Filters

ESG YTD performance and market structure

Can we further discuss an ESG factor in light of its underperformance in 2022? How have ESG indices performed year to date in 2023, and what factors contributed to their performance? How has this influenced fund flows? Did the trend of transitioning to environmentally friendly portfolios persist in 2023?

Smart Beta Focus: 2023 Under the Loop

How did factor strategies perform in 2023? Are the valuations of these factors still attractive? Are Smart Beta strategies still […]

Newsletter:The ESG Break – Q2 2023 ESG funds quarterly update for institutional investors

Click here to subscribe to our newsletter – Thursday 1 June 2023 – The ESG Break – Q2 2023 […]

ESG YTD performance and market structure

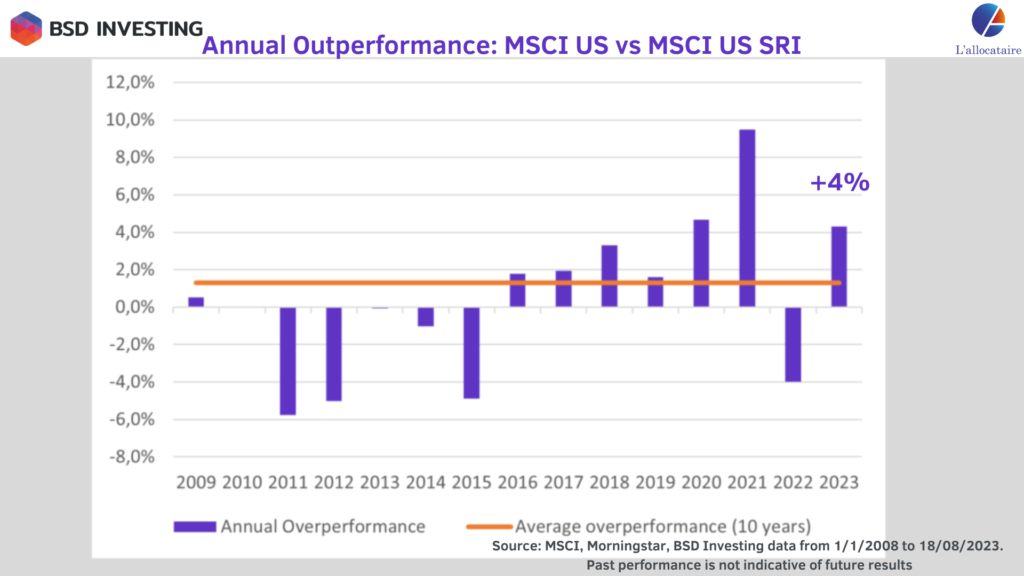

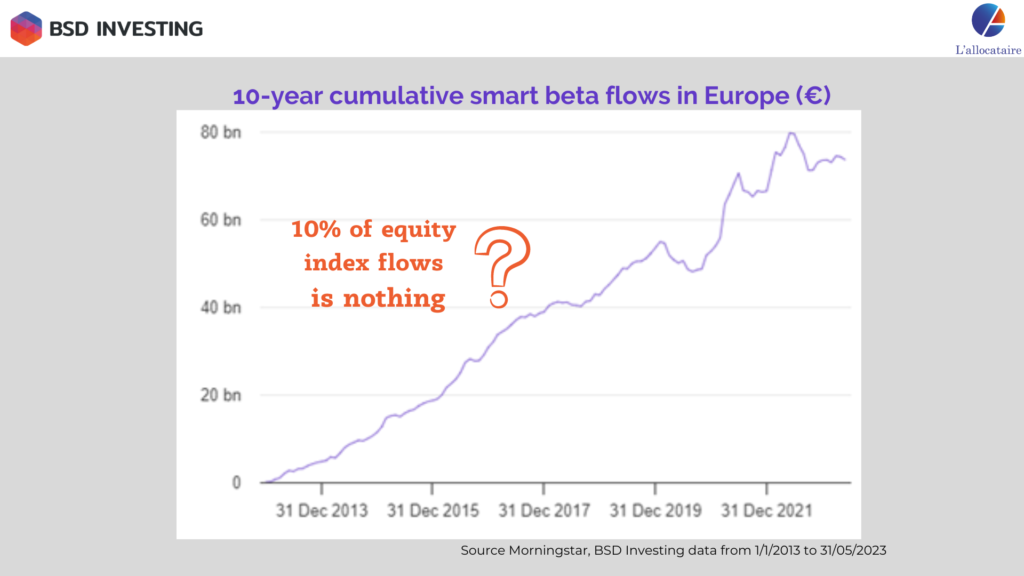

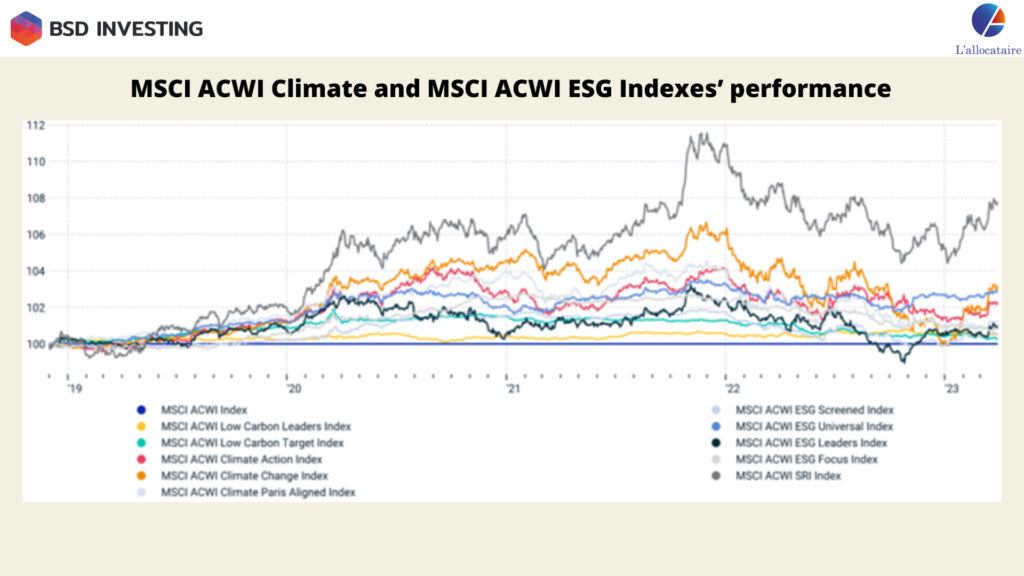

Can we continue talking of an ESG factor following 2022 underperformance? How ESG indices performed in 2023 year to date and why? What have been the impact on fund flows? Did the greening of portfolios continue in 2023? We answer all those questions in this article and take an in-depth look to ESG (sustainable) market structure both for equity and fixed income assets with a split between index and non-index funds.

Are crypto ETPs a growing part of investors’ portfolios?

