the beginning of a new bull market if two catalysts materialize.

Liquidity and Central Bank Actions:

The crypto industry is influenced by liquidity and central bank actions. The US Federal Reserve’s annual change in M2 money supply was still negative in August, and the Bloomberg liquidity index, focusing on reverse repurchase agreements, has been on a downward trend. Improved central bank liquidity and efforts to stimulate economies could create a favorable environment for crypto assets.

Bitcoin Spot ETF:

A Bitcoin spot ETF would be ideal for the vast US$30 trillion investment advisory market in the US, offering a familiar structure and an easy way to trade. If even a small percentage of assets managed by advisors were allocated to bitcoin, it could result in substantial investment flows. Source: WisdomTree Market Outlook October 2023

Marlene Hassine Konqui & Ahmed Khelifa, CFA

Leave a Reply

You must be logged in to post a comment.