| |

BSD Investing & L’Allocataire model portfolio update

|

|

| |

Staying the course even in rough market times

|

|

| |

Click here to discover the performances of our dynamic portfolio allocation. Our mixed approach between active and passive management on this profile has generated -1% since the beginning of the year (until 30/11/2022), i.e. an outperformance of 5% compared to the MSCI ACWI index (world equities) and is up 6% over the last 3 months (against 1% for world equities).

|

|

| |

Adding Gold to portfolio: the When?

|

|

| |

In which market regime gold performs the best?

|

|

| |

After looking at gold past performances and showing when gold had performed the best, we look at the following questions : Does it make sense to use gold as a tactical play? Is it a dollar Hedge? Is it a safe-haven? Or is it an inflation hedge? What is the sweet spot for Gold?

Access all the answers and more in our last article. |

|

| |

ADDING gold to portfolio: the Why?

What added value does gold bring to a portfolio?

|

| |

Does gold bring any diversification effect to portfolios? What are the correlations of Gold vs other financial assets ? What impact on portfolios’ risk-return?

Click here to understand the role of Gold in portfolio construction.

|

|

|

|

| |

ADDING gold to portfolio: the How?

What are the options currently available for investors to invest in Gold?

|

| |

What is the current size of investors’ portfolio in those products? What are the flows to Gold ETPs? Are all those products offering the same performances?

Click here to have a clear view on Gold ETPs.

|

|

|

|

| |

NEW MARKET VOICE: Adding Gold to portfolio, at What Price?

|

|

| |

How to value this precious metal that is Gold by WisdomTree

|

|

| |

Gold is hard to value. In fact, Gold does not generate cash flow like other assets do, so traditional valuation techniques such as discounted cash flow (DCF) models don’t work. Another complication lies in the fact that there have been many regime shifts in relation to the precious metal over the years. So, clearly, using extremely long time series of data to calibrate a gold valuation model is not appropriate. Currently, there’s little consensus on how to actually value Gold. Nitesh Shah — Head of Commodities and Macroeconomic Research, WisdomTree Europe, explain how they value gold. He details the model WisdomTree has developed and how it uses historic price behaviour to generate gold price forecasts for the future. Discover more on the real price of Gold by following this link.

|

|

|

| |

|

|

| |

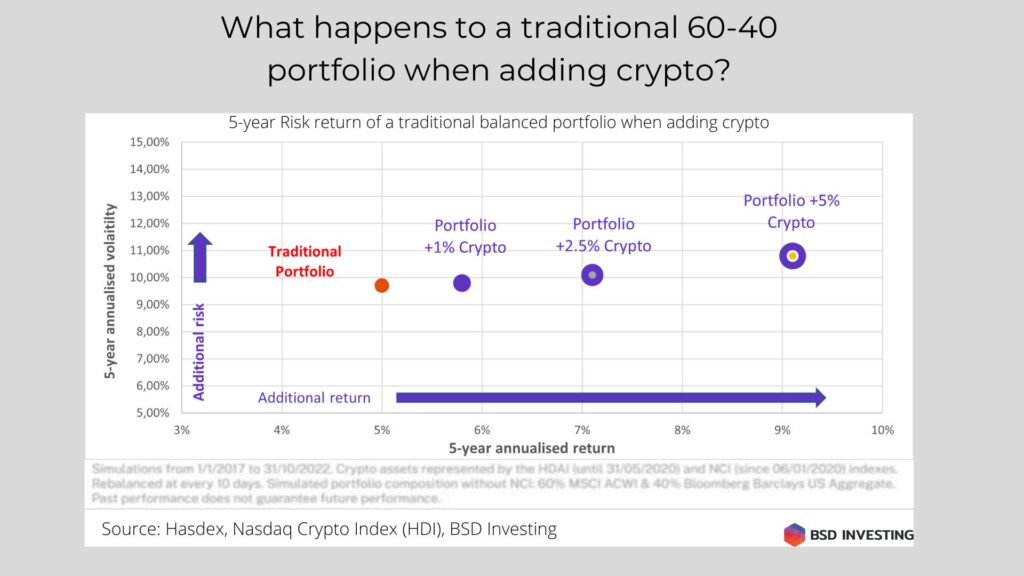

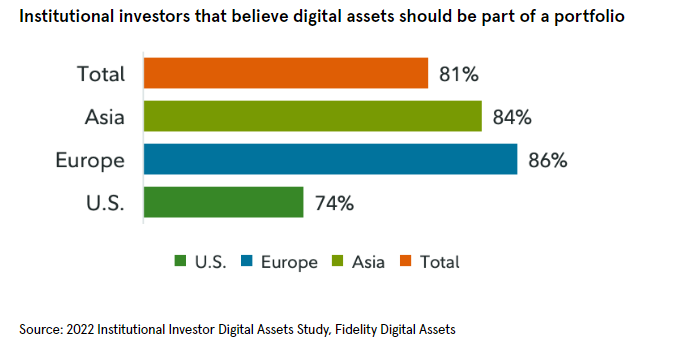

LATEST NEWS

Crypto assets, to be or not to be an asset class?

Ahmed Khelifa, cfa, and Marlene Hassine Konqui explore this key topic, based on prominent academic research (namely CFA Institute research foundation) and market insights (from Invesco and Hashdex), looking at the definition of an asset class, and the set-up of a framework to determine whether an asset can be considered an asset class. They answer the following questions: Do assets within the crypto assets show a similar behavior to market events? Does the asset class add diversification to a portfolio? Do crypto assets have the capacity to absorb a meaningful proportion of an investor’s portfolio? What are the available investable vehicles to a European asset allocator?

Click here to read the full article.

|

|

| |

|

|

| |

LATEST NEWS

When index investing meets crypto assets

As seen in the article untitled “What Crypto weighs in investors’ portfolios?” , investment vehicles to invest in crypto assets have seen an exponential growth since a few years as they provide a simple way of gaining access to crypto assets. What are current options to access crypto assets in Europe? Why index investing is currently expanding to crypto assets? Click here to have all the answers

|

|

| |

|

|

| |

VIDEO

Discover our latest webinar

Discover BSD investing & L’Allocataire latest macro & active vs passive fund 2022 outlook. Click here to view the video.

|

|

| |

|

|

| |

Disclaimer

This website and all of its contents (analysis and research) is published by, and remains the copyright

of, BSD Finances or its licensors. The information contained within is for educational and informational

purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell

funds nor should it be viewed as a communication intended to persuade or incite you to buy or sell

funds. Any commentary provided is the opinion of the author and should not be considered a personalised

recommendation. The information contained within should not be a person’s sole basis for making an

investment decision. Please contact your financial professional before making an investment decision.

Should you undertake any such activity based on information contained on this website, you do so

entirely at your own risk and BSD Finances shall have no liability whatsoever for any loss, damage,

costs or expenses incurred or suffered by you as a result.

Care is taken to ensure that the information provided by BSD Finances is correct but it neither

warrants, represents nor guarantees the contents of the information, nor does it accept any

responsibility for errors, inaccuracies, omissions or any inconsistencies herein.

BSD Finances is a limited liability company registered in France with registered number 852 716 547

00017. Our registered office is at 8 rue de Moscou 75008 Paris. BSD Investing is part of BSD Finances.

|

|

|

Leave a Reply

You must be logged in to post a comment.