What are the implications of this upgrade for investors? have crypto assets confirmed their stake in investors’ portfolios? Have crypto flows rebounded? Toward which crypto segments flows have been going year to date? What crypto asset sector has performed best in 2023?

Bond Market Volatility hits 5 years’ time high: What impact on interest rates curve?

US bond market volatility as measured by the MOVE index “Merrill Lynch Option Volatility Estimate” that measures U.S. interest rate […]

Fixed Income Active funds vs ETF flows & performances: who is the winner in 2022 and so far in 2023?

The year 2022 has been a difficult year for fixed income funds both in terms of flows and performances due to the central bank regime shift and interest rates hikes. Are fund performances improving at the start of 2023? Is there a trend reversal in flows since the end of 2022? Which of index or non-indexed funds are favoured by investors in this asset class?

Index vs. non-index funds: Did the greening of investors’ portfolios continue in 2022?

The development of sustainable index and non-index funds has been very rapid over the past three years, particularly in 2021. […]

What Crypto-asset segments are accessible through existing ETPs?

Classifying the digital assets landscape allows us to capture its breadth, depth, and track its evolution. In our article titled […]

Thematic investing: what place in investors’ portfolio?

Based on BNPP AM, Invesco & WisdomTree market insights and our proprietary research, we assess here the place of these […]