Filters

Climate and ESG Strategies: The Performance Gap

2023 wasn’t the best year for ESG ETFs. How do we explain the performance gaps between ESG indices and traditional […]

ESG YTD performance and market structure

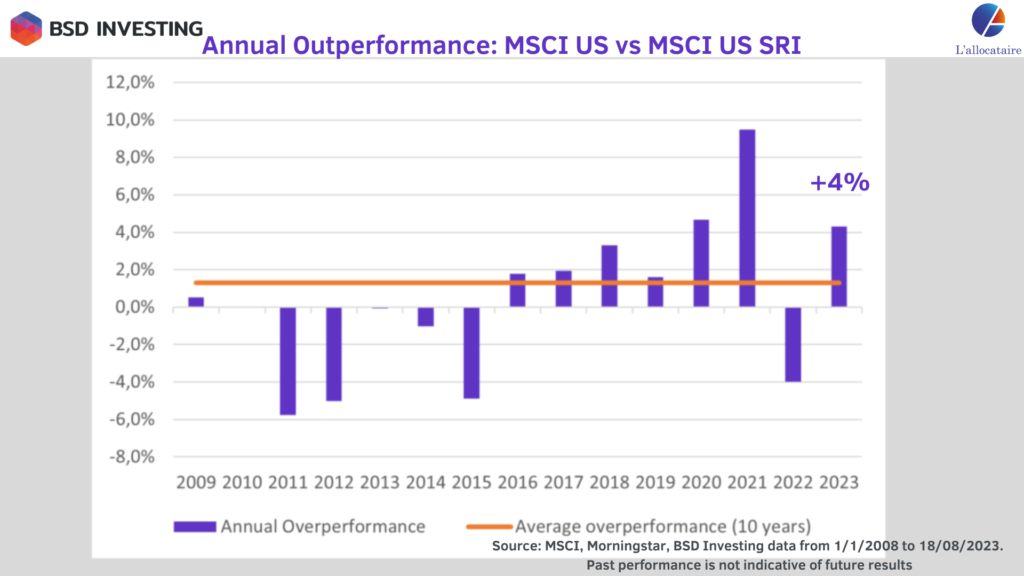

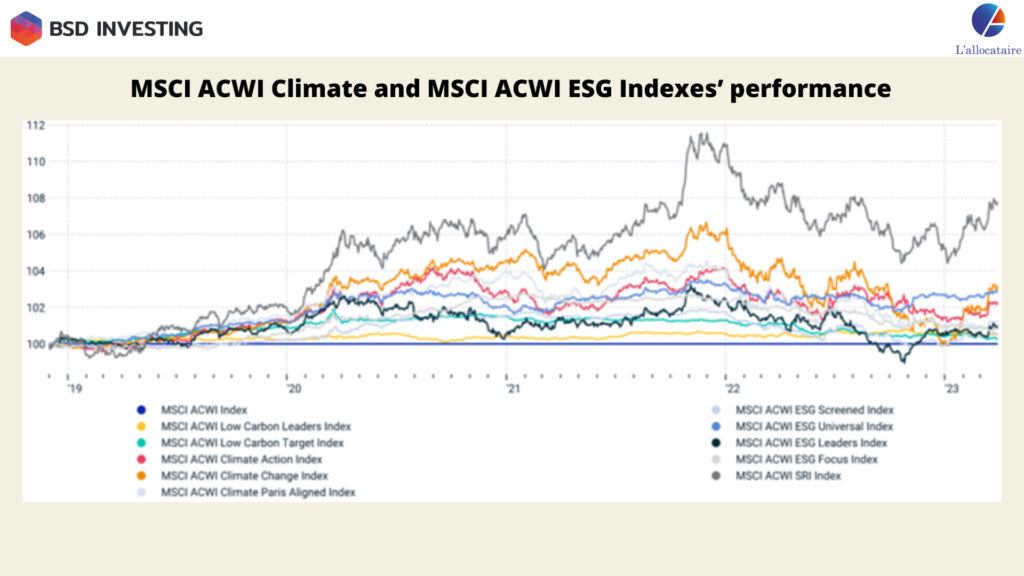

Can we further discuss an ESG factor in light of its underperformance in 2022? How have ESG indices performed year to date in 2023, and what factors contributed to their performance? How has this influenced fund flows? Did the trend of transitioning to environmentally friendly portfolios persist in 2023?

