Filters

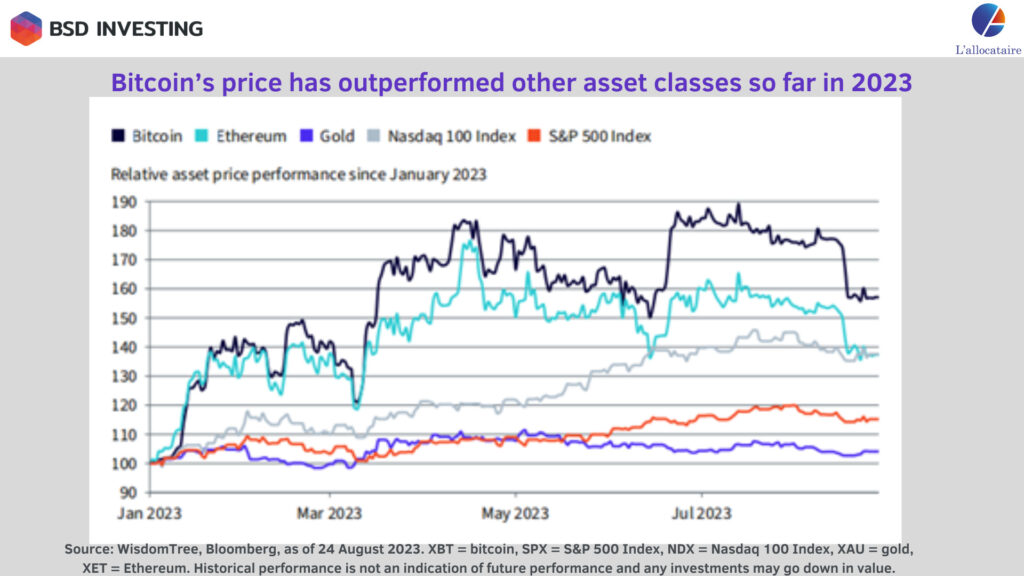

The Crypto Comeback

While 2022 witnessed a sustained decline in crypto-assets, casting doubt on their appeal as an asset class, 2023 could mark […]

Newsletter Macro Realities: from Armed Conflicts to Inflation

Click here to subscribe to our newsletter – Thursday 26 October 2023 – Q4 2023 Macro Realities: […]

Macroeconomic realities: From Armed Conflicts to Inflation

Higher for Longer: Even prior to the outbreak of the Israeli-Palestinian conflict, markets appeared to have already embraced a “higher […]

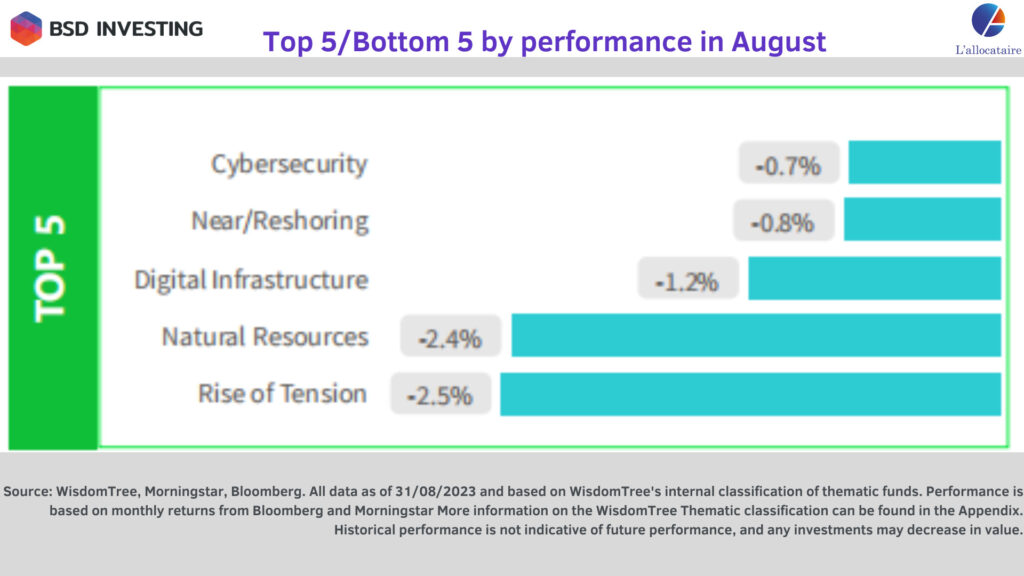

Newsletter: The Thematic Compass – Q3 2023 Thematic funds quarterly update for institutional investors

Click here to subscribe to our newsletter – Thursday 21 September 2023 – The Thematic Compass – Q3 2023 […]

Shift in flows and performance, a Higher For Longer fear

August wasn’t July While performance across all themes was positive in July, with 21 themes outperforming the MSCI ACWI, August […]

