Filters

ESG YTD performance and market structure

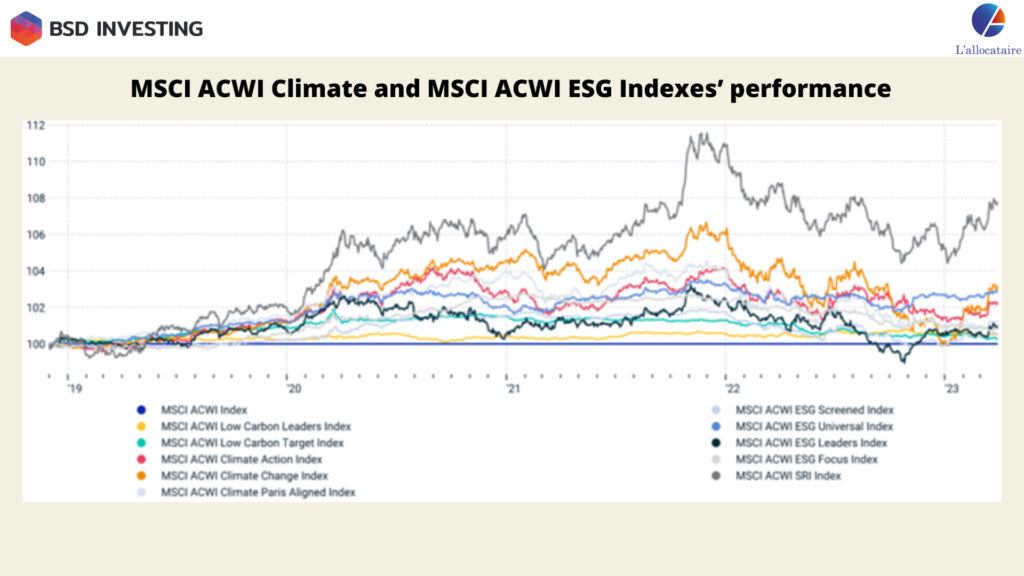

Can we continue talking of an ESG factor following 2022 underperformance? How ESG indices performed in 2023 year to date and why? What have been the impact on fund flows? Did the greening of portfolios continue in 2023? We answer all those questions in this article and take an in-depth look to ESG (sustainable) market structure both for equity and fixed income assets with a split between index and non-index funds.

Are crypto ETPs a growing part of investors’ portfolios?

What are the implications of this upgrade for investors? have crypto assets confirmed their stake in investors’ portfolios? Have crypto flows rebounded? Toward which crypto segments flows have been going year to date? What crypto asset sector has performed best in 2023?

Thematic rotations : A new indicator of investors expectations?

What Thematics gathered the most flows? Can thematics flows rotation be considered as a good indicator of market sentiment and investors expectations?

Active fund vs ETF in 2022: Who is the winner?

For the full year 2022, 36% of active managers outperformed passive management. This figure masks a contrasting situation throughout the […]

What place for Active ETFs in investors’ portfolios?

What share for active ETFs in investors’ portfolios worldwide? Are European portfolios following the same trend as those of American investors? What is the real place of active ETFs in investors’ portfolios?

Active or index funds: have we seen a return to favor of Smart Beta strategies since the beginning of the year?

Marlene Hassine Konqui, member of the SFAF ETF commission, and Ahmed Khelifa, chairman of the ETF commission, provide an update on investor interest in Smart Beta strategies in the chaotic context of 2022, as well as their role in portfolio construction.

Active funds vs ETFs in Europe: flow review so far in 2021

Have investors favored active management or ETFs in the third quarter of 2021? Do they prefer active management or ETFs to invest in sustainable funds? What about flows to traditional funds?

Seeking a fair performance comparison between active and passive funds

Marlene Hassine Konqui, CEO of BSD Investing questions SPIVA and Morningstar methodologies to compare active vs passive fund performances

BSD Investing research: Issues and solutions to build optimal portfolios

What are the issues of existing active vs passive fund performance comparisons? What are the solutions? How to build optimal portfolios?

Active vs passive funds: what did investors do during the first half of 2022?

How to analyse what investors have done during this turbulent semester in the financial markets? Did they prefer active management or passive management? Is this a harbinger of a change in trend, or just a temporary rebalancing after two years marked by the Covid 9 pandemic?