Filters

ESG YTD performance and market structure

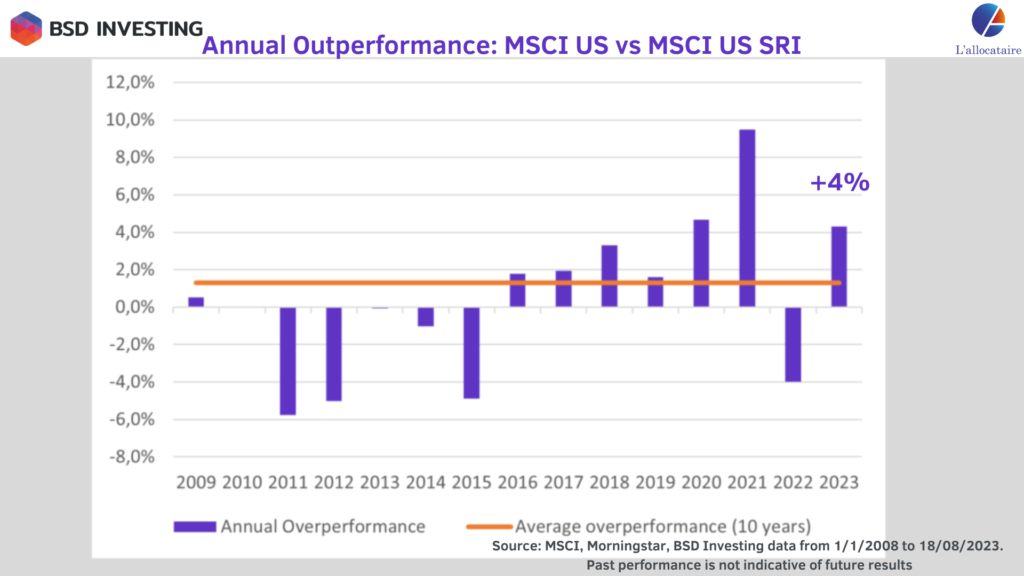

Can we further discuss an ESG factor in light of its underperformance in 2022? How have ESG indices performed year to date in 2023, and what factors contributed to their performance? How has this influenced fund flows? Did the trend of transitioning to environmentally friendly portfolios persist in 2023?

Active fund vs ETF in 2022: Who is the winner?

For the full year 2022, 36% of active managers outperformed passive management. This figure masks a contrasting situation throughout the […]

Seeking a fair performance comparison between active and passive funds

Marlene Hassine Konqui, CEO of BSD Investing questions SPIVA and Morningstar methodologies to compare active vs passive fund performances

BSD Investing research: Issues and solutions to build optimal portfolios

What are the issues of existing active vs passive fund performance comparisons? What are the solutions? How to build optimal portfolios?

Active funds vs ETFs: Are investors’ portfolios more sustainable?

Did investors continue to focus on active management or ETFs for sustainable investments in the first quarter of 2022? Article 8 or 9 sustainable funds: where are the assets of ETFs vs active funds? Is the increase of sustainable fund assets accompanied by a change in fund benchmarks?

Active funds vs ETFs: Did Eurozone equity funds benefit from the market recovery in March 2022?

Did investors favour active management or ETFs on Eurozone equities in March 2022? How have active funds vs. ETFs performed in this segment? What impact for portfolio construction?

Active funds vs ETFs: what is happening to European equity funds since the beginning of 2022?

Have investors favoured active management or ETFs on European equity funds at the beginning of 2022? How have active funds vs. ETFs performed in this segment? What impact for portfolio construction?

Active funds vs ETFs: Where have bond investors been taking refuge since the beginning of the year?

Have investors favoured active management or bond ETFs in early 2022? How have active funds vs. ETFs performed in this segment? What impact for portfolio construction?

Webinar: Asset and Active vs Passive fund Allocation Outlook for 2022

Discover Marlene Hassine Konqui new webinar on 2021 active fund vs ETF performance comparisons.

Active Funds vs ETFs: what performance in emerging markets since the beginning of the year?

Have investors favoured active management or ETFs to invest in emerging equity markets since the beginning of the year? How have active funds vs. ETFs performed in this segment? How to improve portfolio constructio