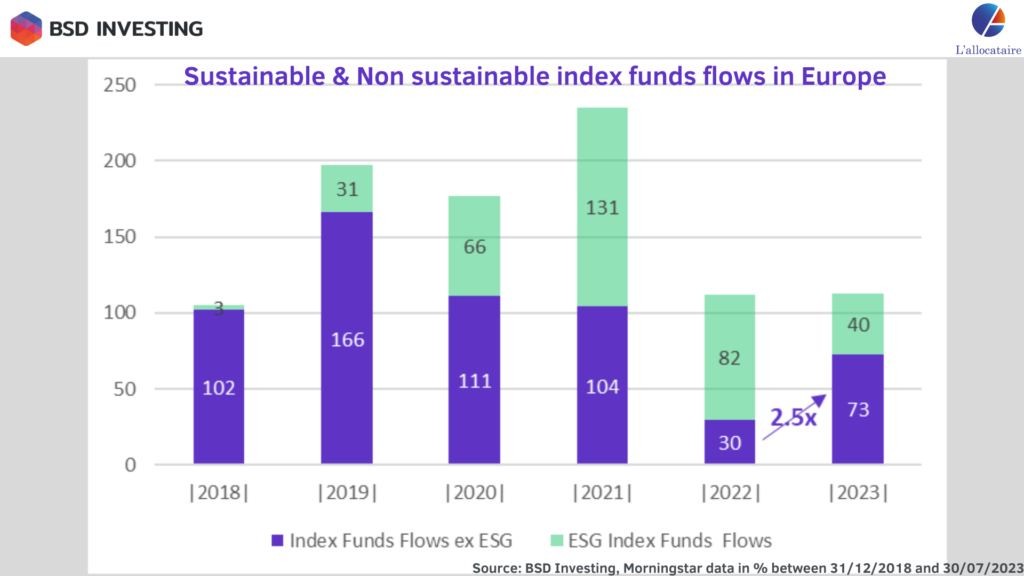

ESG Investment at the crossroads: Did the greening of portfolios continue in 2023?

Sustainable funds are recovering part of their 2022 underperformance. Yet ESG ratings providers have also come under scrutiny over the […]

Subscribe to our next Newsletter on ESG

Join our newsletter to get the latest news dedicated to portfolio construction delivered directly in your inbox.

Newsletter: The ESG Break – Q3 2023 ESG funds quarterly update for institutional investors

Click here to subscribe to our newsletter – Thursday 31 August 2023 – The ESG Break – Q3 2023 […]

ESG YTD performance and market structure

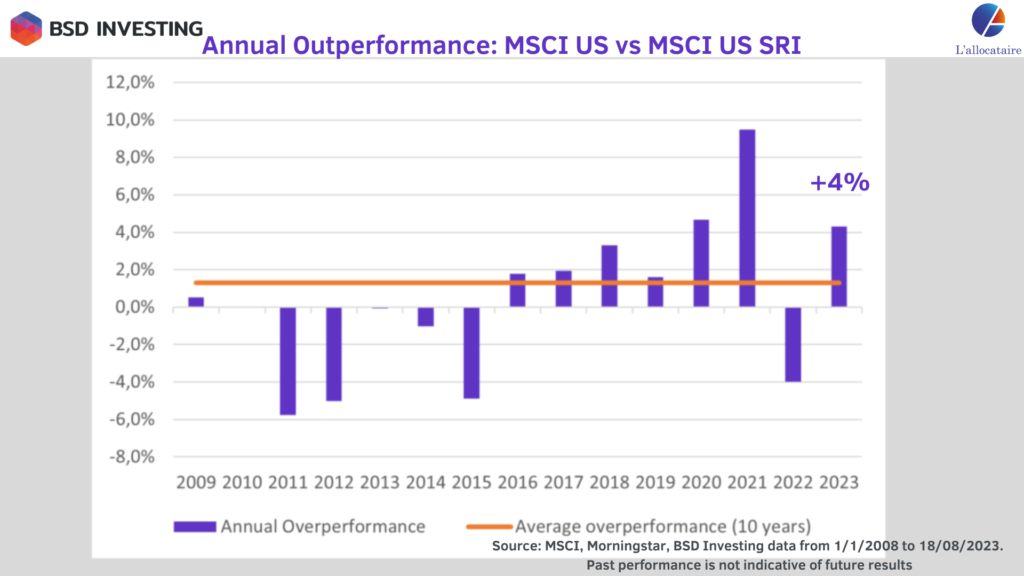

Can we further discuss an ESG factor in light of its underperformance in 2022? How have ESG indices performed year to date in 2023, and what factors contributed to their performance? How has this influenced fund flows? Did the trend of transitioning to environmentally friendly portfolios persist in 2023?

Podcast : Quality or Growth, which factor is the winner of interest rate hikes?

How Factors Performed in the 12 Months Following the End of the Last 7 Fed Rate Hike Cycles? How did […]