Newsletter: Active ETFs: The new Holy Grail ? – Q3 2023

Click here to subscribe to our newsletter – Thursday 20 July 2023 – Active ETFs: The new Holy Grail […]

ESG YTD performance and market structure

Can we continue talking of an ESG factor following 2022 underperformance? How ESG indices performed in 2023 year to date and why? What have been the impact on fund flows? Did the greening of portfolios continue in 2023? We answer all those questions in this article and take an in-depth look to ESG (sustainable) market structure both for equity and fixed income assets with a split between index and non-index funds.

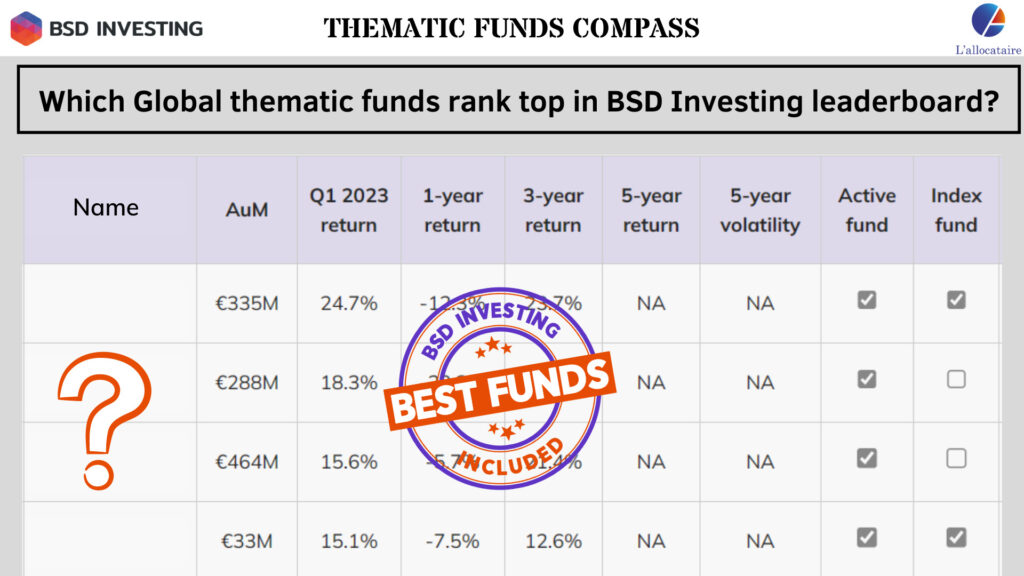

Which Global thematic funds rank top in BSD Investing leaderboard?

BSD Investing has developed leaderboards allowing to rank funds based on its unique proprietary database aiming at giving a fair […]

Thematic Investing : Separating the wheat from the chaff with BSD Investing new leaderboards

Thematic funds have attracted investors’ interests due to their unique ability to tap into human’s innate need for stories. Is […]

Newsletter: Fixed income: an opportunity behind the storm

Click here to subscribe to our newsletter – Thursday 23 March 2023 – Fixed income: an opportunity behind the storm […]

Fixed Income Active funds vs ETF flows & performances: who is the winner in 2022 and so far in 2023?

The year 2022 has been a difficult year for fixed income funds both in terms of flows and performances due to the central bank regime shift and interest rates hikes. Are fund performances improving at the start of 2023? Is there a trend reversal in flows since the end of 2022? Which of index or non-indexed funds are favoured by investors in this asset class?

Active fund vs ETF in 2022: Who is the winner?

For the full year 2022, 36% of active managers outperformed passive management. This figure masks a contrasting situation throughout the […]

Adding Gold to portfolio: The “How”?

As seen in our article untitled, Adding Gold to portfolio: The When?, Gold offers an attractive potential of diversification when […]