Filters

Newsletter The ESG Break – Q2 2024 ESG funds quarterly update for institutional investors

Click here to subscribe to our newsletter – Thursday 16 May 2024 – The ESG Break – […]

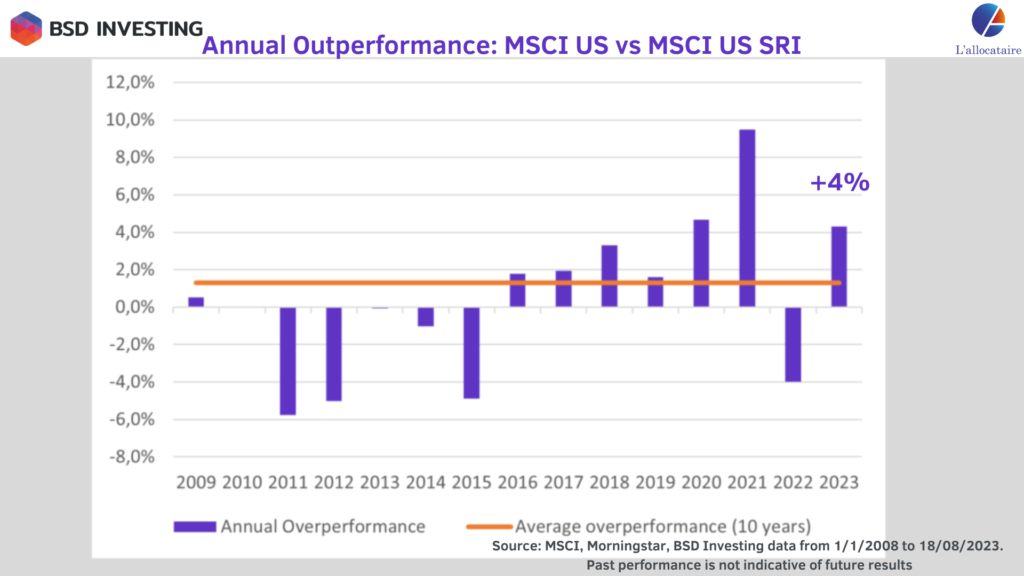

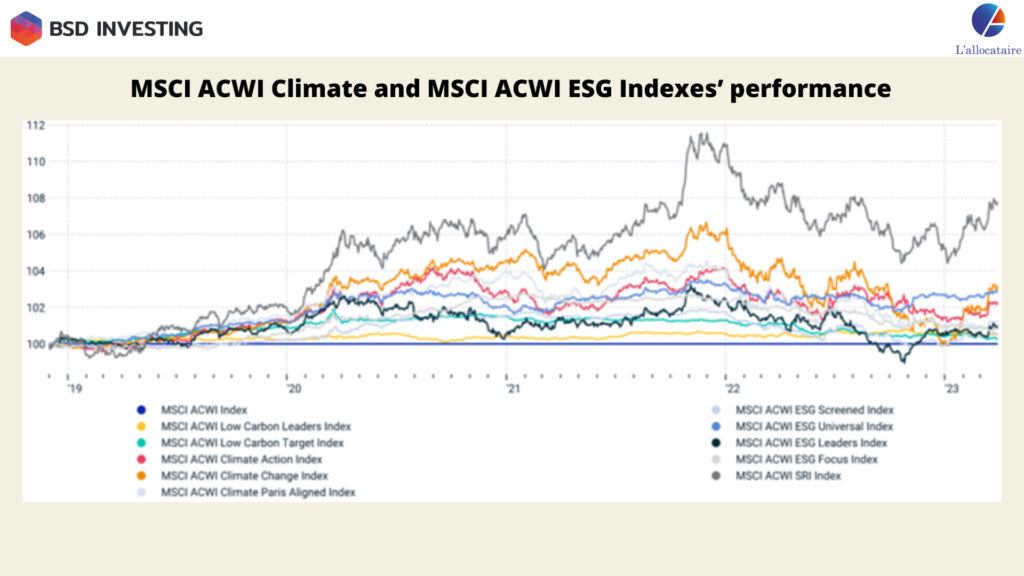

Climate and ESG Strategies: The Performance Gap

2023 wasn’t the best year for ESG ETFs. How do we explain the performance gaps between ESG indices and traditional […]

Newsletter: The ESG Break – Q3 2023 ESG funds quarterly update for institutional investors

Click here to subscribe to our newsletter – Thursday 31 August 2023 – The ESG Break – Q3 2023 […]

ESG YTD performance and market structure

Can we further discuss an ESG factor in light of its underperformance in 2022? How have ESG indices performed year to date in 2023, and what factors contributed to their performance? How has this influenced fund flows? Did the trend of transitioning to environmentally friendly portfolios persist in 2023?

Newsletter:The ESG Break – Q2 2023 ESG funds quarterly update for institutional investors

Click here to subscribe to our newsletter – Thursday 1 June 2023 – The ESG Break – Q2 2023 […]

ESG YTD performance and market structure

Can we continue talking of an ESG factor following 2022 underperformance? How ESG indices performed in 2023 year to date and why? What have been the impact on fund flows? Did the greening of portfolios continue in 2023? We answer all those questions in this article and take an in-depth look to ESG (sustainable) market structure both for equity and fixed income assets with a split between index and non-index funds.

Newsletter: The challenges of ESG-based asset allocation: issues and solutions

Click here to subscribe to our newsletter – Thursday 2 March 2023 – The challenges of ESG-based asset allocation: […]

Index vs. non-index funds: Did the greening of investors’ portfolios continue in 2022?

The development of sustainable index and non-index funds has been very rapid over the past three years, particularly in 2021. […]

How to overcome ESG based asset allocation challenges?

ESG investing has grown rapidly in the last decade and has now a place of choice in investors portfolios.This arises […]

Sustainable active funds vs ETFs: which management style to favor?

How to choose between sustainable active funds vs ETFs? Who of active funds or ETFs favor sustainable investors in 2021?